Stock Analysis

- Portugal

- /

- Renewable Energy

- /

- ENXTLS:EDPR

Should Weakness in EDP Renováveis, S.A.'s (ELI:EDPR) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

It is hard to get excited after looking at EDP Renováveis' (ELI:EDPR) recent performance, when its stock has declined 14% over the past three months. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Specifically, we decided to study EDP Renováveis' ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for EDP Renováveis

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for EDP Renováveis is:

4.8% = €597m ÷ €13b (Based on the trailing twelve months to June 2023).

The 'return' is the yearly profit. That means that for every €1 worth of shareholders' equity, the company generated €0.05 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

EDP Renováveis' Earnings Growth And 4.8% ROE

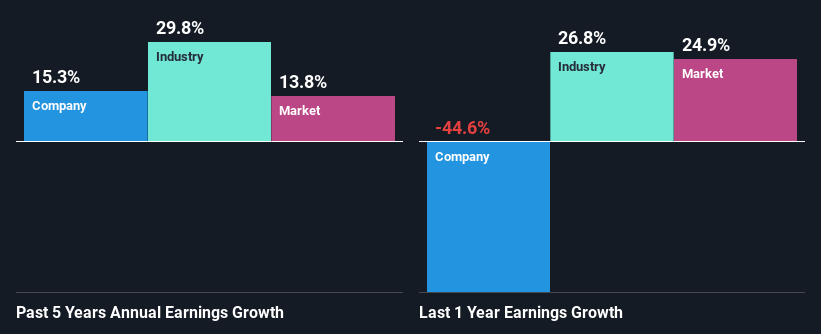

When you first look at it, EDP Renováveis' ROE doesn't look that attractive. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 9.5%. However, the moderate 15% net income growth seen by EDP Renováveis over the past five years is definitely a positive. We reckon that there could be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared EDP Renováveis' net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 30% in the same 5-year period, which is a bit concerning.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if EDP Renováveis is trading on a high P/E or a low P/E, relative to its industry.

Is EDP Renováveis Using Its Retained Earnings Effectively?

In EDP Renováveis' case, its respectable earnings growth can probably be explained by its low three-year median payout ratio of 16% (or a retention ratio of 84%), which suggests that the company is investing most of its profits to grow its business.

Moreover, EDP Renováveis is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Looking at the current analyst consensus data, we can see that the company's future payout ratio is expected to rise to 38% over the next three years. However, EDP Renováveis' future ROE is expected to rise to 6.6% despite the expected increase in the company's payout ratio. We infer that there could be other factors that could be driving the anticipated growth in the company's ROE.

Conclusion

On the whole, we do feel that EDP Renováveis has some positive attributes. Namely, its respectable earnings growth, which it achieved due to it retaining most of its profits. However, given the low ROE, investors may not be benefitting from all that reinvestment after all. We also studied the latest analyst forecasts and found that the company's earnings growth is expected be similar to its current growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're helping make it simple.

Find out whether EDP Renováveis is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:EDPR

EDP Renováveis

EDP Renováveis, S.A., a renewable energy company, plans, constructs, operates, and maintains electricity power stations.

Reasonable growth potential second-rate dividend payer.