- Portugal

- /

- Telecom Services and Carriers

- /

- ENXTLS:NOS

NOS, S.G.P.S., S.A.'s (ELI:NOS) Share Price Is Matching Sentiment Around Its Earnings

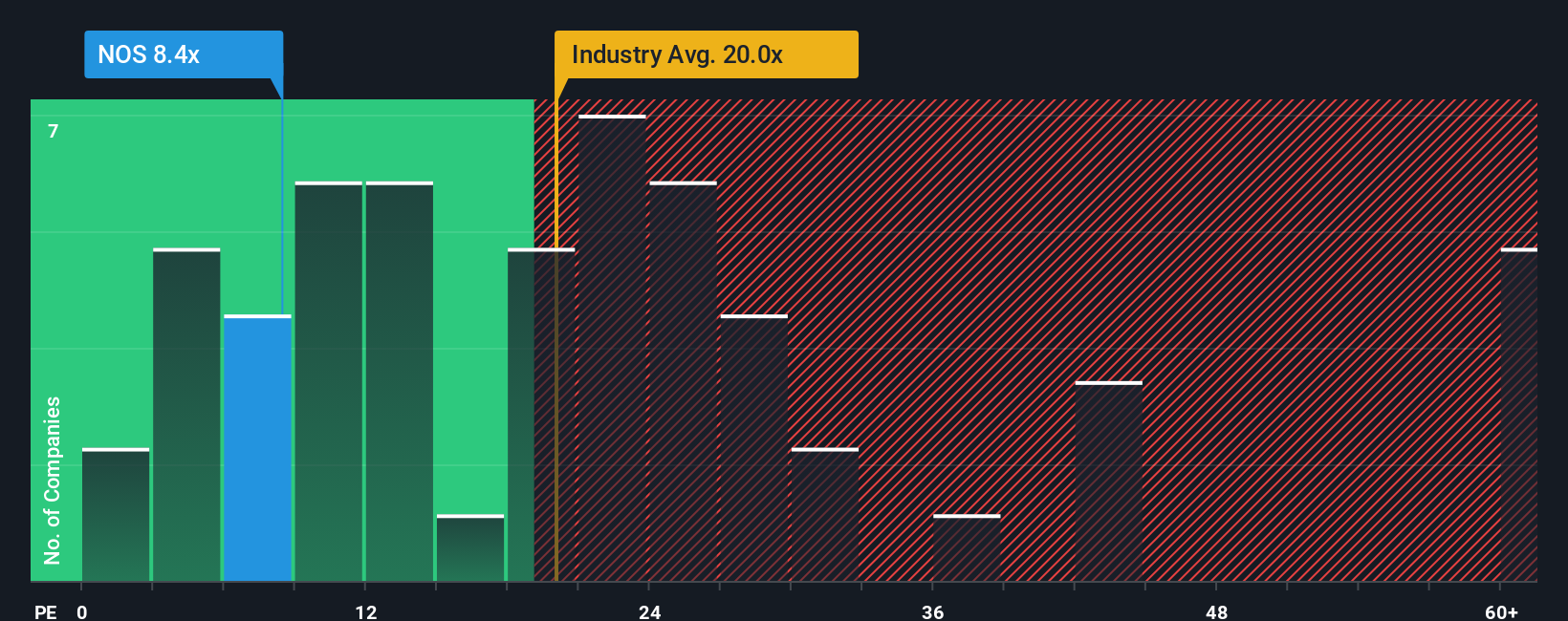

When close to half the companies in Portugal have price-to-earnings ratios (or "P/E's") above 13x, you may consider NOS, S.G.P.S., S.A. (ELI:NOS) as an attractive investment with its 8.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

There hasn't been much to differentiate NOS S.G.P.S' and the market's retreating earnings lately. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

See our latest analysis for NOS S.G.P.S

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as NOS S.G.P.S' is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.6%. Still, the latest three year period has seen an excellent 55% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 8.6% per year during the coming three years according to the nine analysts following the company. That's not great when the rest of the market is expected to grow by 10% per annum.

In light of this, it's understandable that NOS S.G.P.S' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From NOS S.G.P.S' P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of NOS S.G.P.S' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with NOS S.G.P.S (including 1 which can't be ignored).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if NOS S.G.P.S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:NOS

NOS S.G.P.S

Engages in the telecommunications and entertainment business.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026