- Portugal

- /

- Oil and Gas

- /

- ENXTLS:GALP

Galp Energia (ENXTLS:GALP): Examining Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Galp Energia SGPS (ENXTLS:GALP) has seen its shares move in recent sessions, prompting some investors to revisit the company’s fundamentals. Whether you are considering its past performance or looking for new opportunities, there is plenty to discuss around this energy provider.

See our latest analysis for Galp Energia SGPS.

Galp Energia SGPS’s share price has edged higher in recent weeks, continuing a steady climb that reflects cautious optimism around the business. With a recent closing price of $17.2, the stock has delivered a 1-year total shareholder return of 4.6%, while longer-term holders have seen much stronger gains. Momentum seems to be building as investors weigh up its prospects.

If you’re keen to see what else energy investors are watching, it could be the perfect time to discover fast growing stocks with high insider ownership

The big question for investors right now is whether Galp’s recent gains signal a bargain waiting to be seized, or if current prices already reflect expectations for future growth and profitability.

Price-to-Earnings of 12.2x: Is it justified?

Galp Energia SGPS is trading at a price-to-earnings (P/E) ratio of 12.2x based on the latest figures, noticeably below both its industry peers and the wider market average. With a last close price of €17.2, this valuation metric stands out given current sector trends.

The price-to-earnings ratio reflects how much investors are willing to pay today for €1 of company earnings. It provides a direct gauge of perceived value. For an established energy supplier like Galp, a lower P/E suggests the market may be cautious about its earnings outlook or potentially undervaluing its long-term potential.

Compared to the European Oil and Gas industry average P/E of 14x, Galp's multiple looks comparatively attractive. This discount implies that the market may be underpricing the company’s capacity to generate future profits or is factoring in greater risk than its peers. No fair value regression ratio is provided, so the current industry comparison drives the value view.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.2x (UNDERVALUED)

However, slower growth in both revenue and net income means future performance could disappoint if these trends persist or if market conditions worsen.

Find out about the key risks to this Galp Energia SGPS narrative.

Another View: Discounted Cash Flow Model Says Undervalued

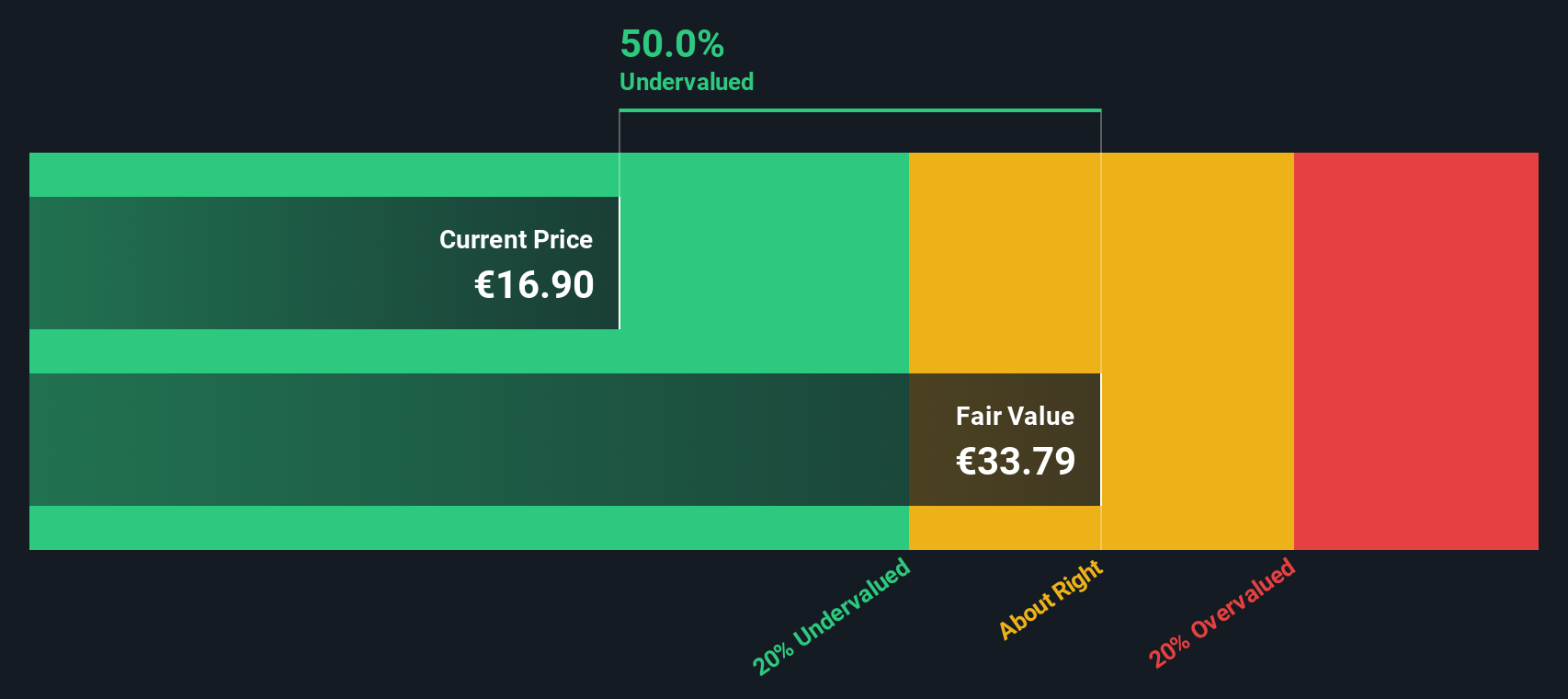

While Galp Energia SGPS looks cheap compared to its sector based on earnings, our DCF model suggests the stock is trading at a significant discount to fair value. With shares at €17.2 and a DCF-derived fair value of €33.79, this approach reinforces the idea that the market may be overly cautious. However, does the gap really point to a true bargain, or does it signal overlooked risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Galp Energia SGPS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Galp Energia SGPS Narrative

If you’d rather dig into the numbers and build your own perspective, it’s quick and easy to shape your own view of Galp Energia SGPS. Do it your way.

A great starting point for your Galp Energia SGPS research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your strategy and multiply your opportunities by seeking out high-potential stocks in other cutting-edge themes chosen by our team. Smart decisions favor prepared investors.

- Uncover value by checking companies priced below their potential through these 885 undervalued stocks based on cash flows and set yourself up for smart bargain hunting.

- Target future game-changers by searching for innovation leaders among these 24 AI penny stocks revolutionizing everyday industries with AI advancements.

- Secure steady returns by exploring these 19 dividend stocks with yields > 3% that offer consistent yields exceeding 3%. This approach is ideal for building resilient income streams.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:GALP

Galp Energia SGPS

Operates as an integrated energy operator in Portugal and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026