- Portugal

- /

- Consumer Durables

- /

- ENXTLS:VAF

Subdued Growth No Barrier To Vista Alegre Atlantis, SGPS, S.A. (ELI:VAF) With Shares Advancing 25%

Vista Alegre Atlantis, SGPS, S.A. (ELI:VAF) shares have continued their recent momentum with a 25% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 21% is also fairly reasonable.

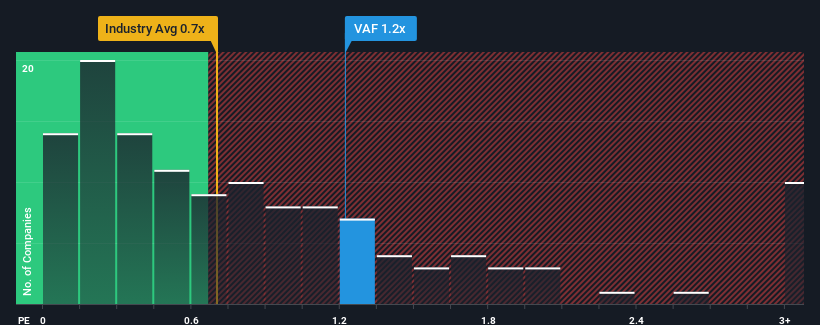

Following the firm bounce in price, you could be forgiven for thinking Vista Alegre Atlantis SGPS is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.2x, considering almost half the companies in Portugal's Consumer Durables industry have P/S ratios below 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Vista Alegre Atlantis SGPS

How Vista Alegre Atlantis SGPS Has Been Performing

Vista Alegre Atlantis SGPS could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vista Alegre Atlantis SGPS.Is There Enough Revenue Growth Forecasted For Vista Alegre Atlantis SGPS?

The only time you'd be truly comfortable seeing a P/S as high as Vista Alegre Atlantis SGPS' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 2.6% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 22% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 4.6% per year over the next three years. That's shaping up to be similar to the 3.1% each year growth forecast for the broader industry.

In light of this, it's curious that Vista Alegre Atlantis SGPS' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Vista Alegre Atlantis SGPS' P/S?

The large bounce in Vista Alegre Atlantis SGPS' shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given Vista Alegre Atlantis SGPS' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Vista Alegre Atlantis SGPS.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:VAF

Vista Alegre Atlantis SGPS

Produces, distributes, and sells articles of porcelain, crystal and hand glass, stoneware, and earthenware in Portugal.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026