- Portugal

- /

- Construction

- /

- ENXTLS:TDSA

A Piece Of The Puzzle Missing From Teixeira Duarte, S.A.'s (ELI:TDSA) 54% Share Price Climb

Despite an already strong run, Teixeira Duarte, S.A. (ELI:TDSA) shares have been powering on, with a gain of 54% in the last thirty days. The last month tops off a massive increase of 102% in the last year.

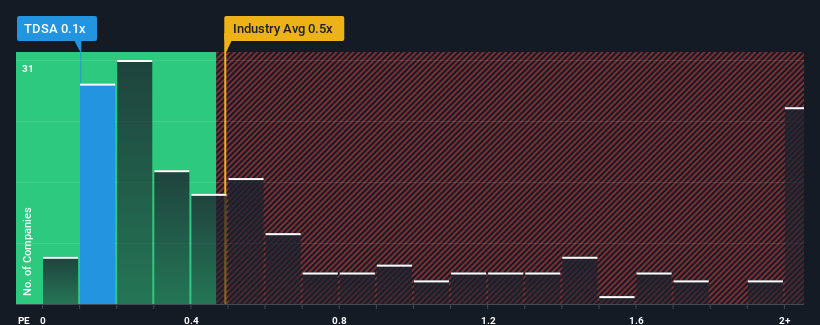

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Teixeira Duarte's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Portugal is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Teixeira Duarte

How Has Teixeira Duarte Performed Recently?

Revenue has risen firmly for Teixeira Duarte recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Teixeira Duarte's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Teixeira Duarte's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.3% gain to the company's revenues. The latest three year period has also seen an excellent 55% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 5.2% shows it's noticeably more attractive.

In light of this, it's curious that Teixeira Duarte's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Teixeira Duarte's P/S Mean For Investors?

Teixeira Duarte's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Teixeira Duarte's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for Teixeira Duarte you should be aware of, and 2 of them can't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Teixeira Duarte might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:TDSA

Teixeira Duarte

Operates in the construction, concessions and services, real estate, hospitality, distribution, and automotive sectors in Portugal, Angola, Brazil, Mozambique, and internationally.

Solid track record and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026