- Portugal

- /

- Construction

- /

- ENXTLS:EGL

If You Had Bought Mota-Engil SGPS' (ELI:EGL) Shares Three Years Ago You Would Be Down 62%

Mota-Engil, SGPS, S.A. (ELI:EGL) shareholders should be happy to see the share price up 13% in the last quarter. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 62%. Some might say the recent bounce is to be expected after such a bad drop. While many would remain nervous, there could be further gains if the business can put its best foot forward.

Check out our latest analysis for Mota-Engil SGPS

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Mota-Engil SGPS moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

We note that the dividend has declined - a likely contributor to the share price drop. In contrast it does not seem particularly likely that the revenue levels are a concern for investors.

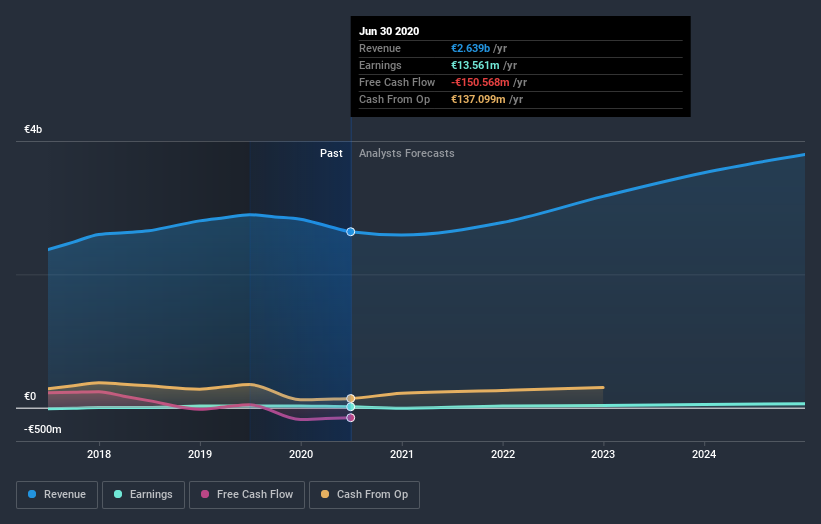

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Mota-Engil SGPS has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Mota-Engil SGPS' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 0.08% in the twelve months, Mota-Engil SGPS shareholders did even worse, losing 16% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 0.1% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Mota-Engil SGPS (1 doesn't sit too well with us) that you should be aware of.

But note: Mota-Engil SGPS may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PT exchanges.

If you’re looking to trade Mota-Engil SGPS, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTLS:EGL

Mota-Engil SGPS

Provides public and private construction works and related services in Europe, Africa, and Latin America.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives