- Portugal

- /

- Construction

- /

- ENXTLS:EGL

Here's Why We Think Mota-Engil SGPS (ELI:EGL) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Mota-Engil SGPS (ELI:EGL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Mota-Engil SGPS with the means to add long-term value to shareholders.

Mota-Engil SGPS' Improving Profits

In the last three years Mota-Engil SGPS' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Mota-Engil SGPS has grown its trailing twelve month EPS from €0.38 to €0.41, in the last year. That's a modest gain of 8.4%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Mota-Engil SGPS remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 7.2% to €6.0b. That's progress.

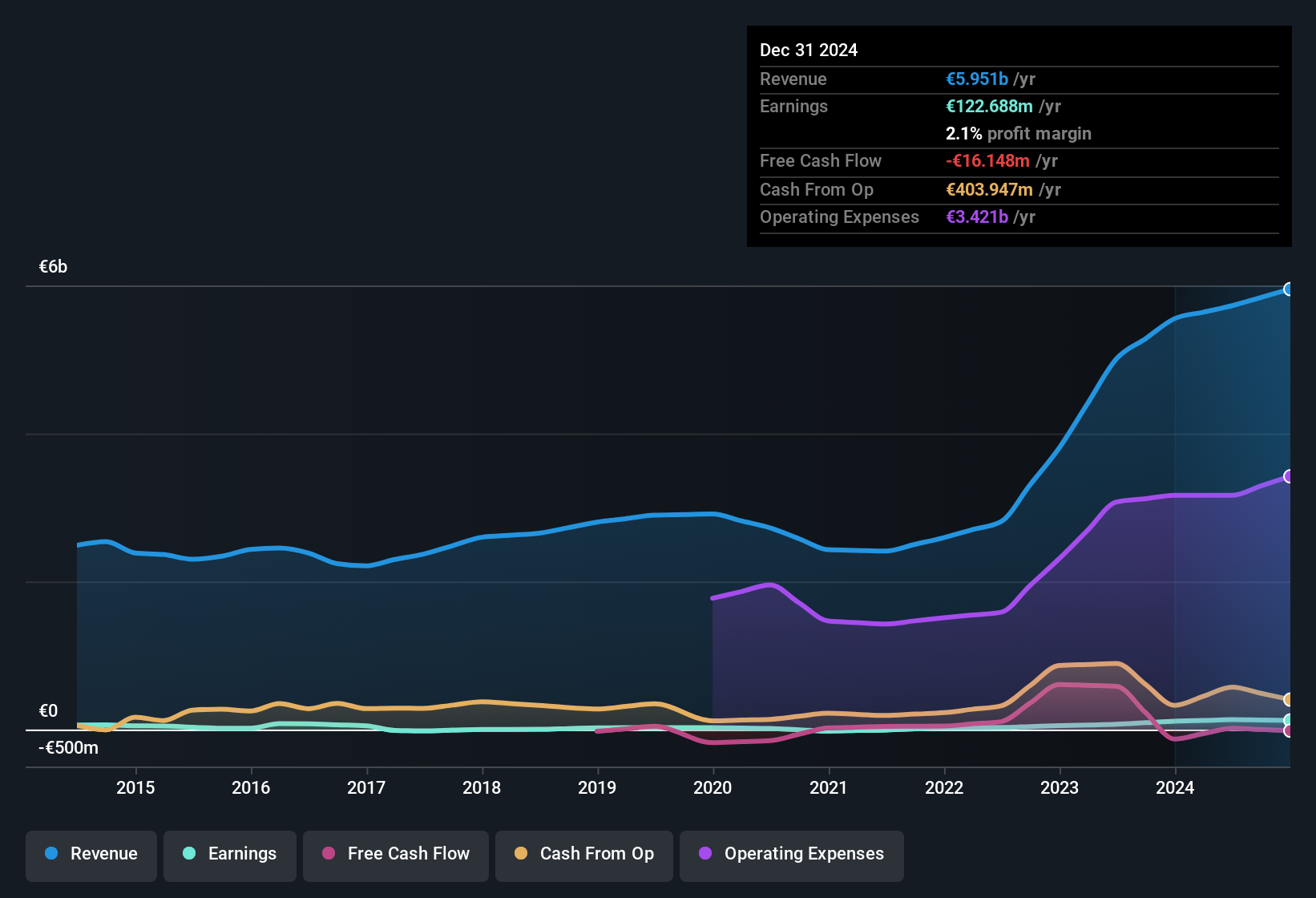

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Check out our latest analysis for Mota-Engil SGPS

Fortunately, we've got access to analyst forecasts of Mota-Engil SGPS' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Mota-Engil SGPS Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Mota-Engil SGPS insiders have a significant amount of capital invested in the stock. Indeed, they hold €20m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 1.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Mota-Engil SGPS To Your Watchlist?

One important encouraging feature of Mota-Engil SGPS is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Mota-Engil SGPS (1 shouldn't be ignored) you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in PT with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:EGL

Mota-Engil SGPS

Provides public and private construction works and related services in Europe, Africa, and Latin America.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.