- Portugal

- /

- Construction

- /

- ENXTLS:EGL

A Fresh Look at Mota-Engil (ENXTLS:EGL) Valuation Following Smart City Energy Collaboration with Wirtek

Reviewed by Kshitija Bhandaru

Price-to-Earnings of 12.2x: Is it justified?

Based on its price-to-earnings (P/E) multiple, EGL appears to be undervalued compared to the broader European construction industry. The stock trades at a lower earnings multiple, which signals the market may not be fully reflecting its underlying profit generation.

The P/E ratio measures how much investors are willing to pay for each euro of earnings. In construction and capital goods, it is a key metric used to evaluate companies with steady, predictable earnings streams. A lower P/E can indicate either overlooked value or anticipated challenges ahead, depending on profit trends and outlook.

For EGL, the current figure of 12.2x sits well below the industry average of 14.9x and its peer average of 13.8x. This suggests the market may be underestimating the sustainability of its recent earnings growth and future potential.

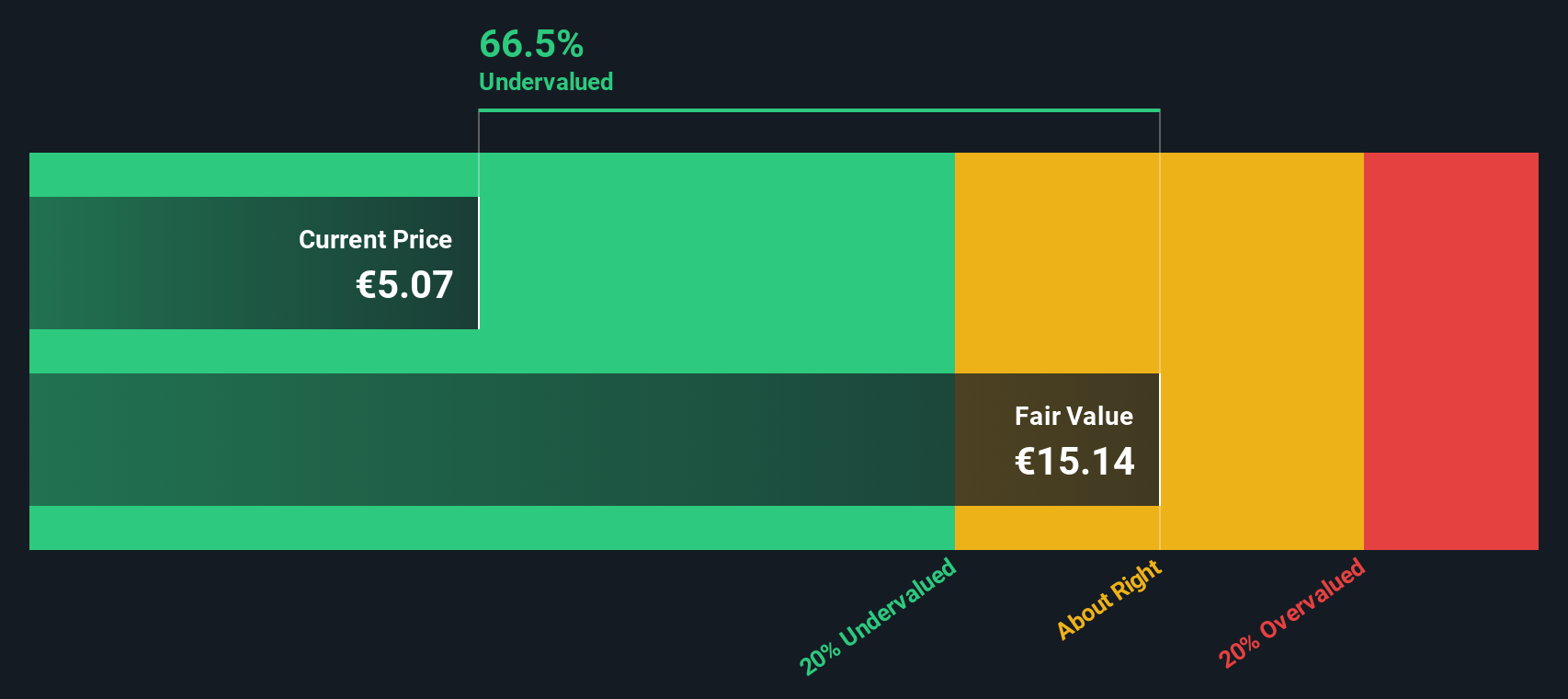

Result: Fair Value of €15.14 (UNDERVALUED)

See our latest analysis for Mota-Engil SGPS.However, slower revenue growth or a sudden dip in net income could quickly change the market’s positive view on Mota-Engil’s prospects.

Find out about the key risks to this Mota-Engil SGPS narrative.Another View: Discounted Cash Flow Model

Looking at EGL through the lens of our DCF model, the stock also appears to be trading well below its intrinsic value. This method supports the earlier suggestion of undervaluation; however, does it capture all the risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mota-Engil SGPS Narrative

If you see the story differently or want to dive deeper into the numbers yourself, you can build your own view in just a few minutes. Do it your way.

A great starting point for your Mota-Engil SGPS research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next great stock slip by. Smart investors are using the Simply Wall St Screener to spot fresh opportunities beyond the obvious choices.

- Unlock growth by tracking potential market leaders in artificial intelligence with our selection of AI penny stocks, which are making big moves in the sector.

- Capture stable income streams by checking out dividend stocks with yields > 3%. This features high-yield picks for steady returns.

- Seize the chance to get ahead of market sentiment with a pack of undervalued stocks based on cash flows, still trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:EGL

Mota-Engil SGPS

Provides public and private construction works and related services in Europe, Africa, and Latin America.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success