- Poland

- /

- Renewable Energy

- /

- WSE:PEP

Undiscovered Gems Including 3 Promising Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience, with indices like the Russell 2000 reflecting moderate gains amidst broader market volatility. In this environment, identifying small-cap companies with strong fundamentals becomes crucial for investors looking to uncover potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

LINK Mobility Group Holding (OB:LINK)

Simply Wall St Value Rating: ★★★★☆☆

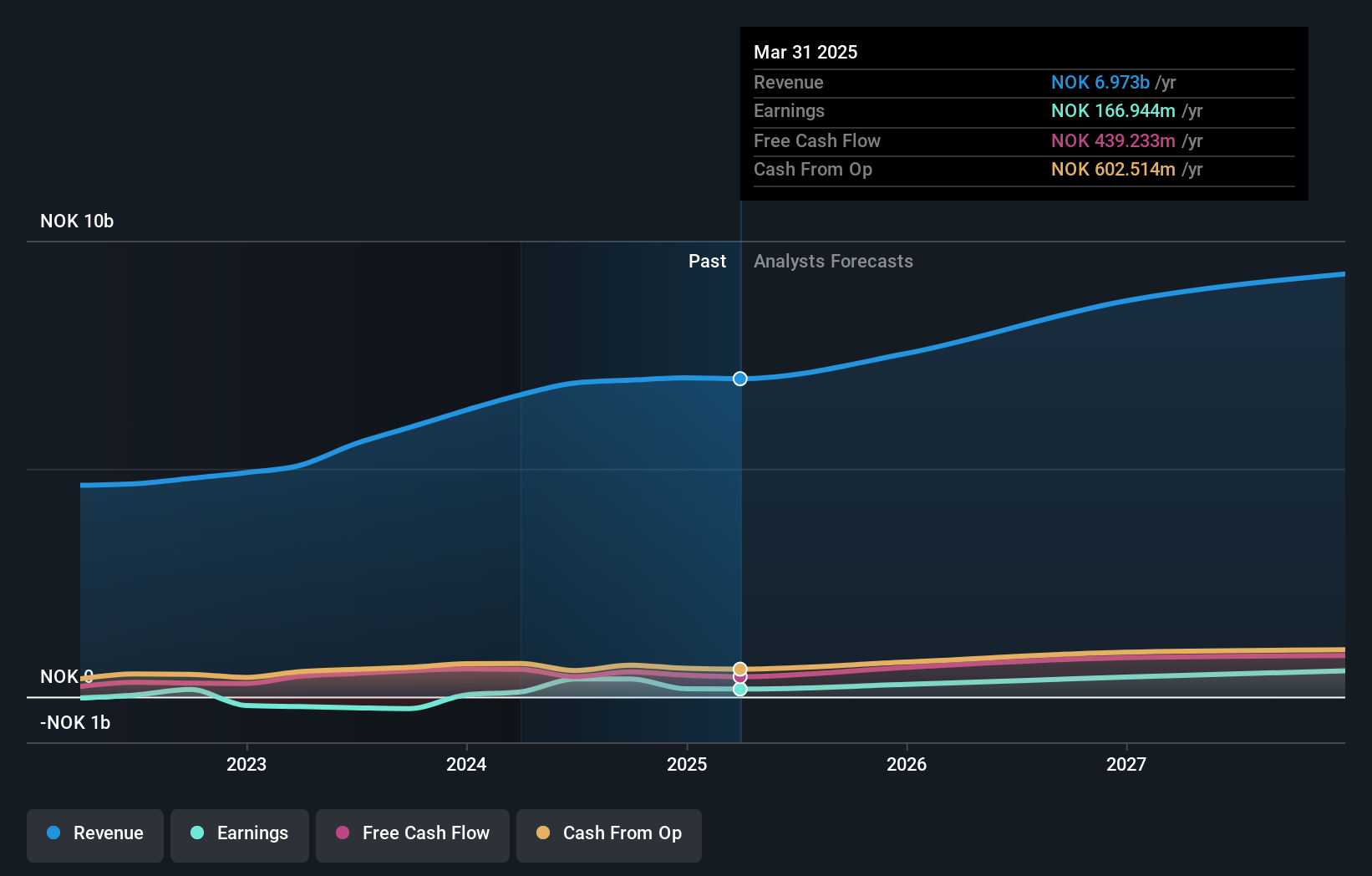

Overview: LINK Mobility Group Holding ASA, along with its subsidiaries, offers mobile and communication-platform-as-a-service solutions and has a market capitalization of NOK 6.49 billion.

Operations: LINK Mobility generates revenue from its regional segments: Central Europe (NOK 1.72 billion), Western Europe (NOK 1.96 billion), Northern Europe (NOK 1.53 billion), and Global Messaging (NOK 1.73 billion).

Having turned profitable this year, LINK Mobility Group Holding is making waves in the software industry. Their debt to equity ratio has impressively decreased from 102.2% to 79.4% over five years, with interest payments comfortably covered at 3.3 times by EBIT. Trading at a significant discount of 46.9% below estimated fair value, it's an attractive proposition for investors seeking value plays in smaller companies. Recent buybacks saw the company repurchase nearly 8.69 million shares for NOK 190 million, while net income for nine months surged to NOK 335 million from just NOK 30 million last year, showcasing robust financial health and strategic growth initiatives.

- Delve into the full analysis health report here for a deeper understanding of LINK Mobility Group Holding.

Understand LINK Mobility Group Holding's track record by examining our Past report.

Idun Industrier (OM:IDUN B)

Simply Wall St Value Rating: ★★★★☆☆

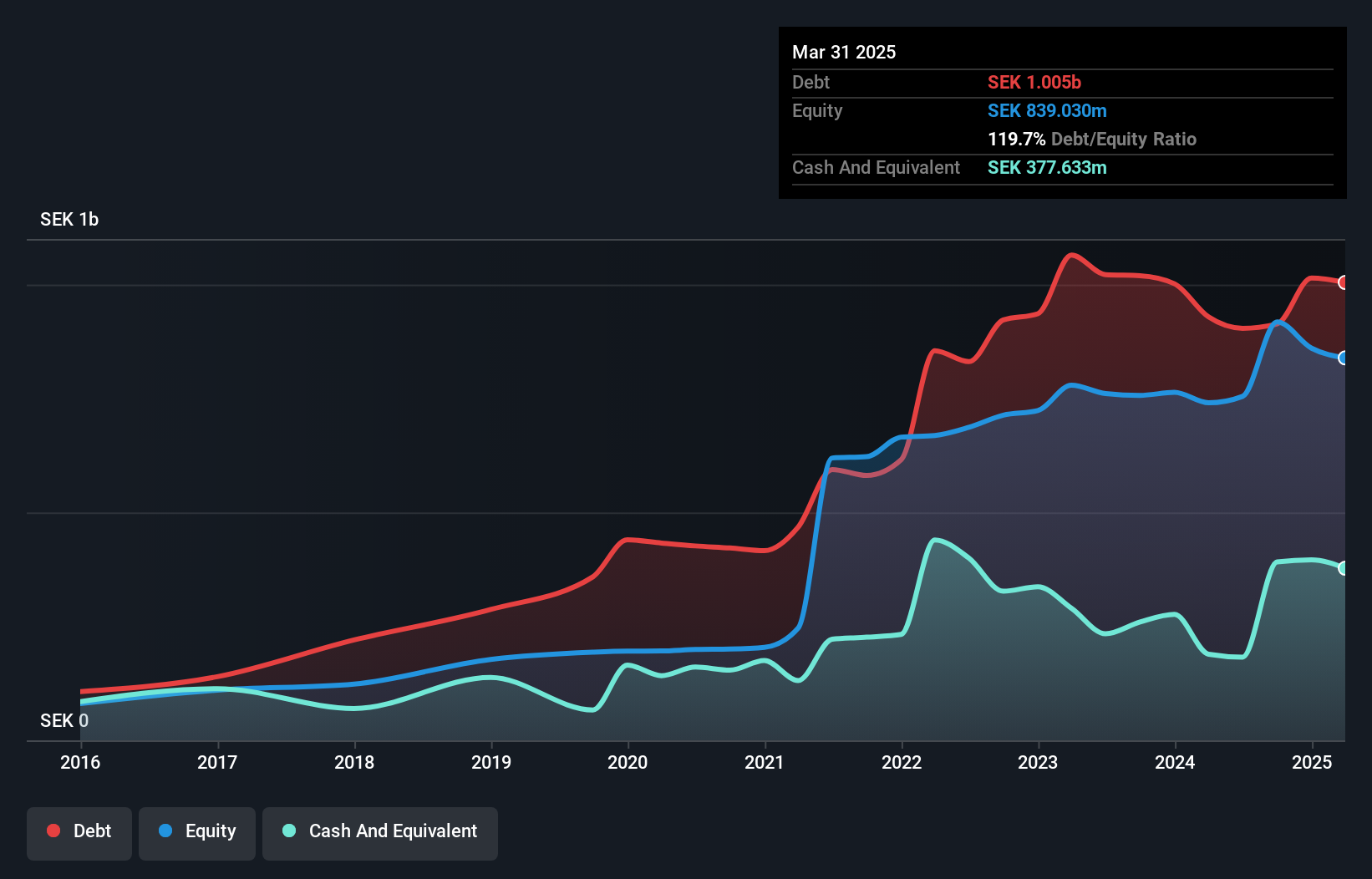

Overview: Idun Industrier AB (publ) is an investment holding company involved in the manufacture and sale of glass fiber reinforced fat- and oil separators in Sweden, with a market capitalization of SEK3.45 billion.

Operations: Idun Industrier generates revenue primarily through its manufacturing segment, which accounts for SEK1.34 billion, and its service and maintenance segment, contributing SEK834.40 million.

Idun Industrier, with a notable presence in the industrial sector, has shown promising financial strides. Over the past year, earnings surged by 37.3%, outpacing industry growth of 3%. Despite this robust performance, interest payments remain a concern with EBIT covering only 2.6 times these obligations. The company's net debt to equity ratio stands at a high 56.9%, although it has improved from 185.4% over five years to now sit at 99.5%. Recent reports highlight revenue growth to SEK 500 million for Q3 and net income rising to SEK 7 million from SEK 2 million last year, indicating positive momentum in its operations.

- Unlock comprehensive insights into our analysis of Idun Industrier stock in this health report.

Examine Idun Industrier's past performance report to understand how it has performed in the past.

Polenergia (WSE:PEP)

Simply Wall St Value Rating: ★★★★★☆

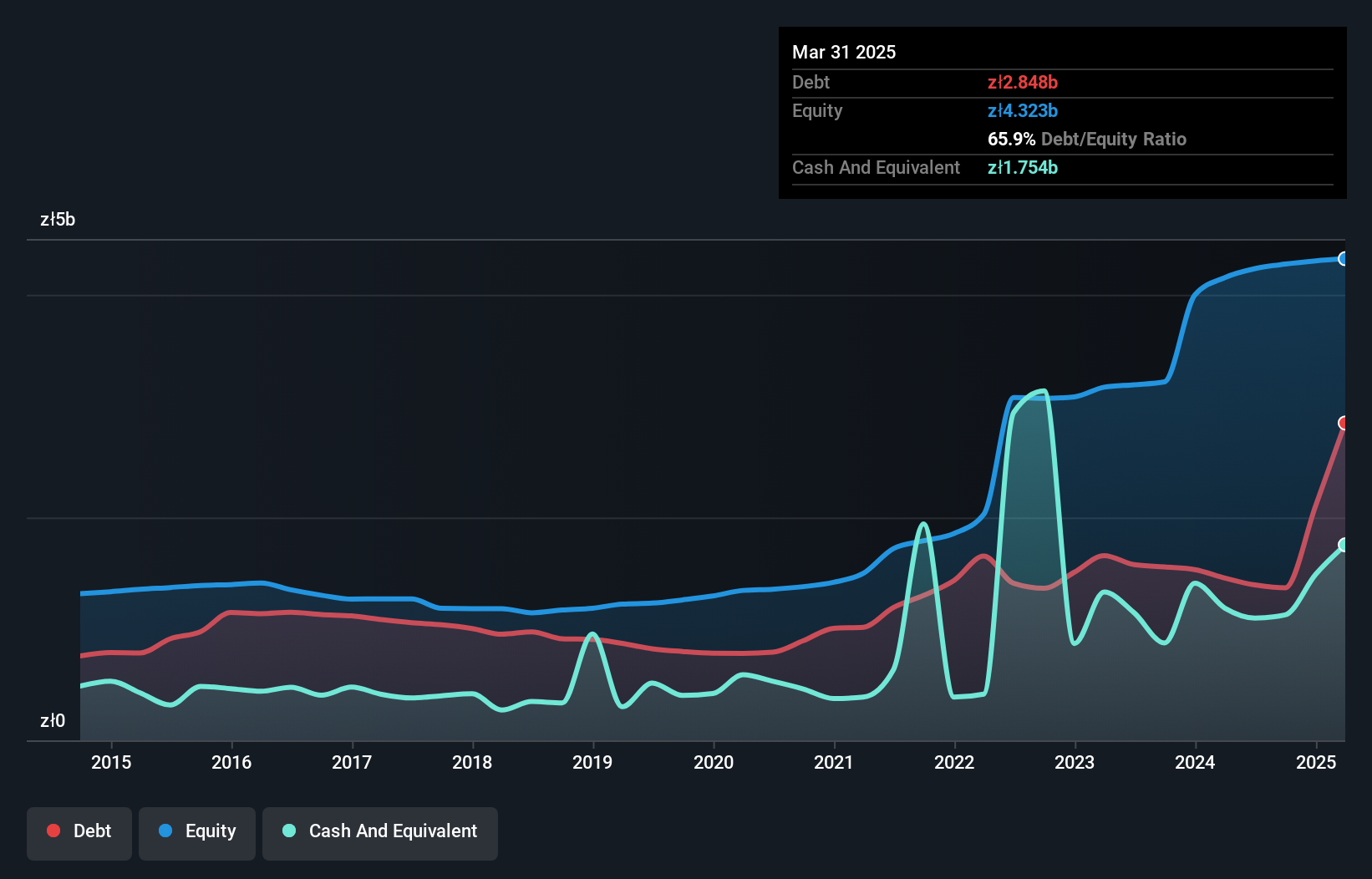

Overview: Polenergia S.A. operates in the generation, distribution, trading, and sale of electricity both in Poland and internationally, with a market capitalization of PLN 5.37 billion.

Operations: The primary revenue streams for Polenergia S.A. are trading and sales, contributing PLN 3.38 billion, and onshore wind farms generating PLN 750.04 million. The company also earns from gas and clean fuel at PLN 129.12 million, distribution and eMobility at PLN 205.31 million, and photovoltaics at PLN 25.02 million.

Polenergia's recent performance highlights its resilience in a challenging market. Despite sales dropping to PLN 908 million from PLN 1.25 billion in the third quarter, net income increased to PLN 74 million from PLN 41 million, indicating improved profitability. Earnings per share rose to PLN 0.95 from PLN 0.62, reflecting strong operational efficiency. Over the past year, earnings grew by an impressive 33%, outpacing the renewable energy industry's negative growth of -14%. The company also reduced its debt-to-equity ratio significantly over five years, now at a satisfactory level of just over 32%, showcasing effective financial management strategies amidst industry challenges.

- Dive into the specifics of Polenergia here with our thorough health report.

Evaluate Polenergia's historical performance by accessing our past performance report.

Where To Now?

- Navigate through the entire inventory of 4647 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PEP

Polenergia

Engages in the generation, distribution, trading, and sale of electricity in Poland and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion