- Poland

- /

- Infrastructure

- /

- WSE:STX

Most Shareholders Will Probably Find That The CEO Compensation For Stalexport Autostrady S.A. (WSE:STX) Is Reasonable

Despite positive share price growth of 18% for Stalexport Autostrady S.A. (WSE:STX) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 31 March 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

See our latest analysis for Stalexport Autostrady

Comparing Stalexport Autostrady S.A.'s CEO Compensation With the industry

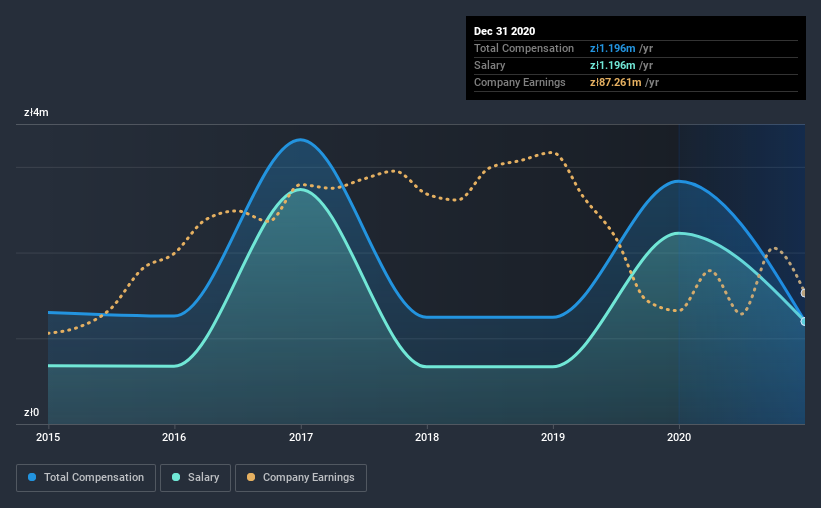

According to our data, Stalexport Autostrady S.A. has a market capitalization of zł992m, and paid its CEO total annual compensation worth zł1.2m over the year to December 2020. That's a notable decrease of 58% on last year. Notably, the salary of zł1.2m is the entirety of the CEO compensation.

In comparison with other companies in the industry with market capitalizations ranging from zł391m to zł1.6b, the reported median CEO total compensation was zł1.1m. This suggests that Stalexport Autostrady remunerates its CEO largely in line with the industry average. What's more, Emil Wasacz holds zł235k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | zł1.2m | zł2.2m | 100% |

| Other | - | zł609k | - |

| Total Compensation | zł1.2m | zł2.8m | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. On a company level, Stalexport Autostrady prefers to reward its CEO through a salary, opting not to pay Emil Wasacz through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Stalexport Autostrady S.A.'s Growth

Stalexport Autostrady S.A. has reduced its earnings per share by 17% a year over the last three years. Its revenue is down 18% over the previous year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Stalexport Autostrady S.A. Been A Good Investment?

Stalexport Autostrady S.A. has served shareholders reasonably well, with a total return of 18% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Stalexport Autostrady rewards its CEO solely through a salary, ignoring non-salary benefits completely. Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Stalexport Autostrady that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Stalexport Autostrady, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:STX

Stalexport Autostrady

Stalexport Autostrady S.A., together with its subsidiaries, constructs and operates motorways in Poland.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives