- Poland

- /

- Telecom Services and Carriers

- /

- WSE:VRB

Market Cool On Verbicom S.A.'s (WSE:VRB) Revenues Pushing Shares 29% Lower

Verbicom S.A. (WSE:VRB) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

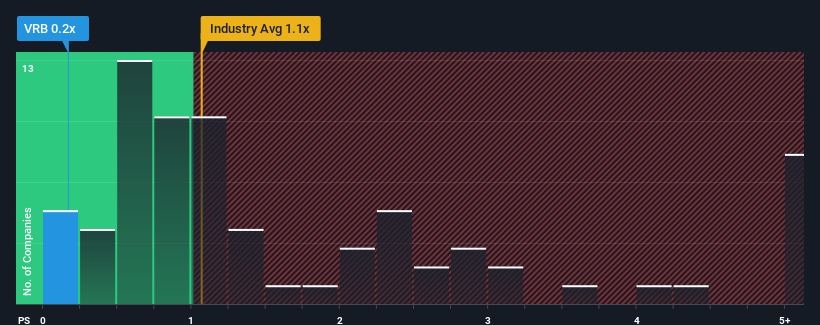

After such a large drop in price, Verbicom may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Telecom industry in Poland have P/S ratios greater than 1x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Verbicom

How Has Verbicom Performed Recently?

For example, consider that Verbicom's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Verbicom will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Verbicom will help you shine a light on its historical performance.How Is Verbicom's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Verbicom's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. Even so, admirably revenue has lifted 39% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 1.3%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Verbicom's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Verbicom's P/S Mean For Investors?

Verbicom's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Verbicom currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Verbicom that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:VRB

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success