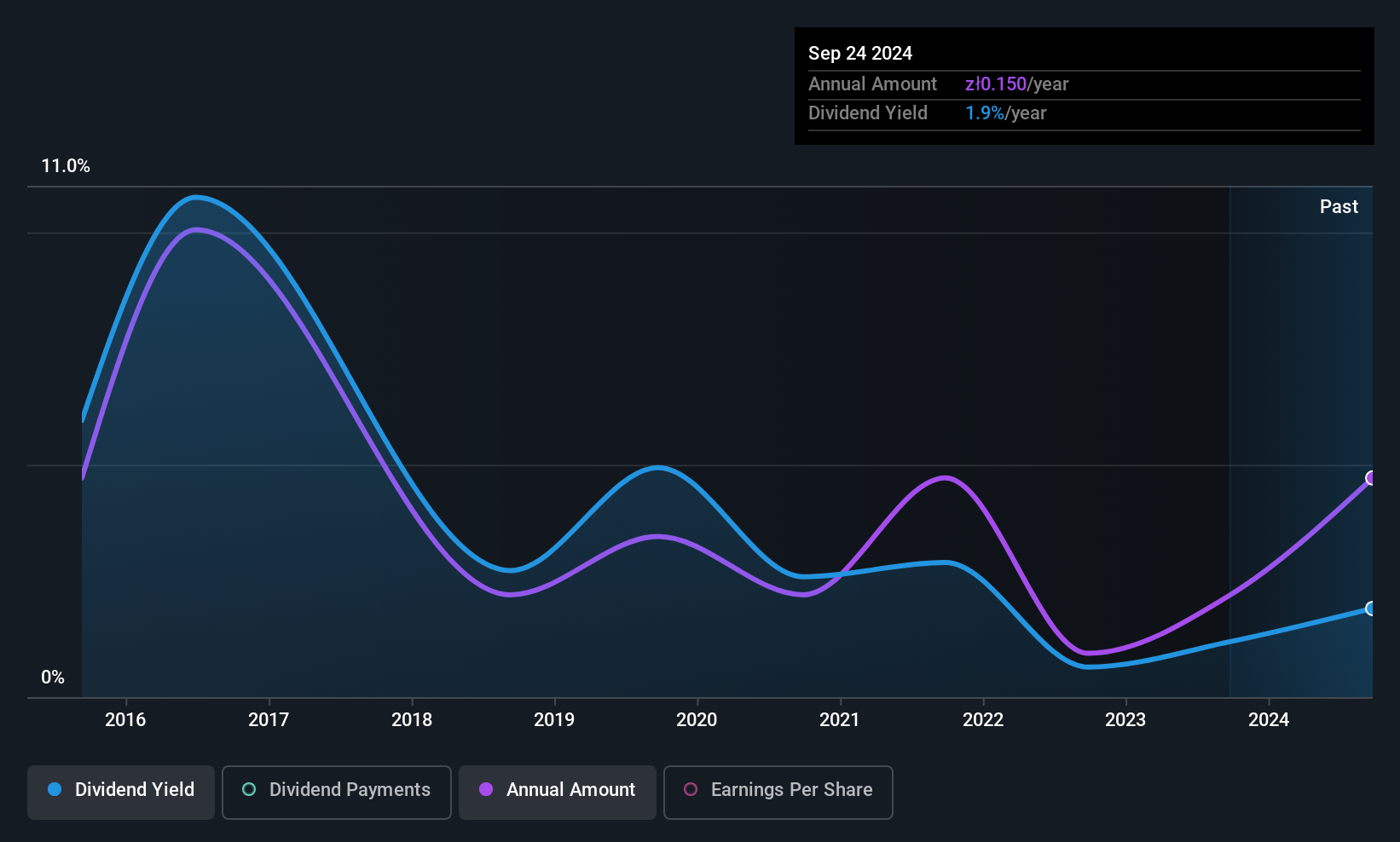

NTT System S.A.'s (WSE:NTT) dividend is being reduced by 6.7% to PLN0.14 per share on 19th of December, in comparison to last year's comparable payment of PLN0.15. The yield is still above the industry average at 1.5%.

NTT System's Future Dividend Projections Appear Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, NTT System was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share could rise by 33.8% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 5.9%, which is in the range that makes us comfortable with the sustainability of the dividend.

See our latest analysis for NTT System

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. There hasn't been much of a change in the dividend over the last 10 years. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. NTT System has seen EPS rising for the last five years, at 34% per annum. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

We Really Like NTT System's Dividend

In general, we don't like to see the dividend being cut, especially when the company has such high potential like NTT System does. The cut will allow the company to continue paying out the dividend without putting the balance sheet under pressure, which means that it could remain sustainable for longer. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for NTT System that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if NTT System might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:NTT

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026