Eurotel S.A.'s (WSE:ETL) Stock's On An Uptrend: Are Strong Financials Guiding The Market?

Eurotel's (WSE:ETL) stock is up by a considerable 18% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study Eurotel's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Eurotel

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Eurotel is:

26% = zł23m ÷ zł87m (Based on the trailing twelve months to March 2021).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every PLN1 worth of equity, the company was able to earn PLN0.26 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Eurotel's Earnings Growth And 26% ROE

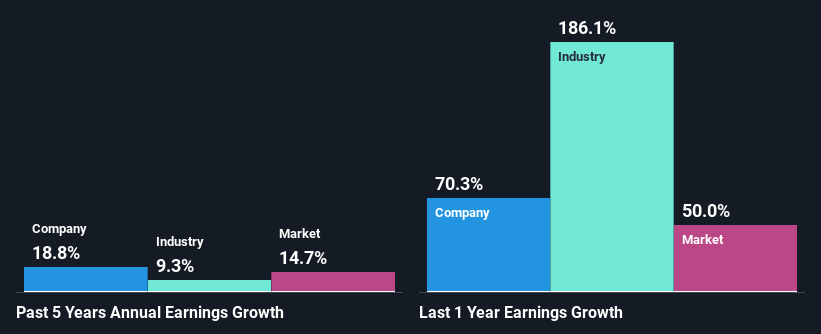

Firstly, we acknowledge that Eurotel has a significantly high ROE. Second, a comparison with the average ROE reported by the industry of 21% also doesn't go unnoticed by us. Probably as a result of this, Eurotel was able to see a decent net income growth of 19% over the last five years.

As a next step, we compared Eurotel's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 9.3%.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Eurotel is trading on a high P/E or a low P/E, relative to its industry.

Is Eurotel Using Its Retained Earnings Effectively?

While Eurotel has a three-year median payout ratio of 70% (which means it retains 30% of profits), the company has still seen a fair bit of earnings growth in the past, meaning that its high payout ratio hasn't hampered its ability to grow.

Additionally, Eurotel has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

Overall, we are quite pleased with Eurotel's performance. We are particularly impressed by the considerable earnings growth posted by the company, which was likely backed by its high ROE. While the company is paying out most of its earnings as dividends, it has been able to grow its earnings in spite of it, so that's probably a good sign. Up till now, we've only made a short study of the company's growth data. You can do your own research on Eurotel and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

When trading Eurotel or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eurotel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:ETL

Eurotel

Operates a chain of retail stores of telecommunications operators and various electronics manufacturers in Poland.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026