Amidst the backdrop of heightened trade tensions and economic uncertainty, European markets have experienced significant volatility, with the pan-European STOXX Europe 600 Index seeing its largest drop in five years. In this environment, identifying high growth tech stocks in Europe requires a focus on companies that demonstrate resilience through innovation and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 20.52% | 36.58% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Bonesupport Holding | 30.48% | 50.17% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Skolon | 29.73% | 91.18% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Wiit (BIT:WIIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wiit S.p.A. is a company that offers cloud services to businesses both in Italy and internationally, with a market capitalization of €370.28 million.

Operations: Wiit S.p.A. specializes in delivering cloud services to businesses across Italy and beyond. The company's operations focus on providing tailored cloud solutions, contributing significantly to its revenue streams.

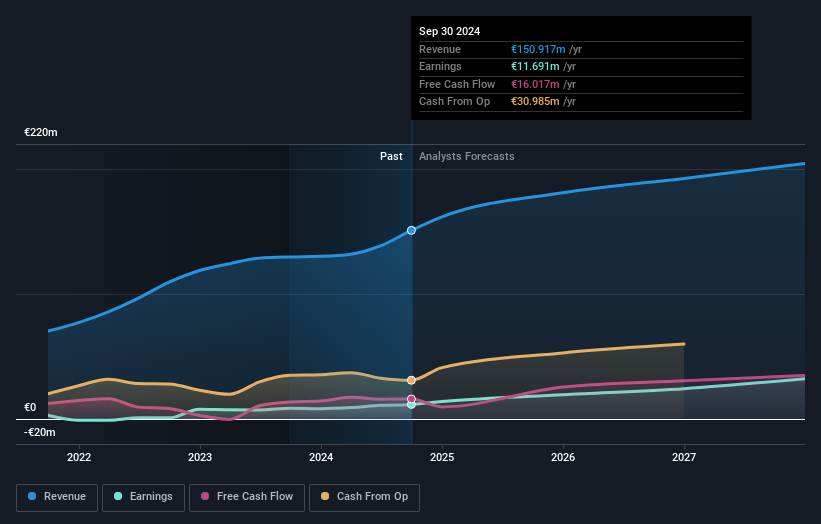

Wiit S.p.A. has demonstrated a robust pattern of growth, with earnings increasing by 30.9% annually over the past five years and a forecasted annual earnings growth of 24% over the next three years, significantly outpacing the Italian market's average of 7.4%. This performance is underscored by a recent surge in revenue to €160.46 million, marking an increase from €130.11 million last year, alongside an improved net income of €9.26 million from €8.29 million previously reported in 2024. The company's strategic positioning was highlighted at the Euronext Milan STAR Conference, suggesting ongoing expansion and innovation efforts that are likely to sustain its competitive edge within Europe's high-growth tech landscape.

- Unlock comprehensive insights into our analysis of Wiit stock in this health report.

Understand Wiit's track record by examining our Past report.

CS Communication & Systemes (ENXTPA:SX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CS Communication & Systemes SA is a global company that specializes in designing, integrating, and operating mission-critical systems, with a market capitalization of €281.82 million.

Operations: The company focuses on creating and managing essential systems globally, leveraging its expertise in system integration and operations.

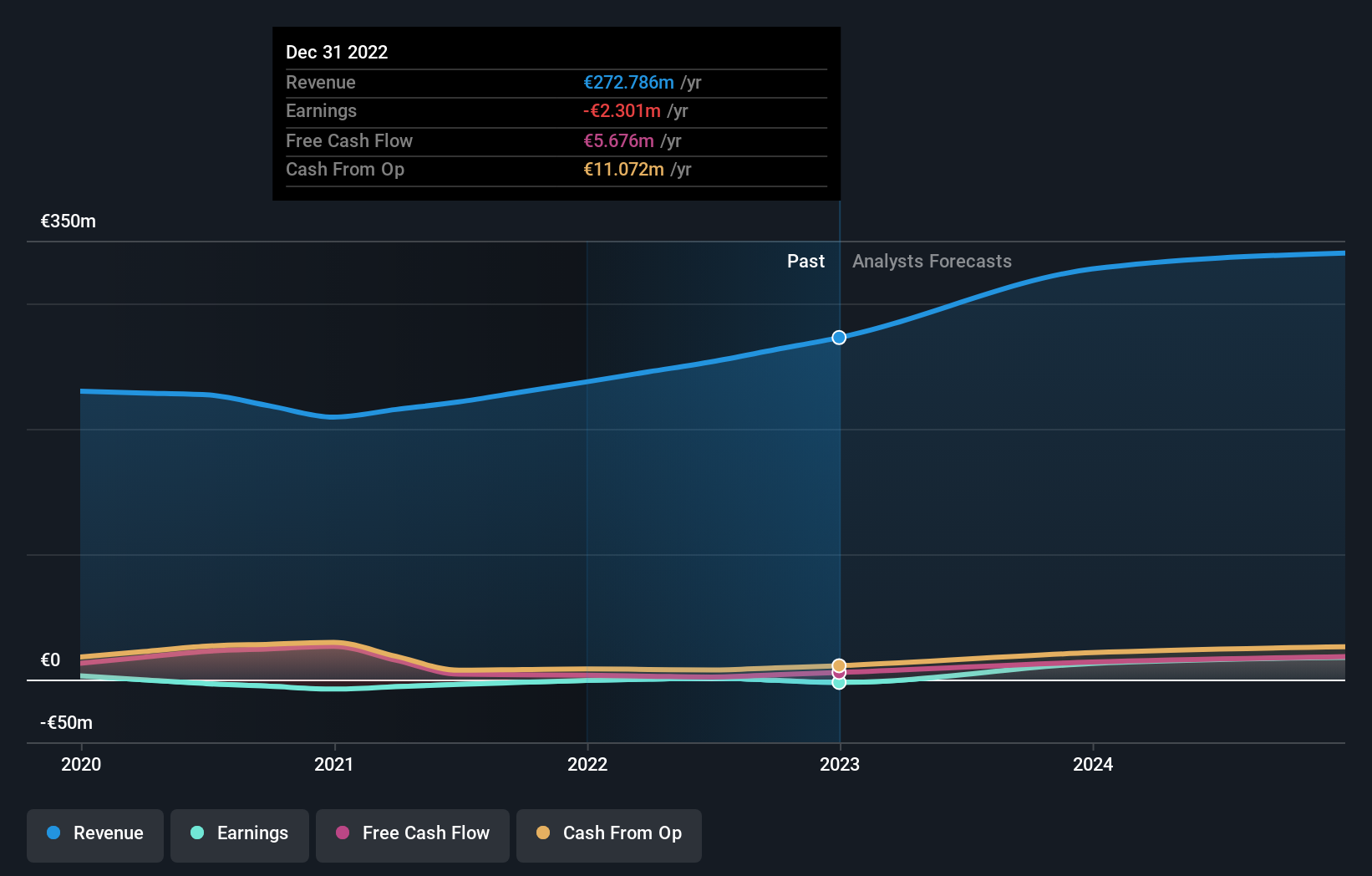

CS Communication & Systemes, amidst a challenging tech landscape, is setting a distinct path with its strategic focus on specialized software solutions. With an impressive revenue growth rate of 10.4% annually, the company outpaces the broader French market's average growth of 5%. This performance is bolstered by substantial investments in R&D, which have surged to €15 million this year from €12 million last year, underpinning its commitment to innovation and securing a competitive edge. Moreover, earnings are expected to soar by 88.2% annually over the next three years, reflecting potential profitability and robust financial health highlighted by positive free cash flow. These factors collectively suggest CS Communication & Systemes could play a pivotal role in shaping Europe's high-growth tech sector moving forward.

- Click here to discover the nuances of CS Communication & Systemes with our detailed analytical health report.

Gain insights into CS Communication & Systemes' past trends and performance with our Past report.

Vercom (WSE:VRC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vercom S.A. develops cloud communications platforms and has a market cap of PLN2.45 billion.

Operations: The company generates revenue primarily through its CPaaS segment, amounting to PLN496.23 million.

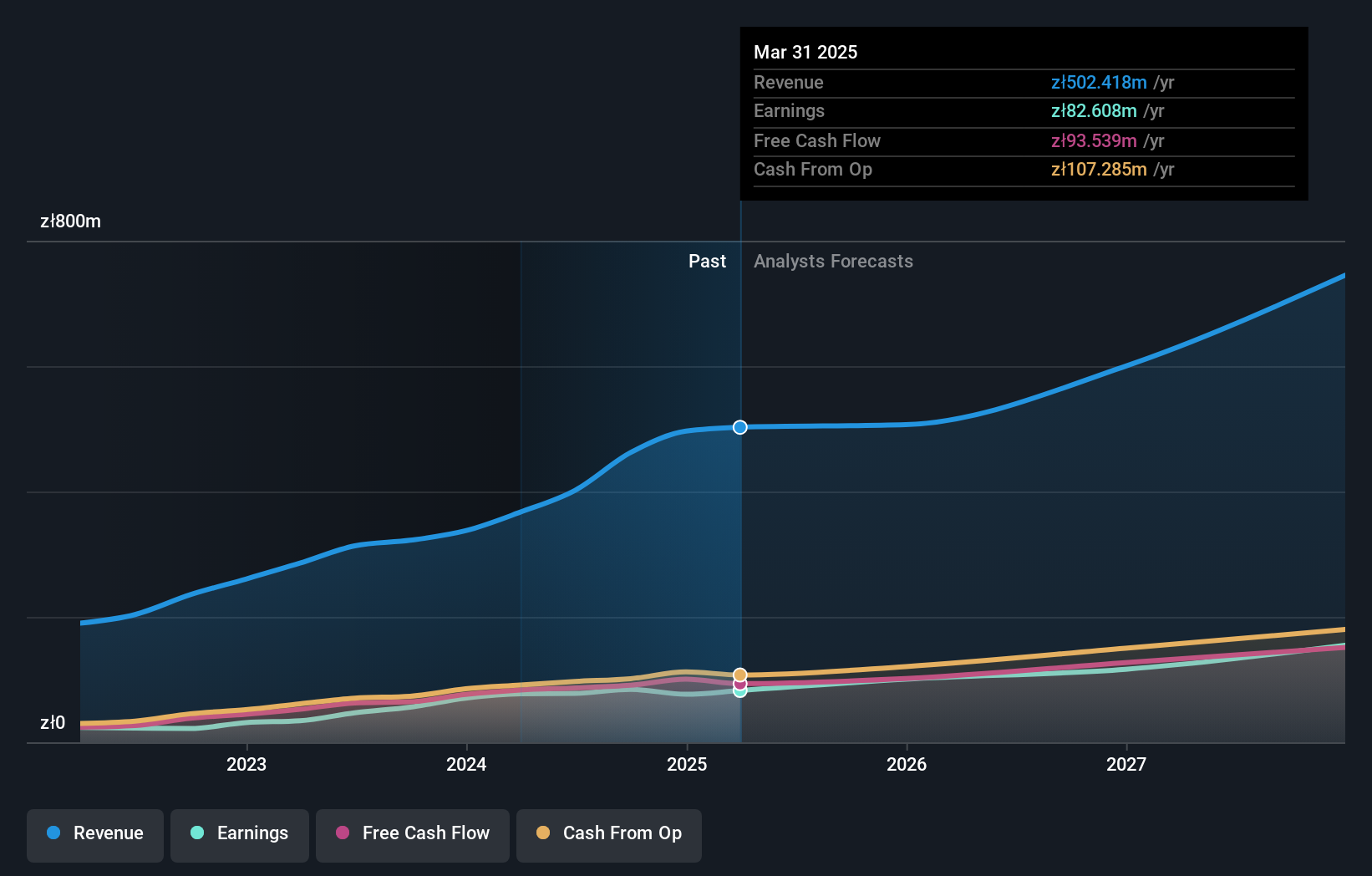

Vercom S.A. has demonstrated robust growth, with revenue surging by 13% annually and earnings predicted to expand by 21.1% per year, outpacing the Polish market's average. This performance is underpinned by a significant R&D commitment, evidenced by its recent announcement of earnings where sales reached PLN 496.23 million, up from PLN 337.38 million the previous year. The company's strategic focus on innovation is further reflected in its high Return on Equity forecast at 23%, suggesting potential for continued industry leadership and value creation in a competitive tech landscape.

- Get an in-depth perspective on Vercom's performance by reading our health report here.

Assess Vercom's past performance with our detailed historical performance reports.

Next Steps

- Unlock our comprehensive list of 232 European High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wiit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:WIIT

Wiit

Provides cloud services for various businesses in Italy and internationally.

High growth potential with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion