The European market has shown tentative optimism as the pan-European STOXX Europe 600 Index rose by 0.54%, buoyed by hopes of a potential EU-U.S. trade deal and steady interest rates from the European Central Bank, despite lingering uncertainties in global trade dynamics. In this environment, high-growth tech stocks in Europe become particularly intriguing to investors seeking opportunities that align with current market conditions, where resilience and adaptability to geopolitical changes are key factors for success.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| KebNi | 20.56% | 65.02% | ★★★★★★ |

| Comet Holding | 12.58% | 32.19% | ★★★★★☆ |

| Lipigon Pharmaceuticals | 104.89% | 93.94% | ★★★★★☆ |

| Yubico | 16.27% | 23.90% | ★★★★★☆ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| ContextVision | 5.83% | 39.78% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Aelis Farma | 79.30% | 106.93% | ★★★★★☆ |

| CD Projekt | 33.57% | 40.19% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pexip Holding ASA is a video technology company that offers a comprehensive video conferencing platform and digital infrastructure across multiple regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market capitalization of NOK6.25 billion.

Operations: Pexip generates revenue primarily through the sale of collaboration services, amounting to NOK1.17 billion.

Pexip Holding's recent strategic moves, including a share repurchase program and robust quarterly earnings growth, underscore its upward trajectory in the high-tech sector. With a revenue increase to NOK 347.95 million from NOK 291.98 million year-over-year and net income rising to NOK 66.37 million from NOK 45.41 million, the company is demonstrating solid financial health. Notably, Pexip's commitment to innovation is evident as it earmarks substantial funds (NOK 100 million) for share-based compensation plans through its buyback strategy, aligning interests with long-term shareholder value and employee incentives. This approach not only enhances capital efficiency but also positions Pexip favorably within Europe’s competitive tech landscape as it continues to outpace average market growth with a projected annual revenue increase of 9.4% and earnings growth of 25.5%.

- Click here and access our complete health analysis report to understand the dynamics of Pexip Holding.

Evaluate Pexip Holding's historical performance by accessing our past performance report.

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CD Projekt S.A. is a Polish company that, along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for personal computers and consoles, with a market capitalization of PLN25.19 billion.

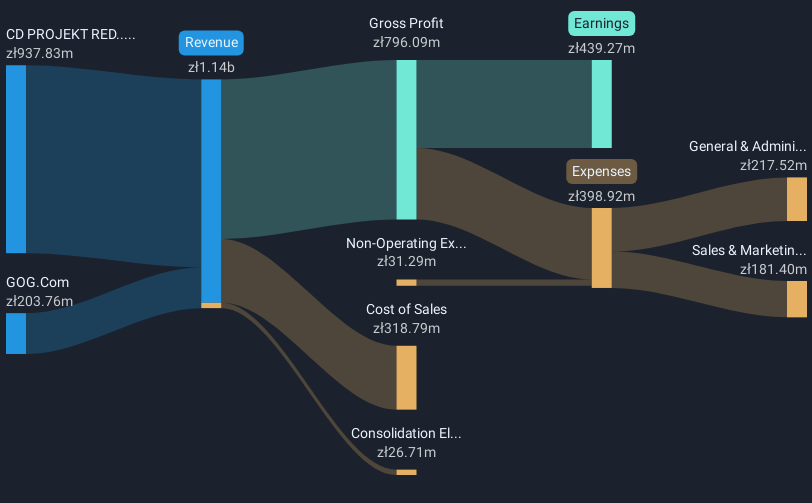

Operations: CD Projekt, along with its subsidiaries, generates revenue primarily through CD PROJEKT RED, contributing PLN795.50 million, and GOG.Com, adding PLN203.79 million. The company focuses on video game development and distribution for PCs and consoles in Poland.

CD Projekt, navigating through a challenging landscape with a slight dip in quarterly revenue to PLN 226.31 million from PLN 226.79 million, still managed to maintain robust projections with expected annual revenue growth at an impressive 33.6%. Despite a recent decline in net income from PLN 100.06 million to PLN 86 million, the company is poised for significant earnings expansion, forecasted at an annual rate of 40.2%. This growth trajectory is bolstered by strategic R&D investments aimed at fostering innovation and securing its competitive edge in the dynamic gaming industry. These financial and strategic maneuvers highlight CD Projekt's resilience and adaptability within Europe's tech sector, underscoring its potential amidst evolving market demands and consumer preferences.

- Click here to discover the nuances of CD Projekt with our detailed analytical health report.

Understand CD Projekt's track record by examining our Past report.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shoper S.A. is a Polish company offering Software as a Service solutions for e-commerce, with a market capitalization of PLN1.35 billion.

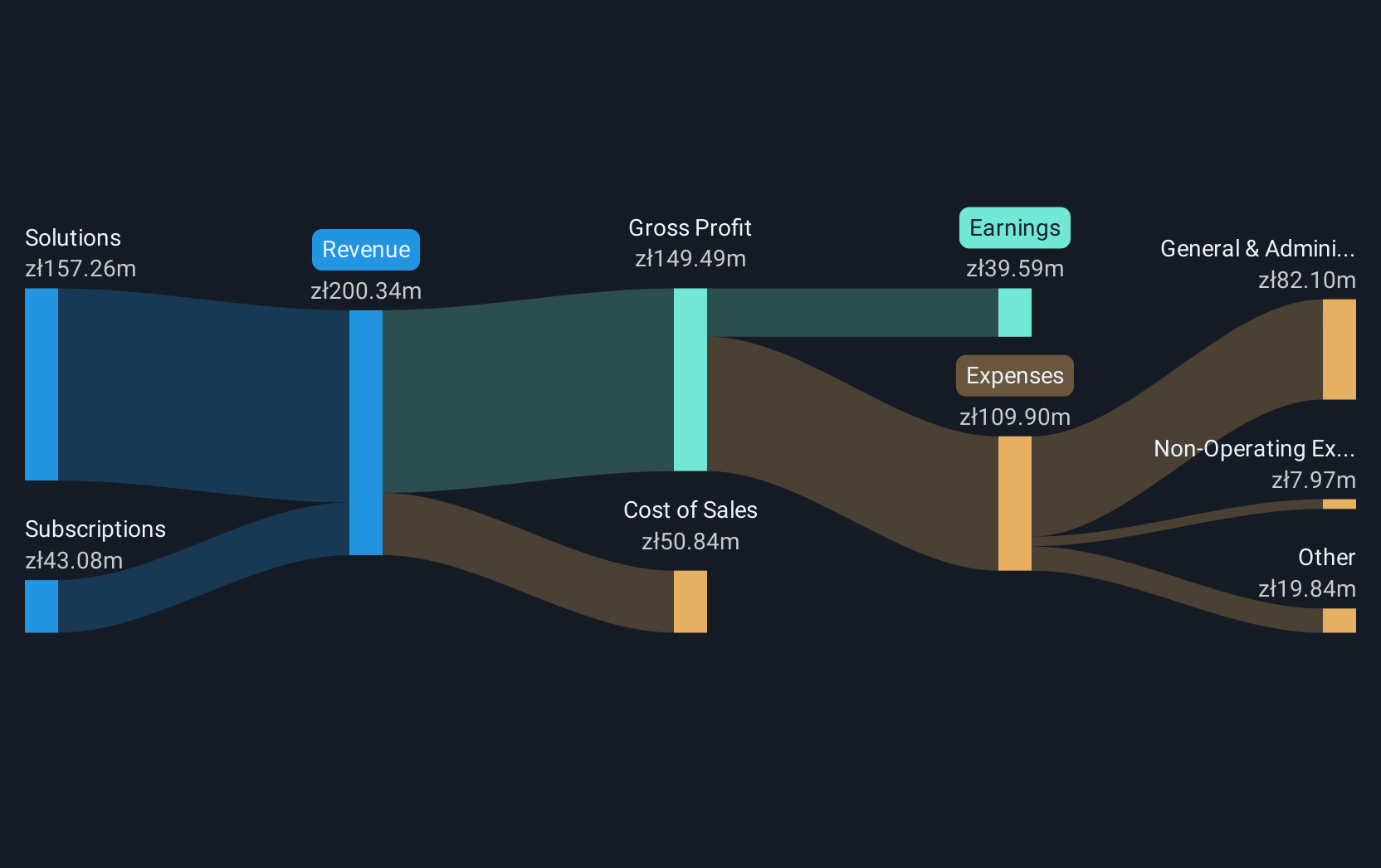

Operations: Shoper S.A. generates revenue primarily through its Solutions segment, contributing PLN157.26 million, and Subscriptions, adding PLN43.08 million.

Shoper S.A. has demonstrated a robust growth trajectory, with earnings surging by 37.8% over the past year, outpacing the software industry's average of 20.9%. This growth is underpinned by a significant annual revenue increase of 14.3%, which exceeds the broader Polish market's growth rate of 4.5%. Notably, Shoper's strategic focus on R&D has been crucial in maintaining its competitive edge and fostering innovation within the tech landscape. The firm’s recent financial results reflect this momentum, with first-quarter revenue climbing to PLN 51.73 million from PLN 44.19 million year-over-year and net income rising to PLN 9.84 million from PLN 7.76 million in the same period last year, signaling strong operational performance and potential for sustained growth.

- Unlock comprehensive insights into our analysis of Shoper stock in this health report.

Review our historical performance report to gain insights into Shoper's's past performance.

Make It Happen

- Access the full spectrum of 51 European High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SHO

Shoper

Provides Software as a Service solutions for e-commerce in Poland.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives