- China

- /

- Electronic Equipment and Components

- /

- SHSE:600366

Exploring High Growth Tech Stocks For January 2025

Reviewed by Simply Wall St

As global markets continue to navigate the evolving political landscape and economic indicators show mixed signals, U.S. stocks are pushing toward record highs, driven by optimism around trade policies and advancements in artificial intelligence. In this context of growth stock outperformance and AI enthusiasm, identifying promising high-growth tech stocks involves looking for companies that are well-positioned to capitalize on emerging technologies and market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Ningbo Yunsheng (SHSE:600366)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Yunsheng Co., Ltd. focuses on the research, development, manufacture, and sale of rare earth permanent magnet materials in China, with a market cap of approximately CN¥8.16 billion.

Operations: With a primary focus on rare earth permanent magnet materials, Ningbo Yunsheng generates revenue predominantly from the Neodymium Iron Boron segment, totaling approximately CN¥5 billion.

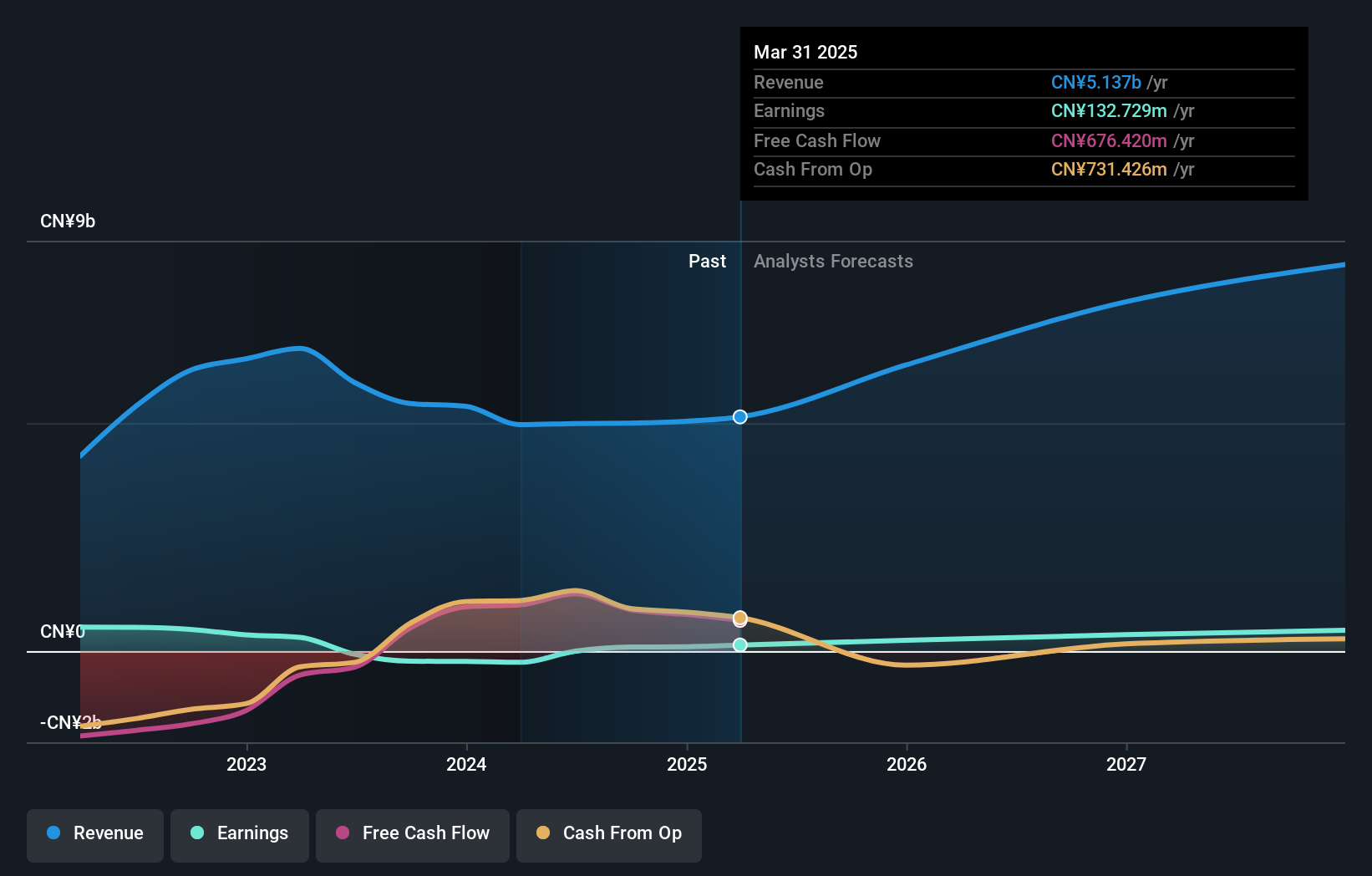

Ningbo Yunsheng's recent pivot to profitability marks a significant turnaround, with net income reaching CNY 69.14 million from a previous loss of CNY 246.92 million, reflecting robust operational improvements and strategic realignments. The company's revenue growth forecast at an annual rate of 23.5% outpaces the broader Chinese market's 13.3%, signaling strong market capture and expansion capabilities. Furthermore, projected earnings growth is exceptionally high at 64.6% annually, suggesting potential for sustained financial health driven by effective R&D investments and market strategies that align with evolving industry demands in electronics and technology sectors.

- Navigate through the intricacies of Ningbo Yunsheng with our comprehensive health report here.

Explore historical data to track Ningbo Yunsheng's performance over time in our Past section.

NanJing GOVA Technology (SHSE:688539)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NanJing GOVA Technology Co., Ltd. focuses on the research, design, development, production, and sale of sensors and sensor network systems in China with a market capitalization of approximately CN¥4.45 billion.

Operations: GOVA Technology generates revenue primarily through its electronic test and measurement instruments segment, which recorded sales of CN¥365.35 million. The company operates within the sensor and sensor network systems industry in China.

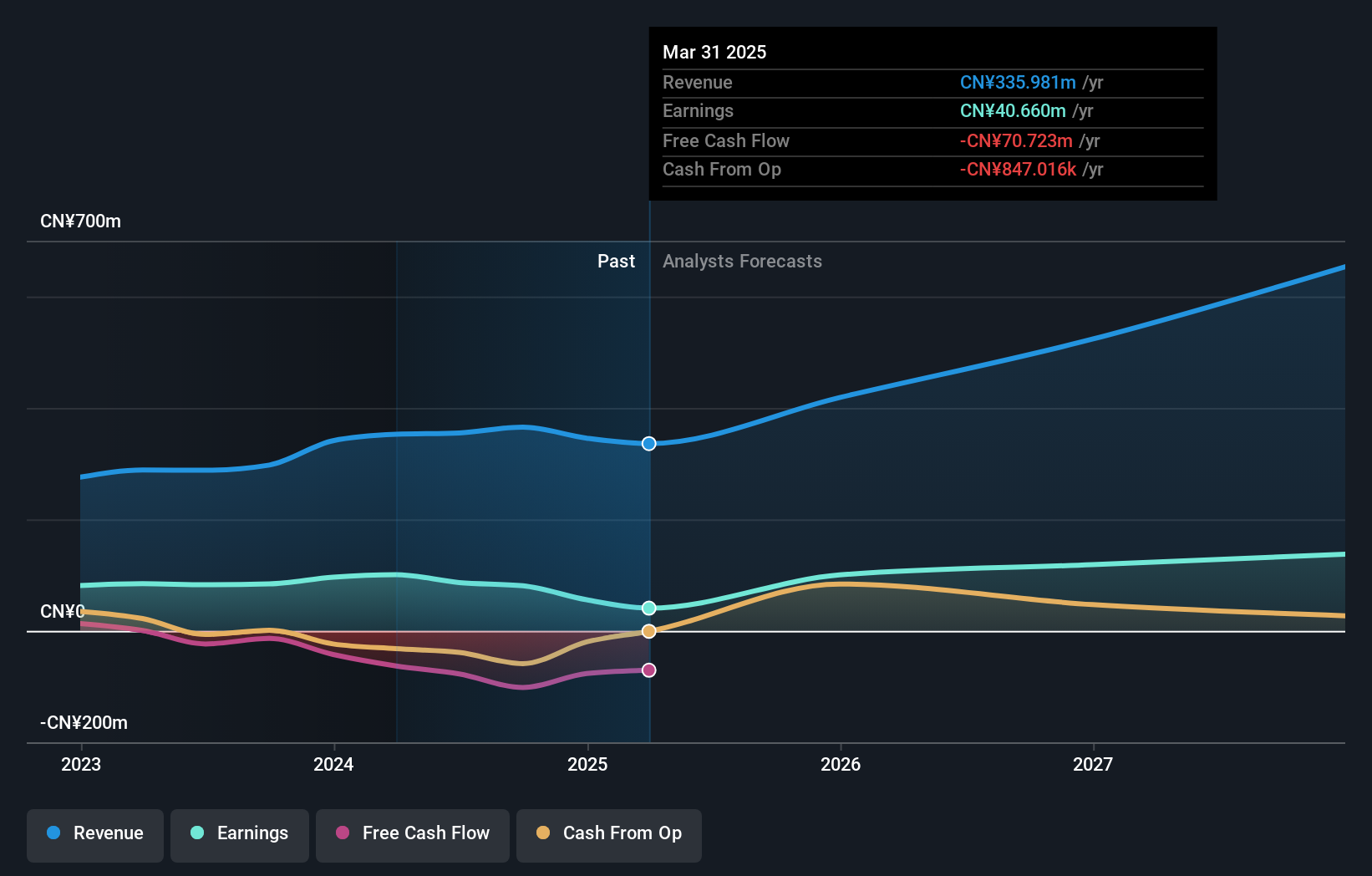

NanJing GOVA Technology has demonstrated robust growth, with revenue and earnings expansion outpacing the broader Chinese market. Its annual revenue growth rate stands at 27.8%, significantly higher than the market's 13.3%, while its earnings are projected to grow by an impressive 35.9% annually. Recent strategic buybacks underscore confidence in future prospects, with nearly a million shares repurchased for CNY 23.89 million in the last quarter of 2024 alone, signaling strong internal optimism about the company's trajectory amidst evolving tech landscapes.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland and has a market capitalization of PLN1.12 billion.

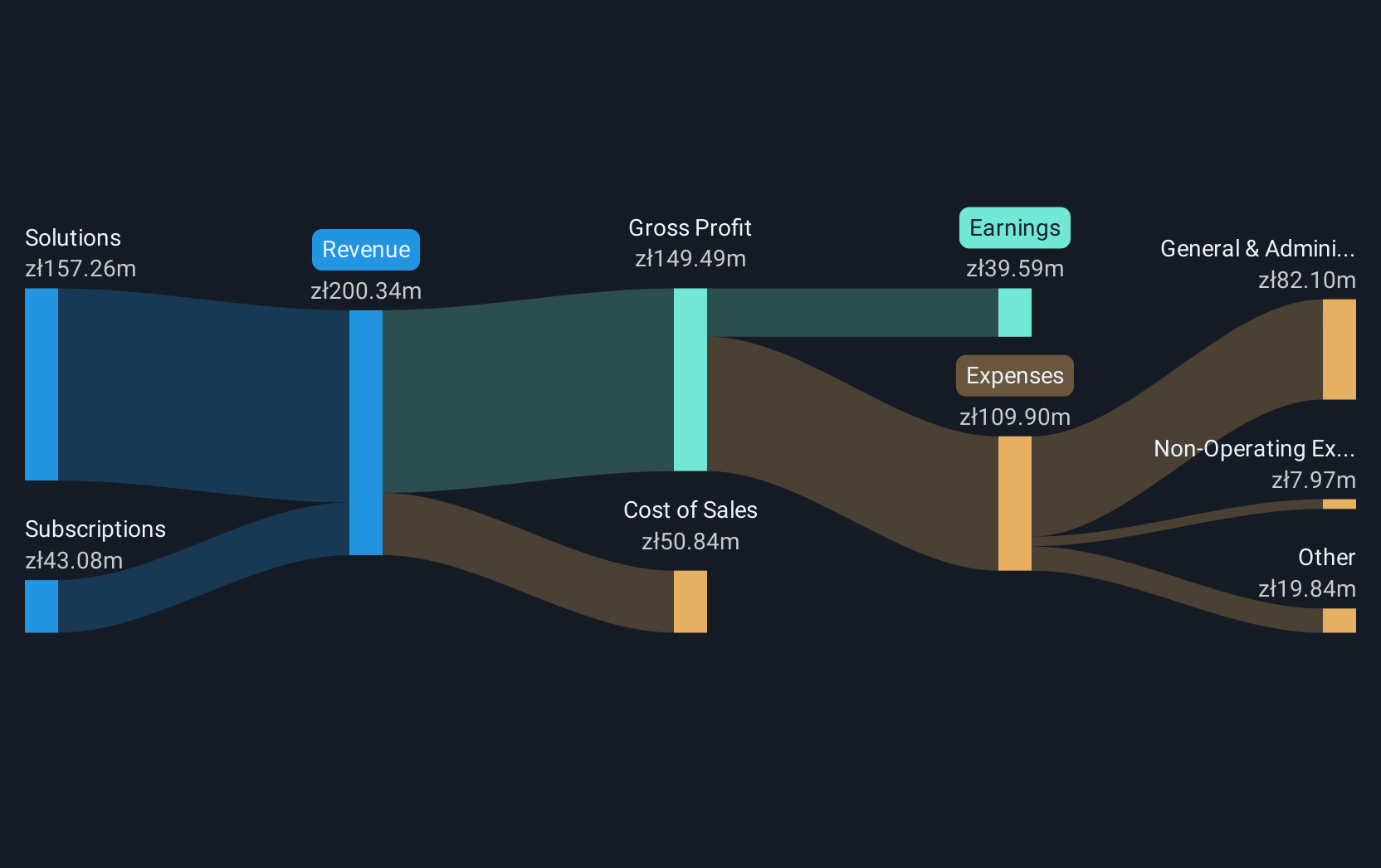

Operations: Shoper SA generates revenue primarily through its Solutions segment, contributing PLN141.44 million, and Subscriptions, which add PLN39.87 million. The company's business model focuses on providing e-commerce solutions in Poland.

Shoper S.A. has outpaced its industry with a notable 39.2% earnings growth over the past year, significantly higher than the software sector's average of 15.2%. This trend is set to continue, with earnings expected to surge by 26.6% annually, surpassing Poland's market growth rate of 16.1%. The company's strategic acquisition by Cyber_Folks for approximately PLN 550 million not only highlights its robust market position but also sets the stage for enhanced operational synergies and expanded market reach, promising a bright future in an increasingly competitive landscape.

Seize The Opportunity

- Embark on your investment journey to our 1230 High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Yunsheng might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600366

Ningbo Yunsheng

Engages in the research and development, manufacture, and sale of rare earth permanent magnet materials in China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives