Ifirma SA (WSE:IFI) Stocks Shoot Up 25% But Its P/E Still Looks Reasonable

Ifirma SA (WSE:IFI) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 4.0% isn't as impressive.

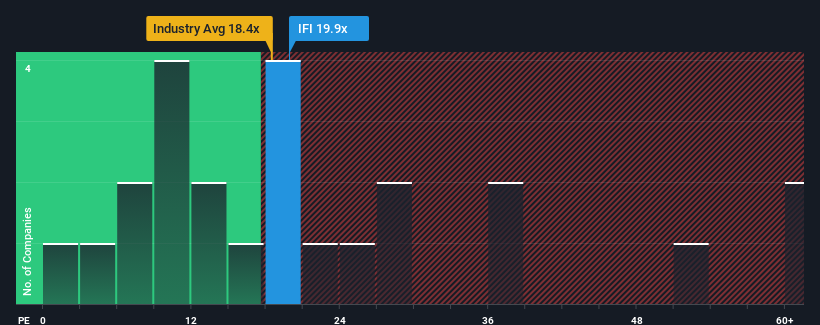

Following the firm bounce in price, Ifirma's price-to-earnings (or "P/E") ratio of 19.9x might make it look like a strong sell right now compared to the market in Poland, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Ifirma has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Ifirma

Is There Enough Growth For Ifirma?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Ifirma's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.9% last year. This was backed up an excellent period prior to see EPS up by 59% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Ifirma's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Ifirma's P/E

Ifirma's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Ifirma maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ifirma (of which 1 is concerning!) you should know about.

You might be able to find a better investment than Ifirma. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:IFI

Ifirma

IFirma SA provides accounting services. The company operates a website, ifirma.pl, which offers services and tools for tax settlements and supporting business activities.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives