- Poland

- /

- Entertainment

- /

- WSE:PLI

Take Care Before Diving Into The Deep End On Platige Image S.A. (WSE:PLI)

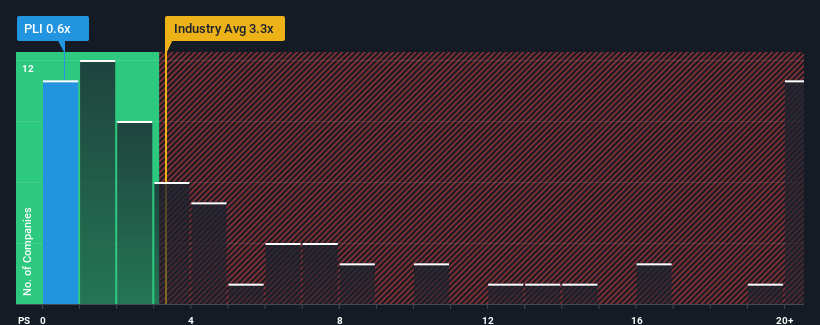

Platige Image S.A.'s (WSE:PLI) price-to-sales (or "P/S") ratio of 0.6x might make it look like a strong buy right now compared to the Entertainment industry in Poland, where around half of the companies have P/S ratios above 3.3x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Platige Image

What Does Platige Image's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Platige Image, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Platige Image will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Platige Image will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Platige Image's to be considered reasonable.

Retrospectively, the last year delivered a decent 2.9% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 55% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

When compared to the industry's one-year growth forecast of 9.7%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that Platige Image is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Platige Image's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Platige Image revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Platige Image that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PLI

Platige Image

Engages in the production of films, video recordings, and television programs.

Slight risk and slightly overvalued.

Market Insights

Community Narratives