- Poland

- /

- Entertainment

- /

- WSE:PCF

Positive Sentiment Still Eludes PCF Group Spólka Akcyjna (WSE:PCF) Following 39% Share Price Slump

PCF Group Spólka Akcyjna (WSE:PCF) shareholders that were waiting for something to happen have been dealt a blow with a 39% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 78% share price decline.

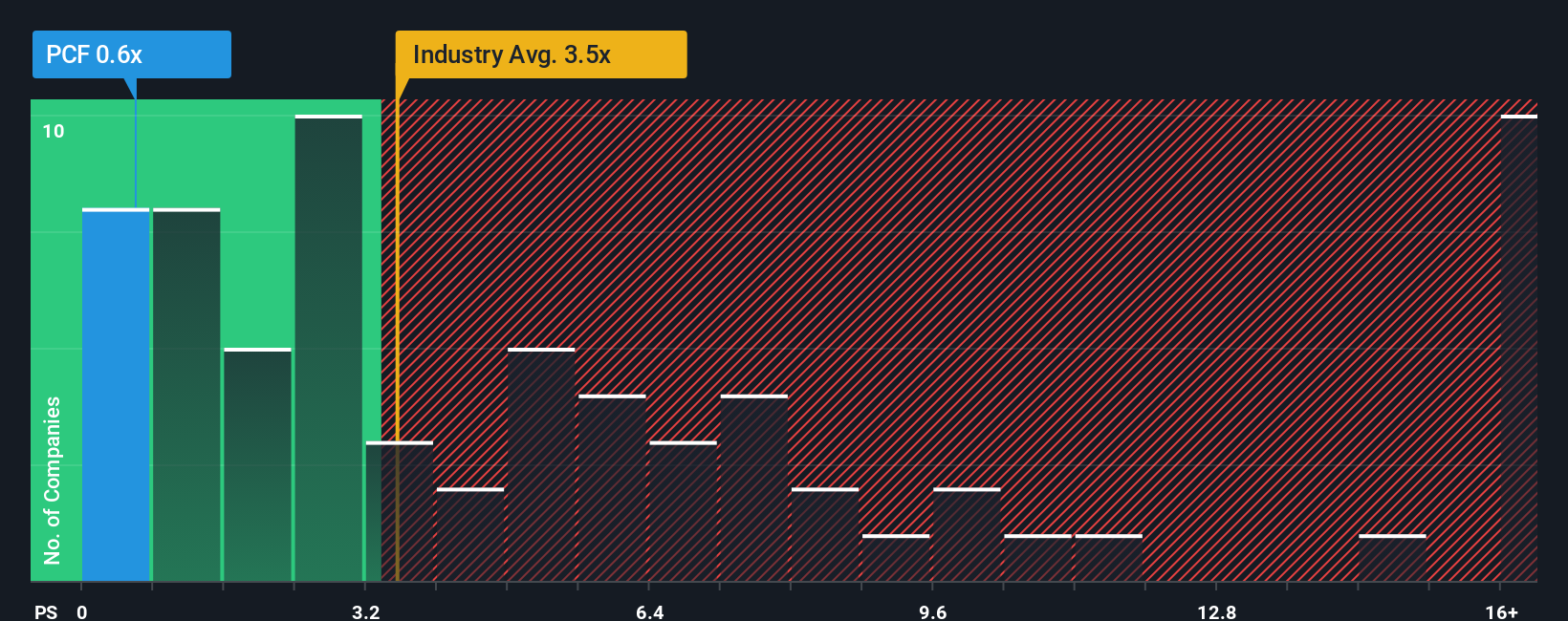

Since its price has dipped substantially, PCF Group Spólka Akcyjna's price-to-sales (or "P/S") ratio of 0.6x might make it look like a strong buy right now compared to the wider Entertainment industry in Poland, where around half of the companies have P/S ratios above 3.5x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for PCF Group Spólka Akcyjna

How PCF Group Spólka Akcyjna Has Been Performing

PCF Group Spólka Akcyjna has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on PCF Group Spólka Akcyjna's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For PCF Group Spólka Akcyjna?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like PCF Group Spólka Akcyjna's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Still, lamentably revenue has fallen 1.6% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 5.5% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

With this information, it's perhaps strange but not a major surprise that PCF Group Spólka Akcyjna is trading at a lower P/S in comparison. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From PCF Group Spólka Akcyjna's P/S?

Having almost fallen off a cliff, PCF Group Spólka Akcyjna's share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we've mentioned, PCF Group Spólka Akcyjna's lower than industry P/S comes as a bit of a surprise due to its recent three-year revenue not being as bad as the forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this comparatively more attractive revenue performance. We'd hazard a guess that some investors are concerned about the company's revenue performance tailing off amidst these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for PCF Group Spólka Akcyjna (1 shouldn't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of PCF Group Spólka Akcyjna's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PCF

PCF Group Spólka Akcyjna

Engages in the development and production of video games in Poland and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives