- Poland

- /

- Entertainment

- /

- WSE:PCF

It's Down 34% But PCF Group Spólka Akcyjna (WSE:PCF) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the PCF Group Spólka Akcyjna (WSE:PCF) share price has dived 34% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 69% share price decline.

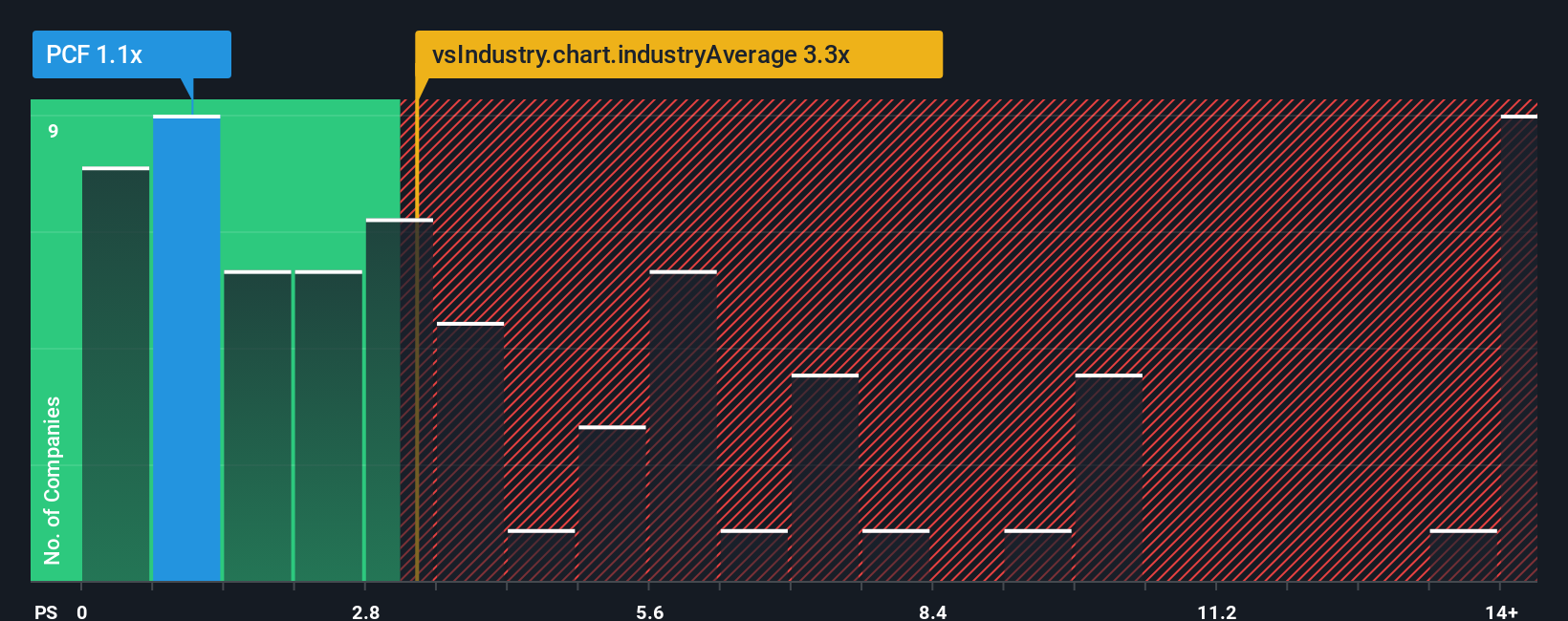

After such a large drop in price, PCF Group Spólka Akcyjna may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Entertainment industry in Poland have P/S ratios greater than 3.3x and even P/S higher than 8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for PCF Group Spólka Akcyjna

How PCF Group Spólka Akcyjna Has Been Performing

Revenue has risen firmly for PCF Group Spólka Akcyjna recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for PCF Group Spólka Akcyjna, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is PCF Group Spólka Akcyjna's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as PCF Group Spólka Akcyjna's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. However, this wasn't enough as the latest three year period has seen an unpleasant 1.6% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 10% shows the industry is even less attractive on an annualised basis.

With this information, it's perhaps strange but not a major surprise that PCF Group Spólka Akcyjna is trading at a lower P/S in comparison. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Key Takeaway

Shares in PCF Group Spólka Akcyjna have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of PCF Group Spólka Akcyjna revealed its narrower three-year contraction in revenue isn't contributing to its P/S anywhere near as much as we would have predicted, given the industry is set to shrink even more. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this comparatively more attractive revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and resist the broader industry turmoil. While recent medium-term revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Having said that, be aware PCF Group Spólka Akcyjna is showing 3 warning signs in our investment analysis, and 2 of those can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PCF

PCF Group Spólka Akcyjna

Engages in the development and production of video games in Poland and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives