- Poland

- /

- Entertainment

- /

- WSE:GOP

Risks To Shareholder Returns Are Elevated At These Prices For Games Operators S.A. (WSE:GOP)

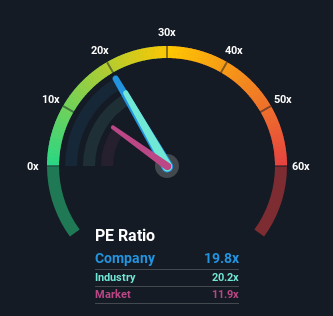

Games Operators S.A.'s (WSE:GOP) price-to-earnings (or "P/E") ratio of 19.8x might make it look like a strong sell right now compared to the market in Poland, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Earnings have risen firmly for Games Operators recently, which is pleasing to see. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Games Operators

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Games Operators would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 17% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 28% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for a contraction of 4.2% shows the market is more attractive on an annualised basis regardless.

In light of this, it's odd that Games Operators' P/E sits above the majority of other companies. In general, when earnings shrink rapidly the P/E premium often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Games Operators' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Games Operators currently trades on a much higher than expected P/E since its recent three-year earnings are even worse than the forecasts for a struggling market. When we see below average earnings, we suspect the share price is at risk of declining, sending the high P/E lower. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough market conditions. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 4 warning signs for Games Operators that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:GOP

Games Operators

A publishing company, invests, releases, and promotes video games.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026