Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, the European market has seen a decline, with major stock indexes such as Germany’s DAX and France’s CAC 40 Index experiencing notable drops. In this climate of volatility, investors might find opportunities in lesser-known corners of the market. Penny stocks, though an outdated term, still hold relevance as they often represent smaller or newer companies that can offer unique growth potential at lower price points. This article will explore three European penny stocks that stand out for their financial strength and potential to deliver impressive returns despite their modest valuations.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.69 | SEK276.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.02 | €63.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.57 | €17.09M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.00 | PLN10.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.37 | SEK2.27B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.04 | €83.92M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.125 | €293.39M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.982 | €33.12M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 453 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

MEMSCAP (ENXTPA:MEMS)

Simply Wall St Financial Health Rating: ★★★★★☆

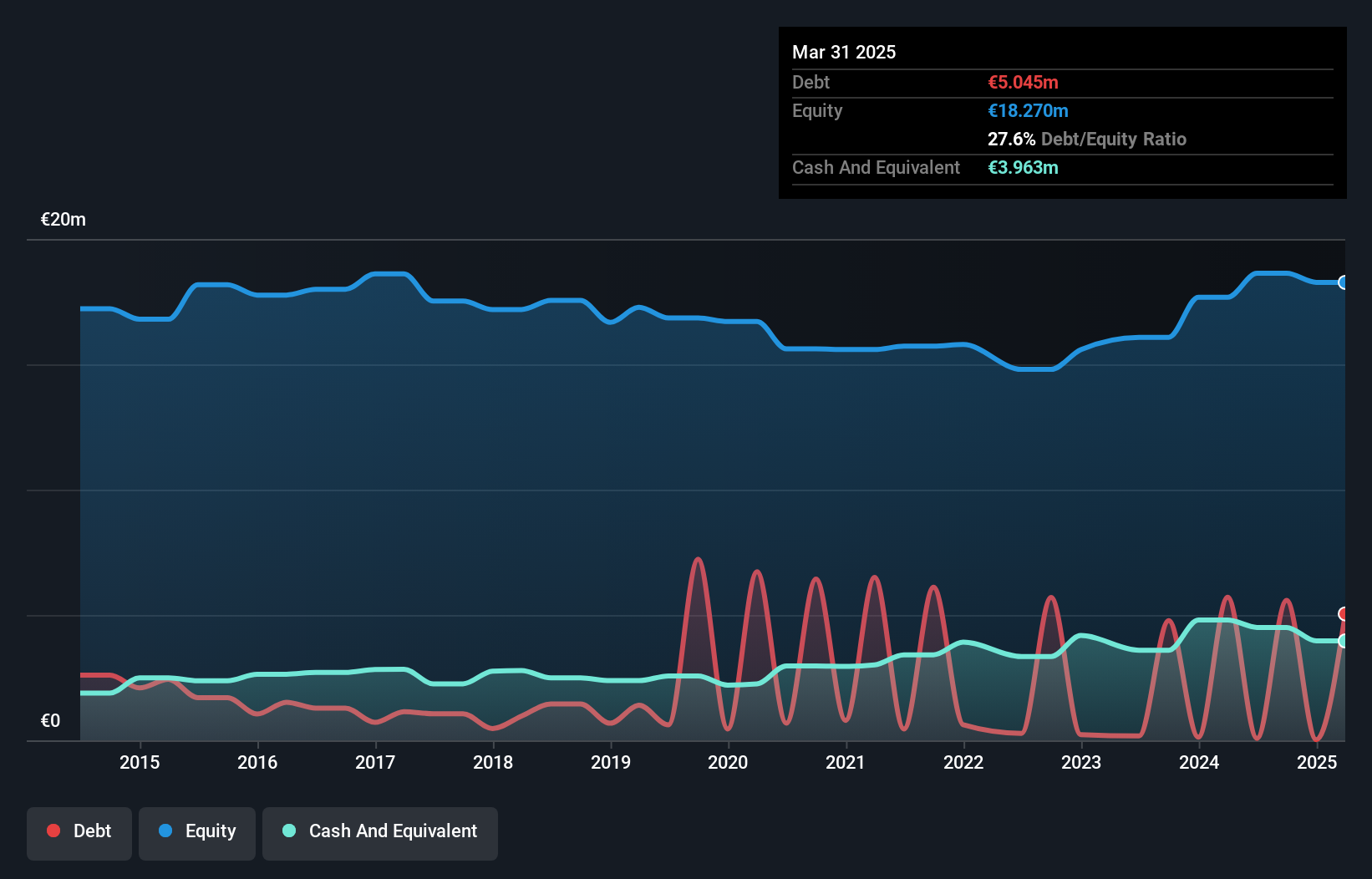

Overview: MEMSCAP, S.A. offers micro-electro-mechanical systems (MEMS) based solutions across aerospace and defense, optical communications, medical, and biomedical sectors globally, with a market cap of €28.73 million.

Operations: The company's revenue is primarily derived from its aerospace segment (€8.10 million), followed by medical (€2.49 million) and optical communications (€1.27 million) sectors, highlighting its focus on diverse applications of micro-electro-mechanical systems technology.

Market Cap: €28.73M

MEMSCAP, S.A. demonstrates a diversified revenue stream with its primary focus on the aerospace sector (€8.10 million), followed by medical and optical communications. Despite recent declines in sales and net income for Q1 2025, the company maintains strong financial health with short-term assets exceeding liabilities and satisfactory debt levels. Its board is experienced, though earnings growth has been negative recently, contrasting previous robust five-year profit growth of 59.1% annually. The company completed a share buyback program in late 2024, indicating potential confidence in its long-term prospects despite current challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of MEMSCAP.

- Assess MEMSCAP's future earnings estimates with our detailed growth reports.

Arctic Bioscience (OB:ABS)

Simply Wall St Financial Health Rating: ★★★★★☆

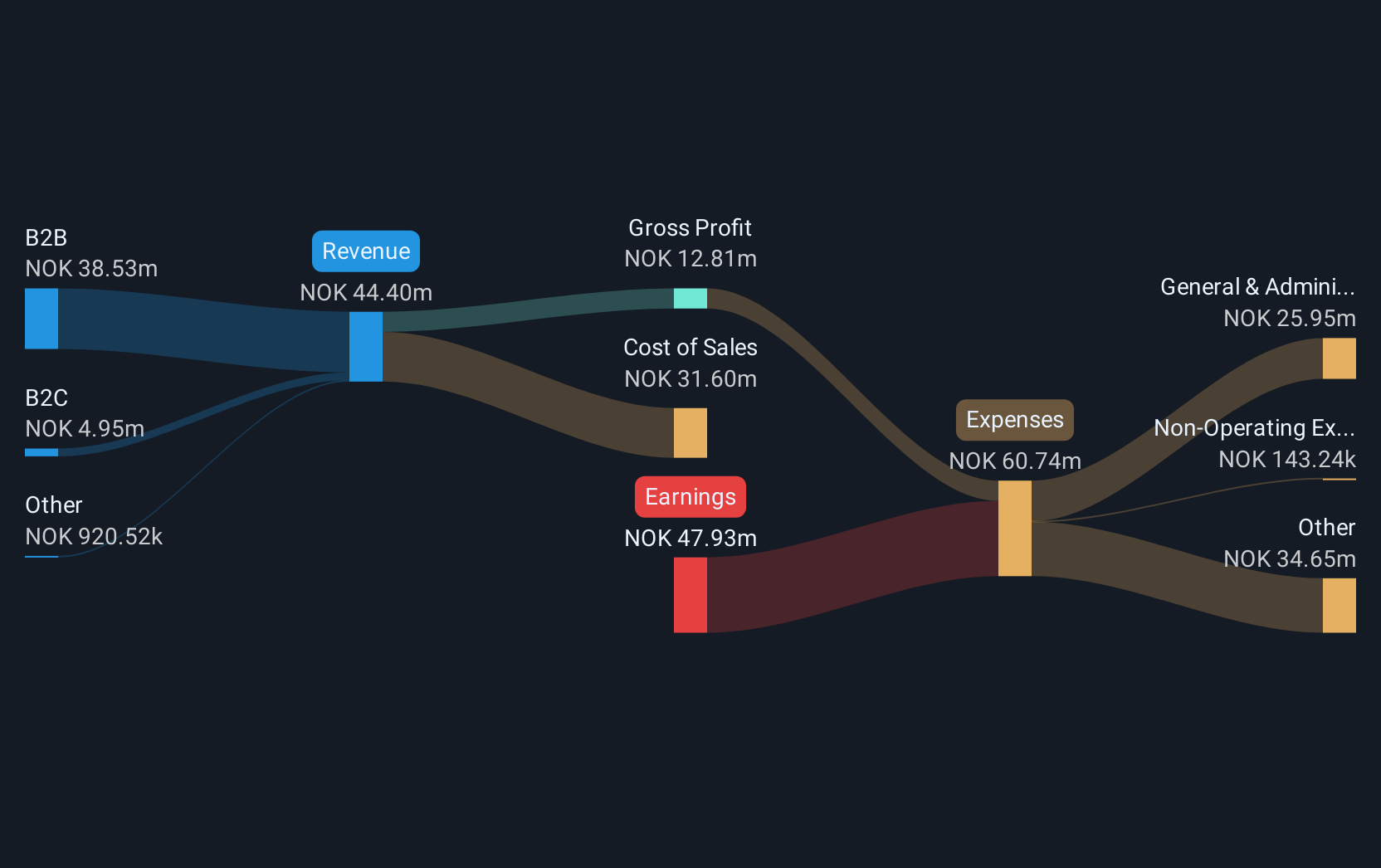

Overview: Arctic Bioscience AS is a clinical-stage biotechnology company focused on developing and commercializing pharmaceutical and nutraceutical ingredients derived from bioactive marine compounds, with a market cap of NOK101.26 million.

Operations: The company's revenue is primarily generated from its B2B segment, which accounts for NOK38.53 million, while the B2C segment contributes NOK4.95 million.

Market Cap: NOK101.26M

Arctic Bioscience AS, with a market cap of NOK101.26 million, remains unprofitable and faces challenges with a net loss of NOK47.93 million for 2024. Despite its seasoned management team and recent board changes, the company struggles with high volatility and insufficient short-term asset coverage for liabilities. Recent clinical trials in psoriasis treatment show promising results but require further funding beyond phase 2b through partnerships or project-specific financing. The auditor expressed doubts about its going concern status, though Arctic Bioscience aims for solid sales growth in 2025 and expects cash flow positive nutraceutical operations by 2026.

- Jump into the full analysis health report here for a deeper understanding of Arctic Bioscience.

- Evaluate Arctic Bioscience's historical performance by accessing our past performance report.

Gamedust (WSE:GDC)

Simply Wall St Financial Health Rating: ★★★★★☆

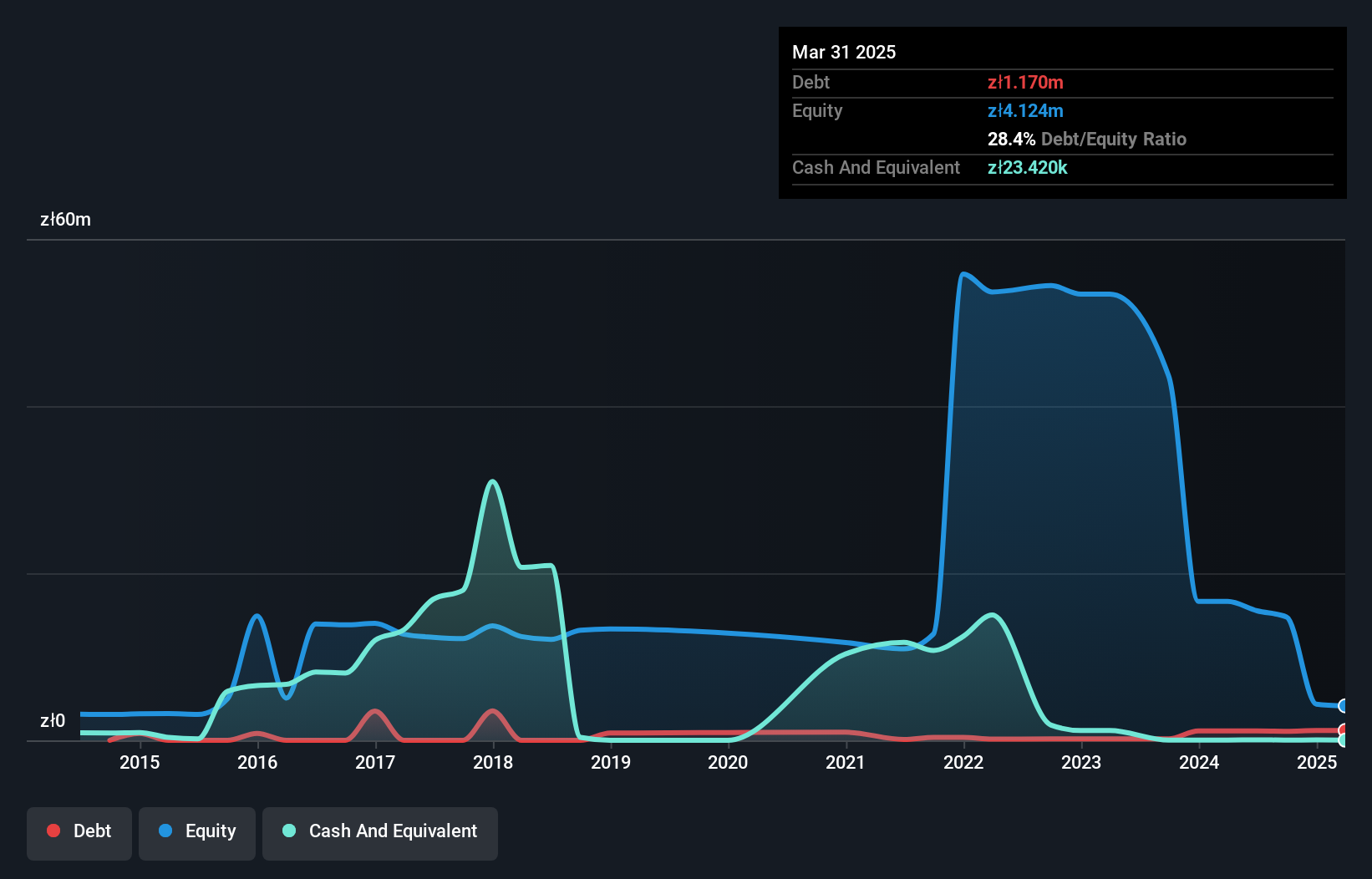

Overview: Gamedust S.A. is a Polish company that develops and publishes video games for both VR and non-VR platforms, with a market cap of PLN15.28 million.

Operations: The company generates revenue primarily from its segment as an online financial information provider, amounting to PLN0.90 million.

Market Cap: PLN15.28M

Gamedust S.A., with a market cap of PLN15.28 million, is currently pre-revenue, generating less than US$1 million annually. Despite being unprofitable, the company has a sufficient cash runway for over three years due to positive free cash flow. Recent earnings showed a revenue decline to PLN0.16 million from PLN0.58 million year-on-year and reduced net losses to PLN0.21 million from PLN0.82 million previously. The company's short-term assets of PLN3.9M comfortably cover both its long-term and short-term liabilities, although its debt-to-equity ratio has increased significantly over five years to 28.4%.

- Click here to discover the nuances of Gamedust with our detailed analytical financial health report.

- Gain insights into Gamedust's past trends and performance with our report on the company's historical track record.

Where To Now?

- Navigate through the entire inventory of 453 European Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:GDC

Gamedust

Develops and publishes video games for VR and non-VR platforms in Poland.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives