- Poland

- /

- Entertainment

- /

- WSE:CIG

I Ran A Stock Scan For Earnings Growth And CI Games (WSE:CIG) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in CI Games (WSE:CIG). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for CI Games

CI Games's Improving Profits

In the last three years CI Games's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, CI Games's EPS soared from zł0.062 to zł0.089, over the last year. That's a commendable gain of 43%.

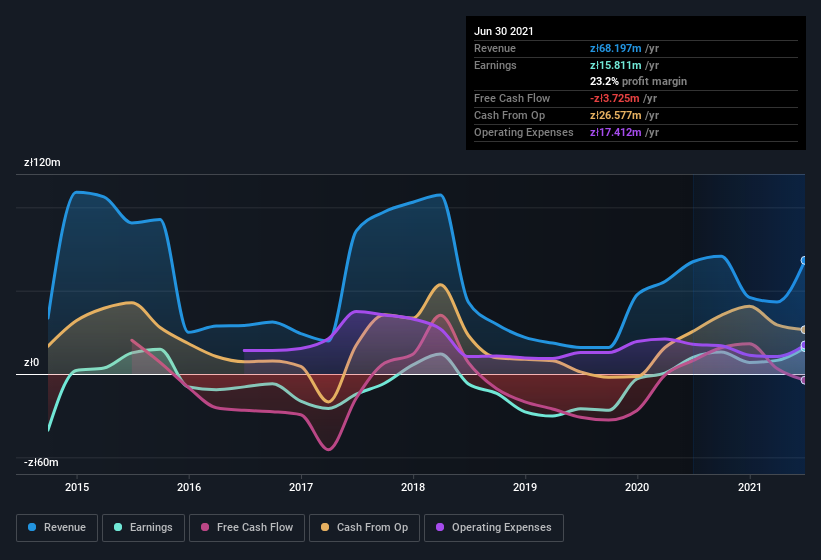

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. This approach makes CI Games look pretty good, on balance; although revenue is flattish, EBIT margins improved from 17% to 30% in the last year. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

CI Games isn't a huge company, given its market capitalization of zł271m. That makes it extra important to check on its balance sheet strength.

Are CI Games Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own CI Games shares worth a considerable sum. Indeed, they hold zł79m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 29% of the company; visible skin in the game.

Does CI Games Deserve A Spot On Your Watchlist?

For growth investors like me, CI Games's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Before you take the next step you should know about the 3 warning signs for CI Games (1 can't be ignored!) that we have uncovered.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade CI Games, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:CIG

CI Games

Produces, publishes, and distributes video games in Europe, North and South America, Asia, and Africa.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives