Exploring Pexip Holding And Two High Growth Tech Stocks In Europe

Reviewed by Simply Wall St

As European markets experience a positive shift, with the pan-European STOXX Europe 600 Index rising by 1.40% amid hopes of lower U.S. borrowing costs and an uptick in eurozone business activity, investors are closely examining high-growth tech stocks that could benefit from these favorable conditions. In this article, we will explore Pexip Holding and two other promising tech companies in Europe, focusing on their potential to thrive amidst the current economic landscape where innovation and adaptability are key factors for success.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| argenx | 21.06% | 26.05% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Bonesupport Holding | 25.30% | 59.70% | ★★★★★★ |

| Hacksaw | 26.01% | 37.60% | ★★★★★★ |

| ContextVision | 3.74% | 53.78% | ★★★★★☆ |

| CD Projekt | 33.65% | 39.46% | ★★★★★★ |

| Aelis Farma | 79.30% | 106.93% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Yubico | 15.46% | 33.06% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

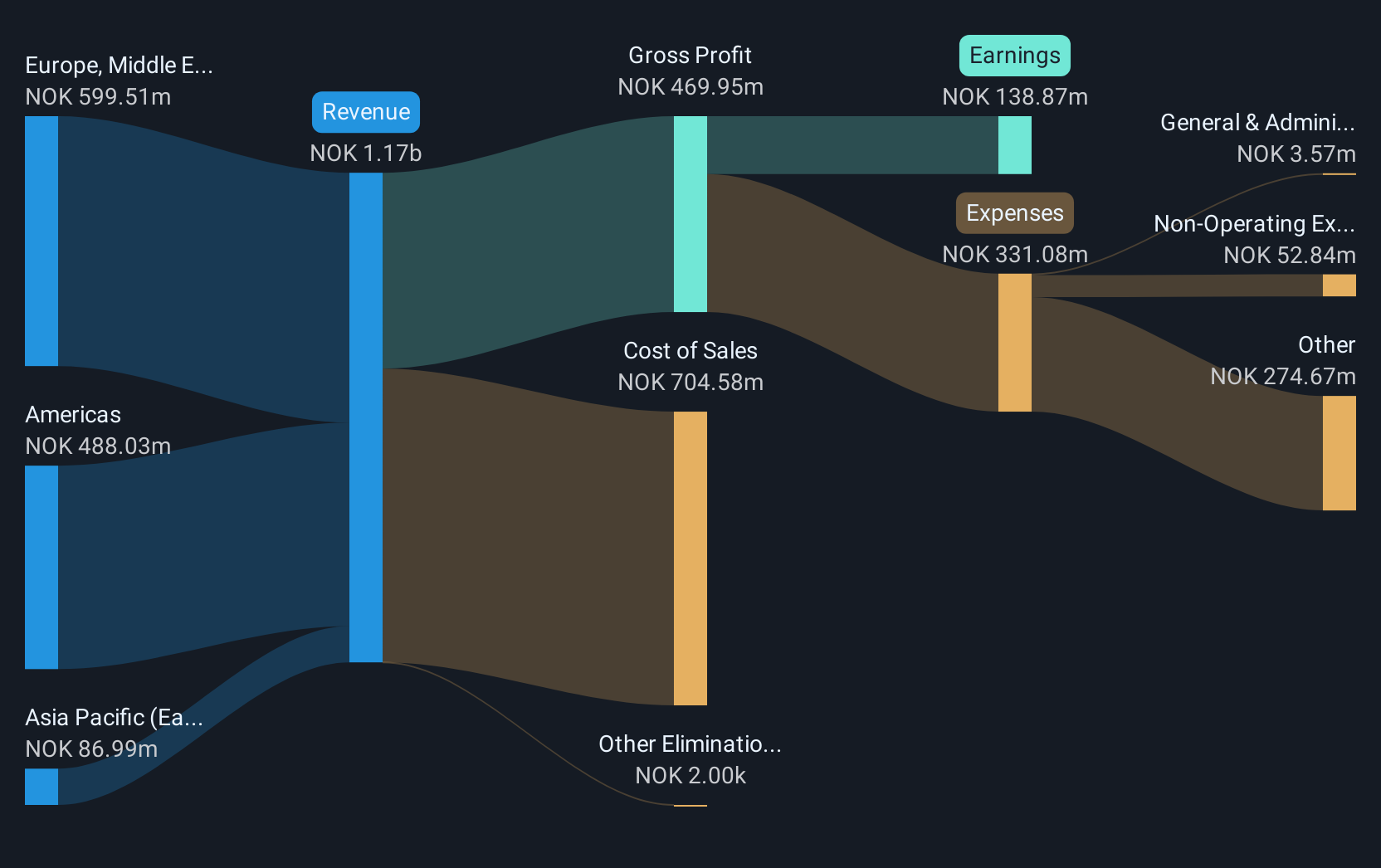

Overview: Pexip Holding ASA is a video technology company that offers a comprehensive video conferencing platform and digital infrastructure across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of NOK6.55 billion.

Operations: The company generates revenue primarily through the sale of collaboration services, amounting to NOK1.19 billion.

Pexip Holding has demonstrated a robust financial performance, with second-quarter sales rising to NOK 281.12 million from NOK 265.58 million year-over-year and net income surging to NOK 43.88 million from NOK 7.03 million, reflecting a significant improvement in profitability. This growth trajectory is underscored by an annual earnings forecast of a substantial 20.7% increase per year, outpacing the Norwegian market's average of 11.9%. Additionally, the company has actively returned value to shareholders through strategic share repurchases totaling NOK 99.9 million for approximately 1.65% of its shares this quarter alone, signaling confidence in its financial health and future prospects.

- Delve into the full analysis health report here for a deeper understanding of Pexip Holding.

Gain insights into Pexip Holding's past trends and performance with our Past report.

BioGaia (OM:BIOG B)

Simply Wall St Growth Rating: ★★★★★☆

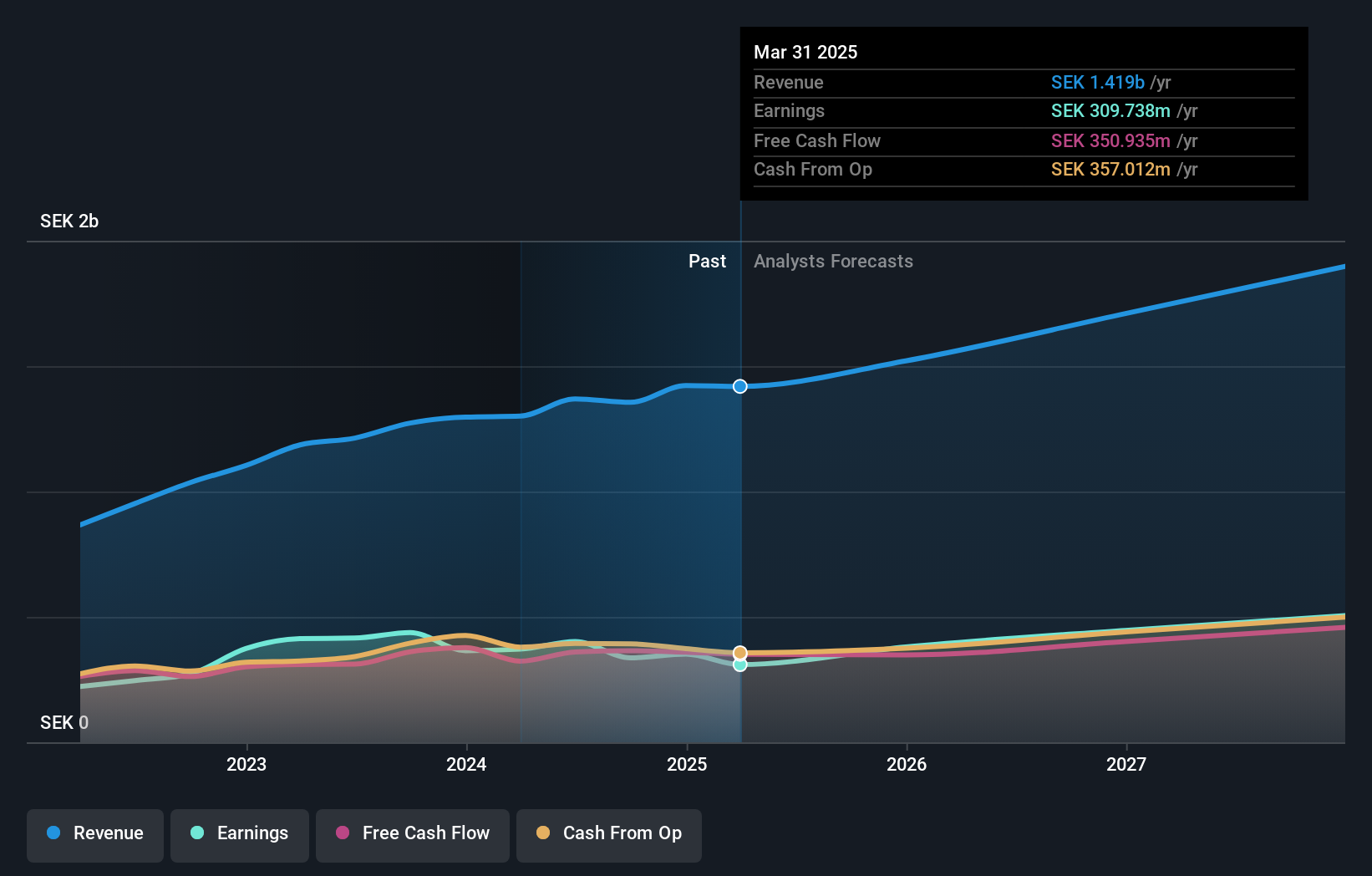

Overview: BioGaia AB (publ) is a healthcare company that develops, manufactures, markets, and sells probiotic products for gut, oral, and immune health across various regions including Europe, the Middle East, Africa, the United States, Asia-Pacific, Australia, and New Zealand with a market capitalization of approximately SEK10.57 billion.

Operations: BioGaia focuses on probiotic products, with Pediatrics generating SEK 1.08 billion and Adult Health contributing SEK 352.62 million in revenue. The company operates across multiple global regions, emphasizing gut, oral, and immune health solutions.

Amidst recent leadership changes, BioGaia has maintained a steady growth trajectory with a reported 11.1% increase in annual revenue. Despite facing a 28.6% decline in earnings last year, the company is poised for a rebound with expected earnings growth of 21.3% annually, outpacing the Swedish market's forecast of 5.1%. The establishment of BioGaia New Sciences AB marks an innovative expansion into skin health, leveraging microbiome science to tap into the burgeoning global skin microbiome market projected to grow at a CAGR of 13.7%. This strategic diversification aligns with consumer trends towards scientifically-backed skincare solutions and could significantly shape BioGaia's future in biotech and wellness sectors.

- Dive into the specifics of BioGaia here with our thorough health report.

Assess BioGaia's past performance with our detailed historical performance reports.

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

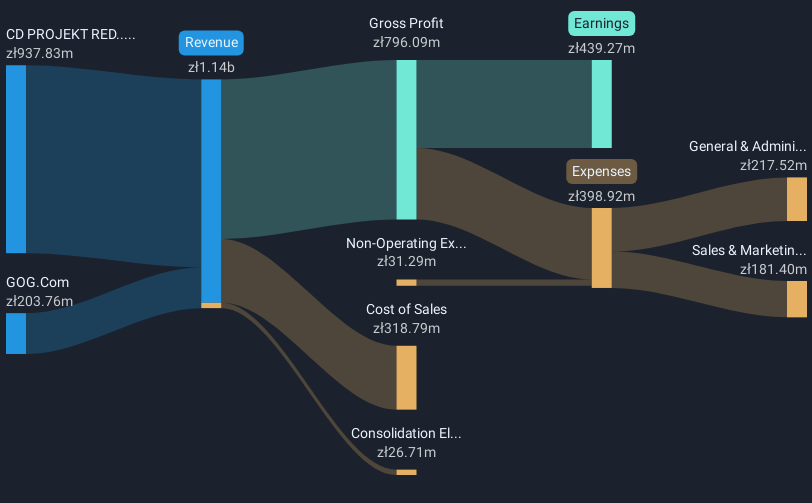

Overview: CD Projekt S.A. is a Polish company involved in developing, publishing, and digitally distributing video games for personal computers and consoles, with a market capitalization of PLN25.74 billion.

Operations: CD Projekt generates revenue primarily from its CD PROJEKT RED segment, contributing PLN 795.50 million, and GOG.Com platform, adding PLN 203.79 million.

CD Projekt, amidst a slight dip in quarterly earnings from PLN 100.06 million to PLN 86 million, continues to demonstrate robust potential with projected annual revenue growth at 33.7% and earnings expected to surge by 39.5%. This performance is notably superior to the broader Polish market's growth rates of 4.4% and 13.9%, respectively. The company's commitment to innovation is evident from its significant R&D investments, aligning with industry trends towards enhanced gaming experiences and interactive entertainment platforms. As CD Projekt navigates through these financial nuances, its strategic focus on developing cutting-edge technologies and content could solidify its standing in the global tech landscape, promising exciting future prospects.

- Click to explore a detailed breakdown of our findings in CD Projekt's health report.

Evaluate CD Projekt's historical performance by accessing our past performance report.

Taking Advantage

- Access the full spectrum of 50 European High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

BioGaia

A healthcare company, develops, manufactures, markets and sells probiotic products for gut, oral, and immune health in Europe, the Middle East, Africa, the United States, the Asia-Pacific, Australia, and New Zealand.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives