3 Promising European Penny Stocks With Market Caps Up To €200M

Reviewed by Simply Wall St

The European market recently faced a downturn, with the STOXX Europe 600 Index dropping by 2.57% amid dissatisfaction with a new trade deal framework between the U.S. and EU. Despite these challenges, investors continue to seek opportunities in smaller companies that show resilience and potential for growth. Penny stocks, often overlooked yet promising when supported by strong financials, offer a unique chance for investors to explore value at lower price points while maintaining solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.97 | €14.41M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.41 | €45.29M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €308.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.97 | €62.64M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.80 | €17.95M | ✅ 2 ⚠️ 3 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.295 | SEK3.15B | ✅ 4 ⚠️ 2 View Analysis > |

| FORIS (XTRA:FRS) | €3.38 | €15.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.22 | €306.5M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.96 | €32.37M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 338 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Mistral Iberia Real Estate SOCIMI (BME:YMIB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mistral Iberia Real Estate SOCIMI, S.A. is a real estate investment company that focuses on investing in real estate and other assets, with a market cap of €21.78 million.

Operations: The company's revenue segment includes €3.66 million from its commercial real estate investment activities.

Market Cap: €21.78M

Mistral Iberia Real Estate SOCIMI, S.A., with a market cap of €21.78 million, has shown significant earnings growth of 104.7% over the past year, surpassing industry averages. Despite its low Return on Equity at 11.9%, the company trades significantly below estimated fair value and maintains satisfactory debt levels with a net debt to equity ratio of 18.4%. Interest payments are well covered by EBIT at 12.4x, though short-term assets do not cover long-term liabilities (€6.3M). A recent dividend increase suggests confidence in cash flow management despite dividends not being well covered by free cash flows.

- Navigate through the intricacies of Mistral Iberia Real Estate SOCIMI with our comprehensive balance sheet health report here.

- Assess Mistral Iberia Real Estate SOCIMI's previous results with our detailed historical performance reports.

Hub.Tech (WSE:HUB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hub.Tech SA operates in the chemical industry in Poland and has a market cap of PLN186.23 million.

Operations: The company's revenue from its Specialty Chemicals segment is PLN265.55 million.

Market Cap: PLN186.23M

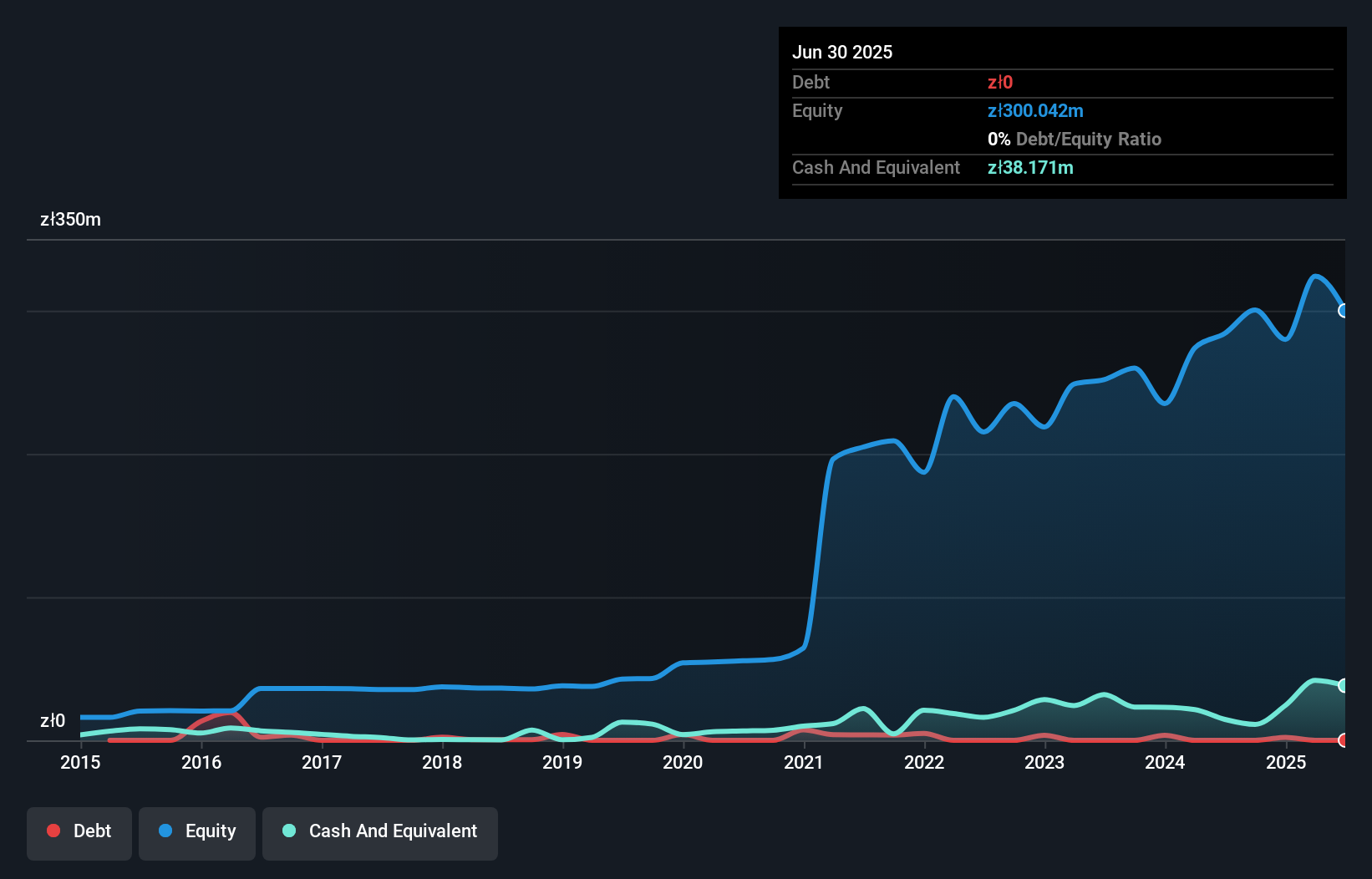

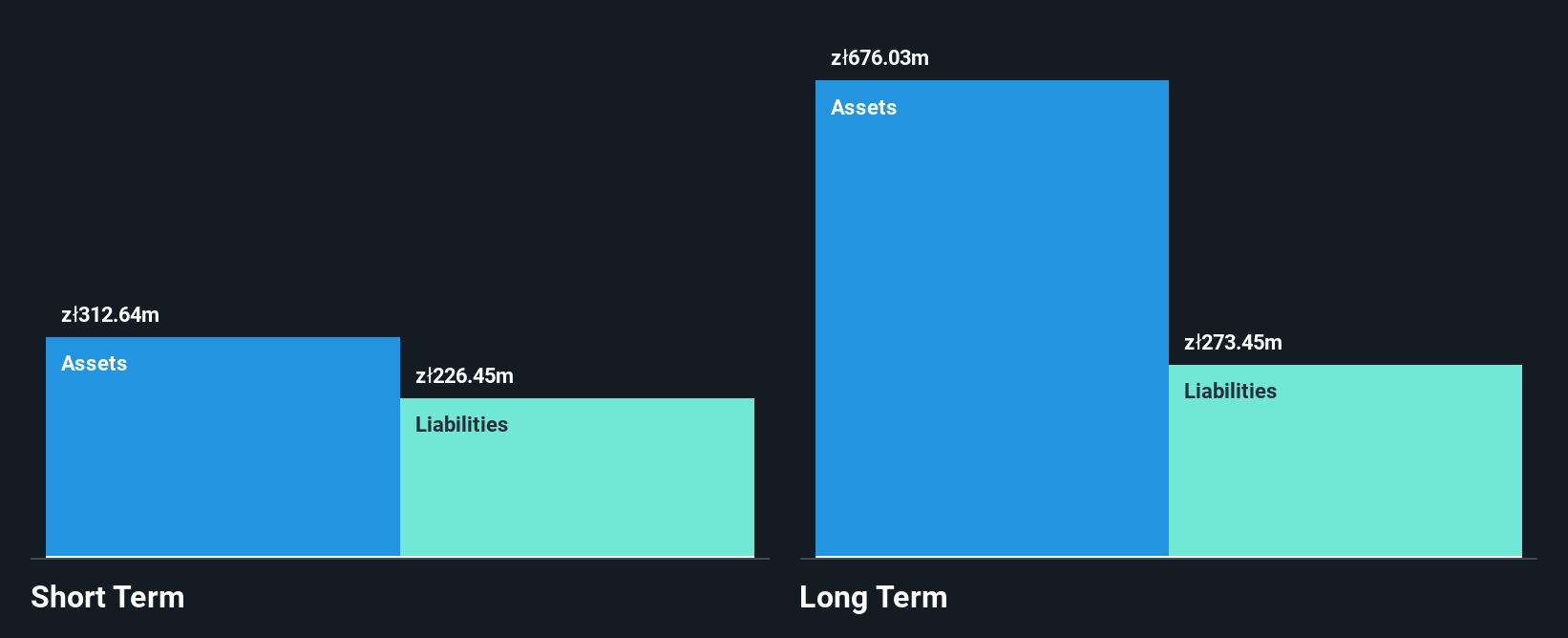

Hub.Tech SA, with a market cap of PLN186.23 million, operates in the Polish chemical industry and has demonstrated robust financial health. Its short-term assets of PLN163.6 million comfortably cover both short and long-term liabilities, indicating strong liquidity. The company is debt-free, eliminating concerns over interest coverage or cash flow adequacy for debt repayment. Despite a low Return on Equity at 9.6%, Hub.Tech's earnings growth has been substantial, with an impressive 80.5% increase over the past year surpassing industry averages significantly. The Price-To-Earnings ratio of 5.8x suggests it may be undervalued compared to the broader Polish market average.

- Jump into the full analysis health report here for a deeper understanding of Hub.Tech.

- Learn about Hub.Tech's historical performance here.

PCC Exol (WSE:PCX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PCC Exol S.A. manufactures and distributes surfactants both in Poland and internationally, with a market cap of PLN454.50 million.

Operations: The company's revenue segment is Specialty Chemicals, contributing PLN996.33 million.

Market Cap: PLN454.5M

PCC Exol S.A., with a market cap of PLN454.50 million, has shown steady financial performance in the specialty chemicals sector. Recent earnings reports indicate growth, with first-quarter sales rising to PLN290.01 million from PLN241.8 million year-over-year and net income increasing to PLN11.43 million from PLN8.98 million. The company benefits from high-quality earnings and improved profit margins but faces challenges with a high net debt to equity ratio of 54.1%, which is not well supported by operating cash flow at 17%. Despite these concerns, its Price-To-Earnings ratio remains competitive at 11.9x against the Polish market average.

- Click here to discover the nuances of PCC Exol with our detailed analytical financial health report.

- Explore historical data to track PCC Exol's performance over time in our past results report.

Key Takeaways

- Discover the full array of 338 European Penny Stocks right here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:YMIB

Mistral Iberia Real Estate SOCIMI

A real estate investment company, invests in real estate and other assets.

Excellent balance sheet and good value.

Market Insights

Community Narratives