David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Arctic Paper S.A. (WSE:ATC) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Arctic Paper

What Is Arctic Paper's Net Debt?

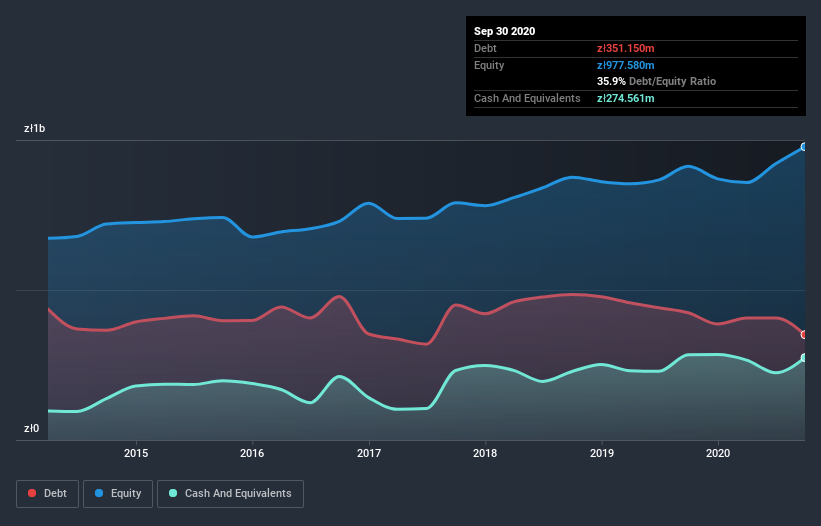

The image below, which you can click on for greater detail, shows that Arctic Paper had debt of zł342.5m at the end of September 2020, a reduction from zł424.0m over a year. However, because it has a cash reserve of zł274.6m, its net debt is less, at about zł67.9m.

A Look At Arctic Paper's Liabilities

The latest balance sheet data shows that Arctic Paper had liabilities of zł641.3m due within a year, and liabilities of zł504.9m falling due after that. Offsetting these obligations, it had cash of zł274.6m as well as receivables valued at zł342.6m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł529.1m.

Given this deficit is actually higher than the company's market capitalization of zł467.0m, we think shareholders really should watch Arctic Paper's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With net debt sitting at just 0.26 times EBITDA, Arctic Paper is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 8.9 times the interest expense over the last year. Also good is that Arctic Paper grew its EBIT at 13% over the last year, further increasing its ability to manage debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Arctic Paper will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Arctic Paper produced sturdy free cash flow equating to 66% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

On our analysis Arctic Paper's net debt to EBITDA should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. In particular, level of total liabilities gives us cold feet. Looking at all this data makes us feel a little cautious about Arctic Paper's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with Arctic Paper .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Arctic Paper, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:ATC

Arctic Paper

Produces and sells paper products for printing houses, paper distributors, book and magazine publishing houses, and the advertising industries.

Excellent balance sheet and good value.

Market Insights

Community Narratives