- Poland

- /

- Healthcare Services

- /

- WSE:VOX

Exploring Europe's Undiscovered Gems For July 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of new trade tariffs and fluctuating economic indicators, major indices like the STOXX Europe 600 have shown resilience despite recent challenges. Amid this backdrop, identifying promising stocks requires a keen eye for companies that can capitalize on emerging opportunities and demonstrate strong fundamentals in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Deutsche Balaton | 5.64% | -7.61% | -16.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Faes Farma (BME:FAE)

Simply Wall St Value Rating: ★★★★★★

Overview: Faes Farma, S.A. is a global company engaged in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials with a market capitalization of €1.42 billion.

Operations: Faes Farma generates revenue primarily through its pharmaceutical and healthcare product lines. The company's market capitalization stands at approximately €1.42 billion, reflecting its position in the global market.

Faes Farma, a promising player in the pharmaceutical sector, has seen its earnings grow 8.2% annually over the past five years. Despite a recent one-off gain of €178.8M impacting results, it trades at 20.7% below estimated fair value, suggesting potential upside. The company reported Q1 2025 sales of €145.57M and net income of €28.38M, slightly down from last year’s €30.47M due to industry pressures with growth not matching the sector's 22.8%. With a debt-to-equity ratio reduced to 3.6%, Faes Farma seems financially robust and well-positioned for future opportunities despite mixed short-term results.

- Dive into the specifics of Faes Farma here with our thorough health report.

Examine Faes Farma's past performance report to understand how it has performed in the past.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★★★

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of €441.51 million.

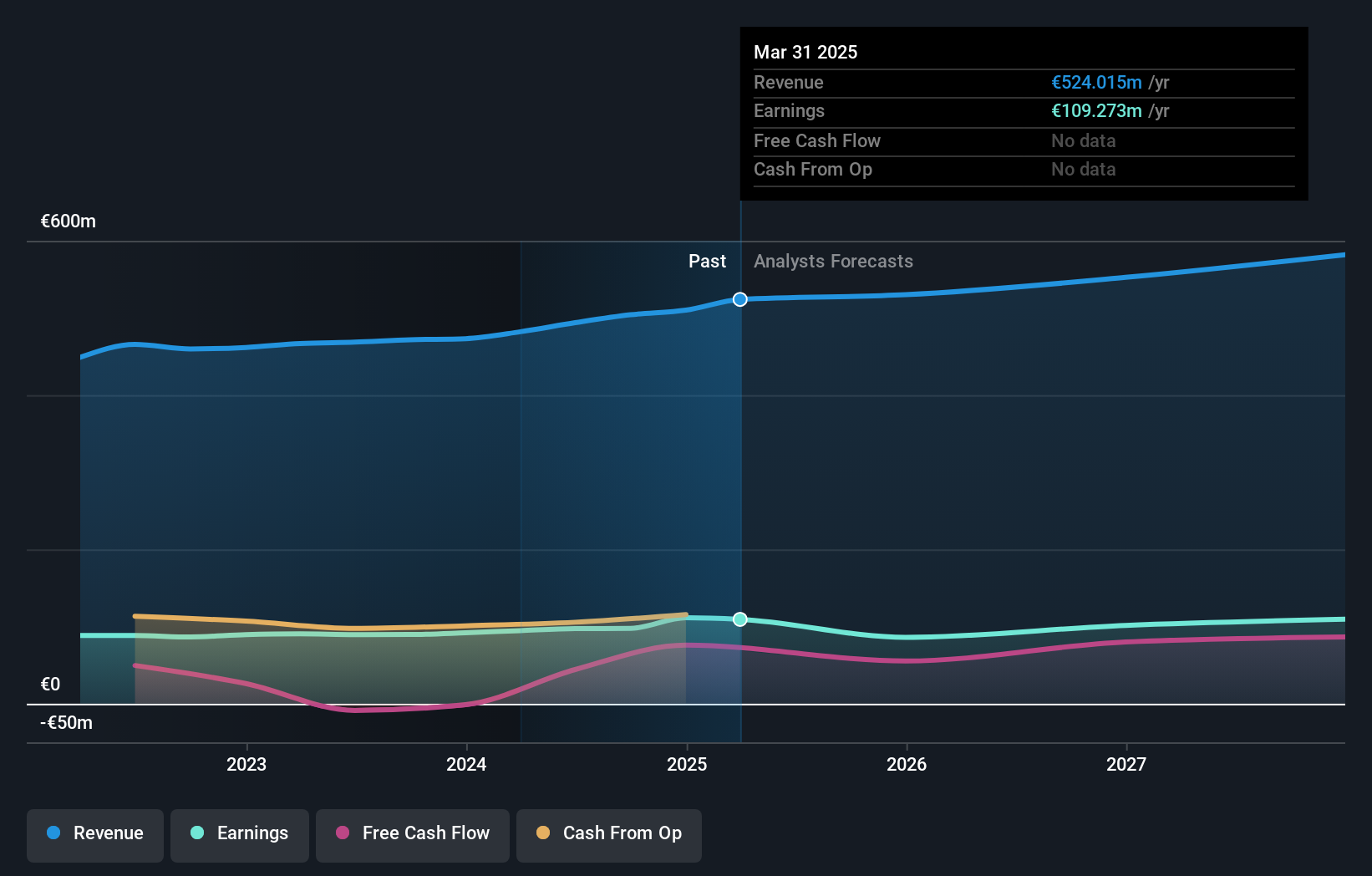

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, which contributed €494.39 million. The company's financial performance can be evaluated through its net profit margin, which reflects the efficiency of converting revenue into profit after expenses.

EPC Groupe, a small player in the chemicals sector, showcases high-quality earnings and positive free cash flow. Notably, its net debt to equity ratio stands at a satisfactory 27.7%, having improved from 73.9% over five years. The company's interest payments are well covered by EBIT at 3.5 times coverage, indicating financial stability. Recent growth of 9.5% in earnings outpaces the industry average and is set to accelerate with forecasts predicting an annual increase of nearly 20%. Trading at approximately 34% below estimated fair value, EPC Groupe seems poised for potential upside amidst its solid financial footing and strategic dividend increases (€1.50 per share).

- Click here and access our complete health analysis report to understand the dynamics of EPC Groupe.

Understand EPC Groupe's track record by examining our Past report.

Voxel (WSE:VOX)

Simply Wall St Value Rating: ★★★★★★

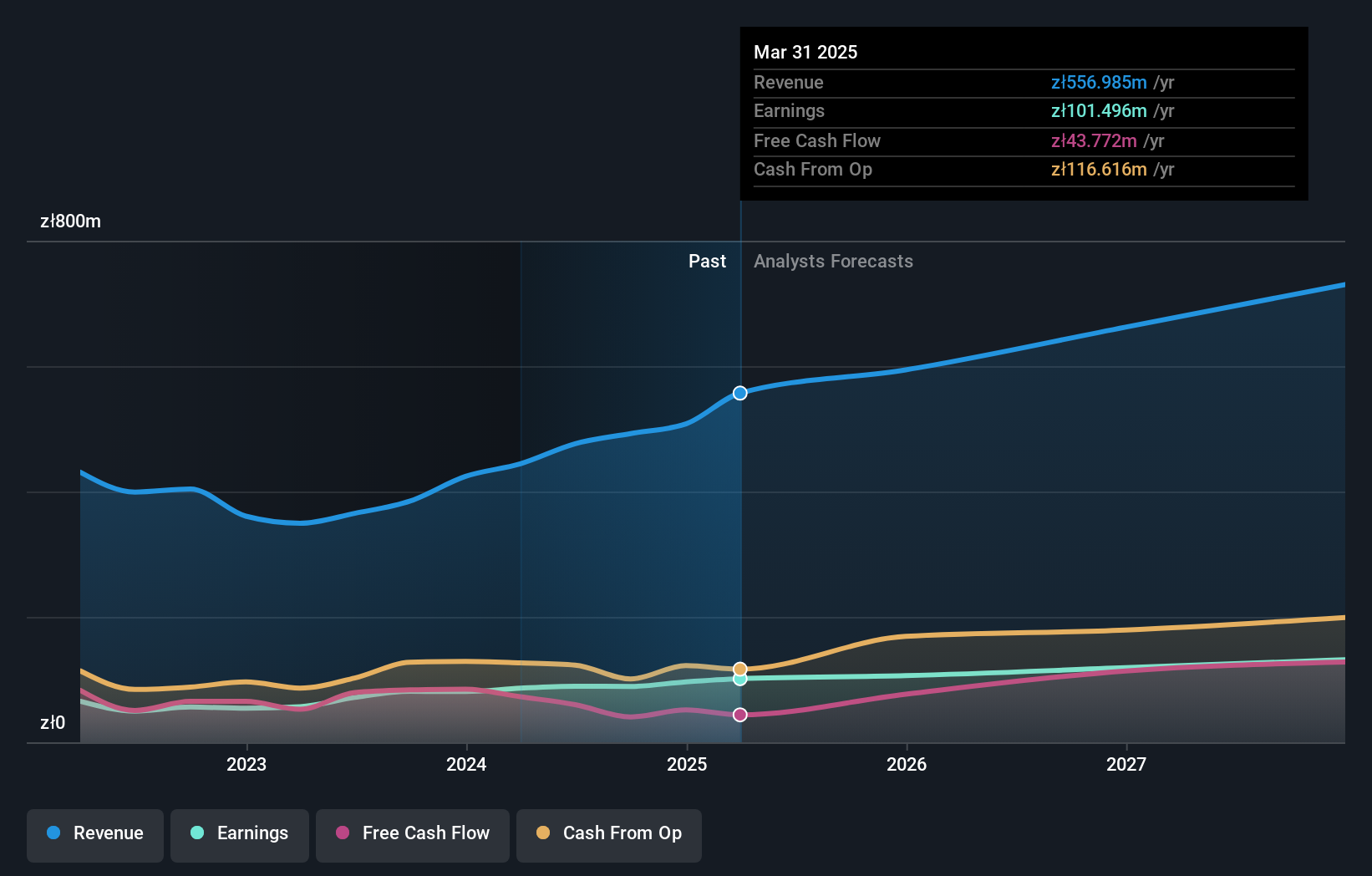

Overview: Voxel S.A. operates a network of diagnostic imaging laboratories in Poland and has a market capitalization of PLN 1.80 billion.

Operations: Voxel generates revenue primarily through its diagnostics segment, which includes medical services and sales of radiopharmaceuticals, contributing PLN 398.28 million. The IT & Infrastructure segment adds PLN 171.92 million to the company's revenue, while the therapy segment accounts for PLN 13.99 million.

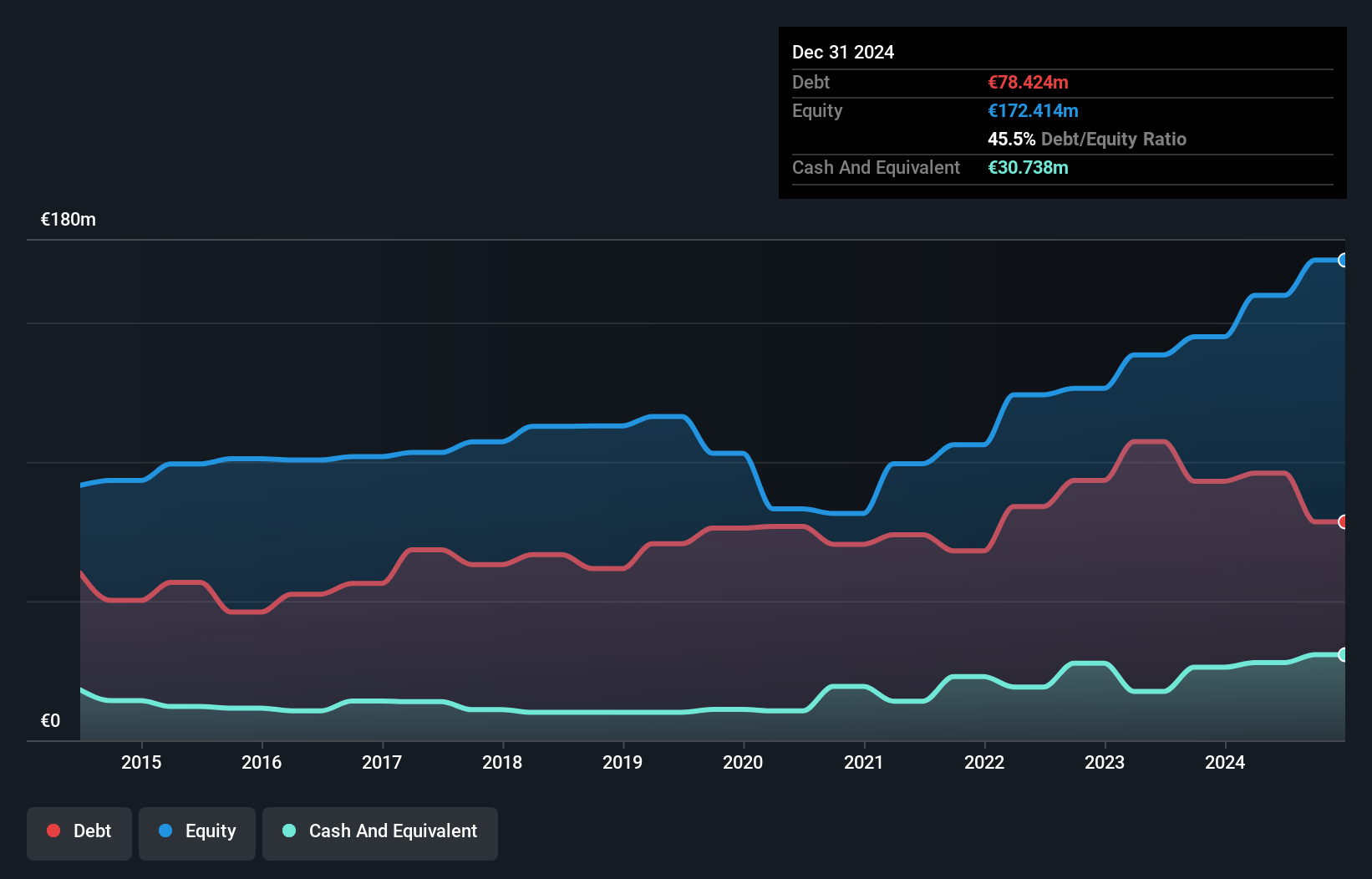

Voxel's financial health shines with high-quality earnings and a debt to equity ratio that has impressively decreased from 53.9% to 9.1% over five years, indicating prudent financial management. The company's EBIT covers interest payments 16.6 times, showcasing strong profitability metrics in the healthcare sector where its earnings growth of 17.6% outpaces the industry average of 12.6%. Recently, Voxel reported a significant rise in sales to PLN 157.85 million from PLN 108.64 million year-on-year, while net income increased to PLN 24.27 million from PLN 19.22 million, reflecting robust operational performance and potential for continued growth.

- Click here to discover the nuances of Voxel with our detailed analytical health report.

Evaluate Voxel's historical performance by accessing our past performance report.

Summing It All Up

- Explore the 316 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VOX

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion