- Poland

- /

- Healthcare Services

- /

- WSE:NEU

NEUCA (WSE:NEU) shareholders notch a 7.6% CAGR over 5 years, yet earnings have been shrinking

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the NEUCA S.A. (WSE:NEU) share price is up 32% in the last five years, that's less than the market return. Unfortunately the share price is down 1.2% in the last year.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, NEUCA actually saw its EPS drop 0.5% per year.

By glancing at these numbers, we'd posit that the decline in earnings per share is not representative of how the business has changed over the years. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 8.2% per year is probably viewed as evidence that NEUCA is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

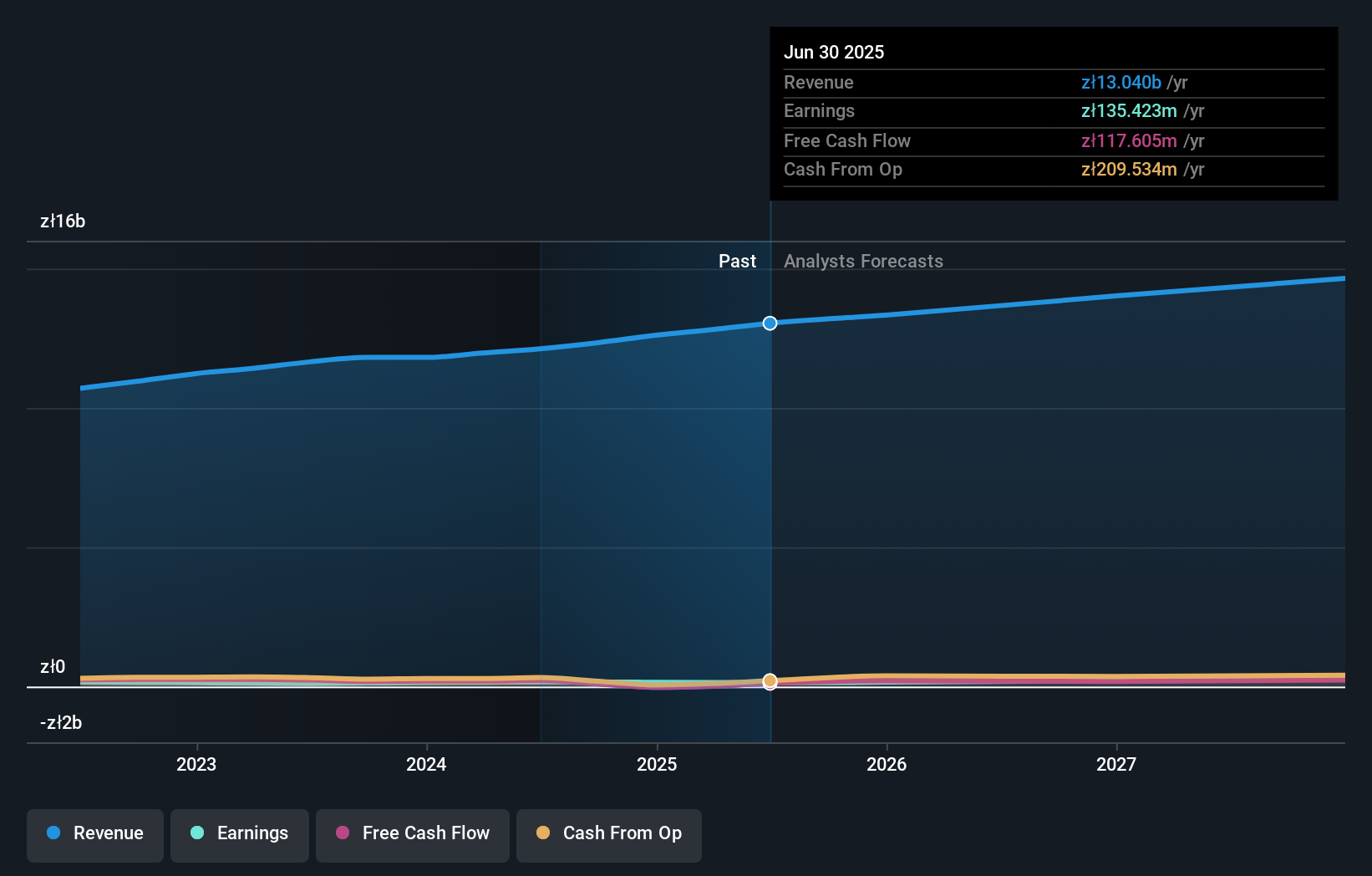

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of NEUCA, it has a TSR of 44% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

NEUCA provided a TSR of 1.1% over the last twelve months. But that return falls short of the market. On the bright side, the longer term returns (running at about 8% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Before deciding if you like the current share price, check how NEUCA scores on these 3 valuation metrics.

We will like NEUCA better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NEUCA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:NEU

NEUCA

Engages in the wholesale distribution of pharmaceuticals in Poland.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives