- Poland

- /

- Healthcare Services

- /

- WSE:MSM

Massmedica S.A. (WSE:MSM) May Have Run Too Fast Too Soon With Recent 32% Price Plummet

Massmedica S.A. (WSE:MSM) shareholders won't be pleased to see that the share price has had a very rough month, dropping 32% and undoing the prior period's positive performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 102%.

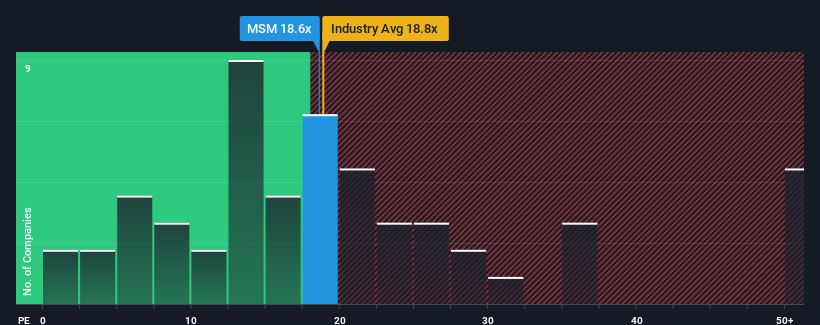

In spite of the heavy fall in price, given close to half the companies in Poland have price-to-earnings ratios (or "P/E's") below 11x, you may still consider Massmedica as a stock to avoid entirely with its 18.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's exceedingly strong of late, Massmedica has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Massmedica

How Is Massmedica's Growth Trending?

In order to justify its P/E ratio, Massmedica would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 137% gain to the company's bottom line. Still, incredibly EPS has fallen 3.8% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 19% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Massmedica is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Even after such a strong price drop, Massmedica's P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Massmedica currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Massmedica that you should be aware of.

You might be able to find a better investment than Massmedica. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:MSM

Massmedica

Engages in the distribution of implants and other medical materials used in the treatment of musculoskeletal system diseases and regenerative medicines in Poland.

Good value with proven track record.

Market Insights

Community Narratives