- Poland

- /

- Medical Equipment

- /

- WSE:MDG

Investors ignore increasing losses at Medicalgorithmics (WSE:MDG) as stock jumps 17% this past week

For us, stock picking is in large part the hunt for the truly magnificent stocks. Not every pick can be a winner, but when you pick the right stock, you can win big. One such superstar is Medicalgorithmics S.A. (WSE:MDG), which saw its share price soar 383% in three years. And in the last week the share price has popped 17%.

Since it's been a strong week for Medicalgorithmics shareholders, let's have a look at trend of the longer term fundamentals.

Medicalgorithmics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Medicalgorithmics actually saw its revenue drop by 22% per year over three years. This is in stark contrast to the strong share price growth of 69%, compound, per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

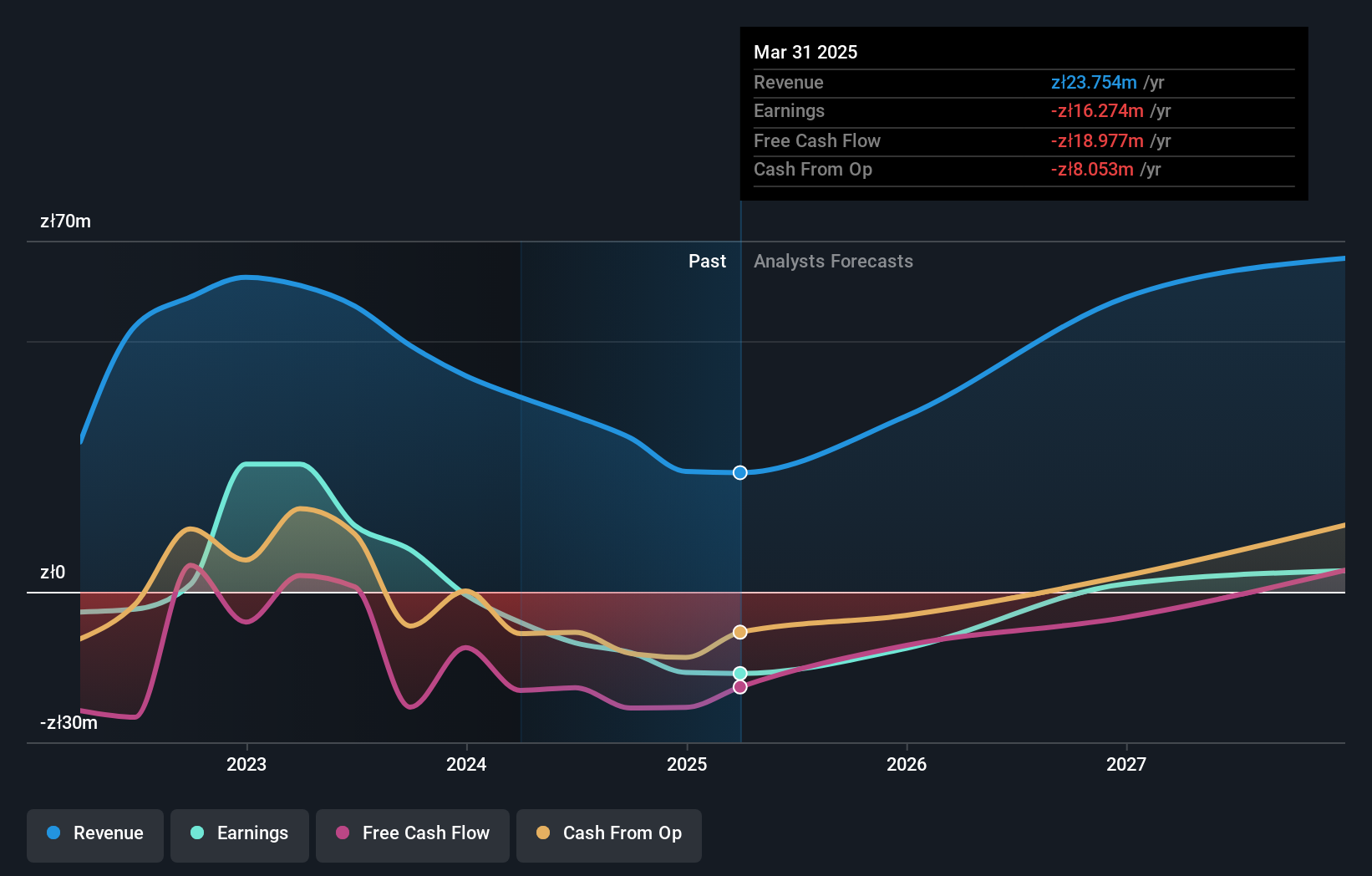

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Medicalgorithmics' financial health with this free report on its balance sheet.

A Different Perspective

Medicalgorithmics provided a TSR of 4.2% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 3% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Medicalgorithmics that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:MDG

Medicalgorithmics

Provides cardiac diagnostic solutions in Poland, the United States, and internationally.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives