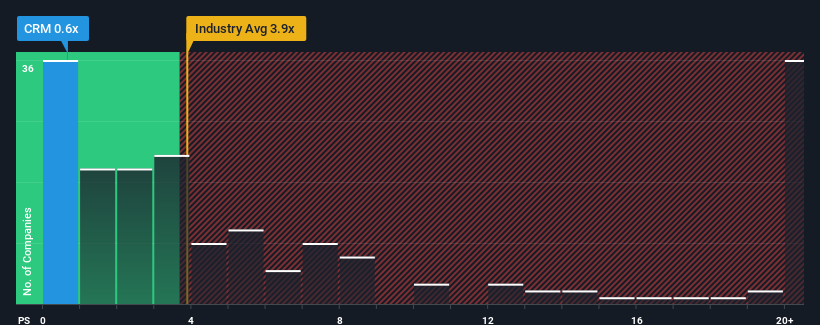

With a price-to-sales (or "P/S") ratio of 0.6x PZ Cormay S.A. (WSE:CRM) may be sending very bullish signals at the moment, given that almost half of all the Medical Equipment companies in Poland have P/S ratios greater than 13.6x and even P/S higher than 177x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for PZ Cormay

How Has PZ Cormay Performed Recently?

It looks like revenue growth has deserted PZ Cormay recently, which is not something to boast about. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for PZ Cormay, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, PZ Cormay would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 23% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 7.4% shows it's about the same on an annualised basis.

With this in consideration, we find it intriguing that PZ Cormay's P/S falls short of its industry peers. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of PZ Cormay revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

You need to take note of risks, for example - PZ Cormay has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If these risks are making you reconsider your opinion on PZ Cormay, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CRM

PZ Cormay

A diagnostic company, provides IVD solutions in Poland and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion