Makarony Polskie S.A. (WSE:MAK) Soars 26% But It's A Story Of Risk Vs Reward

Makarony Polskie S.A. (WSE:MAK) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 161% in the last year.

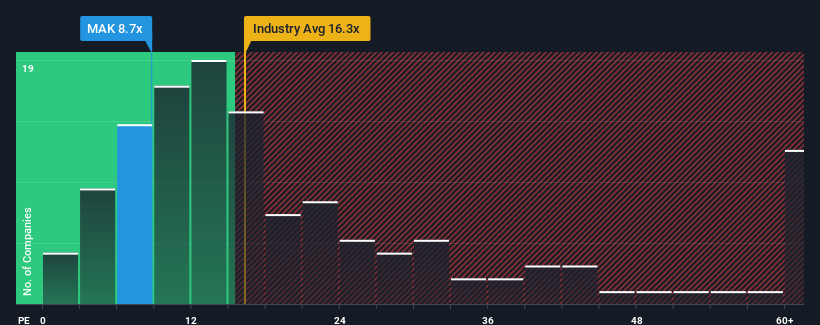

Although its price has surged higher, Makarony Polskie may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.7x, since almost half of all companies in Poland have P/E ratios greater than 13x and even P/E's higher than 28x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Makarony Polskie certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Makarony Polskie

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Makarony Polskie's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 38%. The strong recent performance means it was also able to grow EPS by 559% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 8.3% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Makarony Polskie's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Makarony Polskie's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Makarony Polskie revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 4 warning signs for Makarony Polskie (1 is potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:MAK

Makarony Polskie

Engages in the manufacture and sale of pastas for various consumers in Poland.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives