In the midst of Europe's recent market rebound, highlighted by a 3.93% rise in the STOXX Europe 600 Index following the ECB's rate cuts and improved investor sentiment, there's renewed interest in identifying potential opportunities within smaller-cap stocks. As investors navigate through this landscape, a good stock often exhibits resilience to policy changes and economic fluctuations while maintaining strong fundamentals and growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

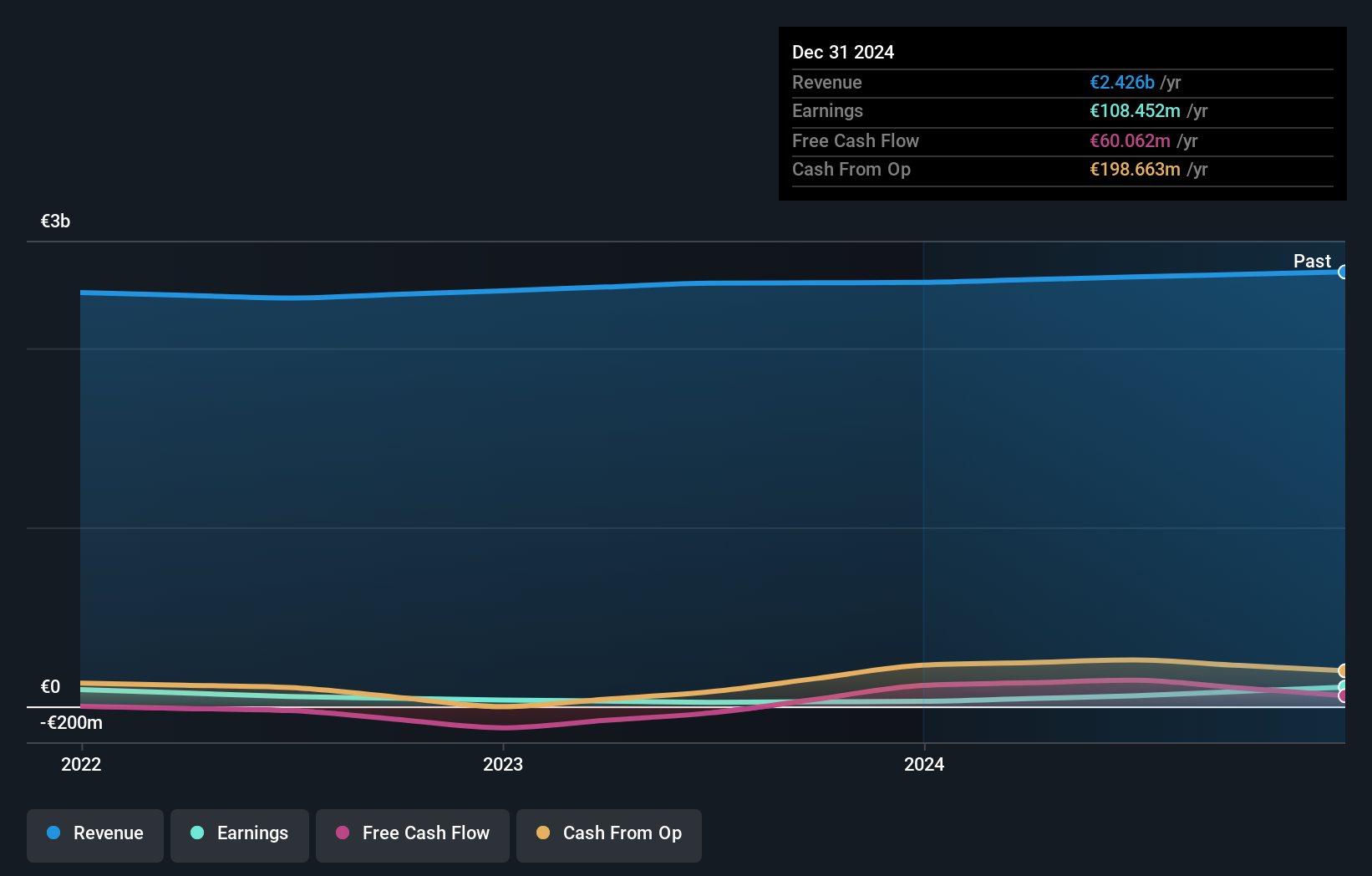

Overview: Paul Hartmann AG is a global manufacturer and distributor of medical and care products, with operations spanning Germany, the rest of Europe, the Middle East, Africa, Asia-Pacific, and the Americas; it has a market cap of approximately €848.87 million.

Operations: Hartmann generates revenue primarily from its Incontinence Management division (€769.92 million), followed by Wound Care (€608.93 million) and Infection Management (€518.89 million). The Complementary divisions contribute €510.18 million to the overall revenue stream, highlighting a diversified income base across its product lines.

Paul Hartmann, a notable player in the medical equipment sector, has demonstrated impressive financial strength despite challenges. Over the past year, earnings surged by 281.6%, significantly outpacing the industry average of 12.7%. The company's net income jumped to €108.45 million from €28.42 million, and basic earnings per share rose to €30.53 from €8 previously. With a price-to-earnings ratio of 7.8x against the German market's 17.6x and a satisfactory net debt to equity ratio of 3.9%, Hartmann seems well-positioned for future growth while maintaining high-quality earnings and robust interest coverage at 10.4x EBIT coverage.

- Delve into the full analysis health report here for a deeper understanding of Paul Hartmann.

Explore historical data to track Paul Hartmann's performance over time in our Past section.

Biotage (OM:BIOT)

Simply Wall St Value Rating: ★★★★★★

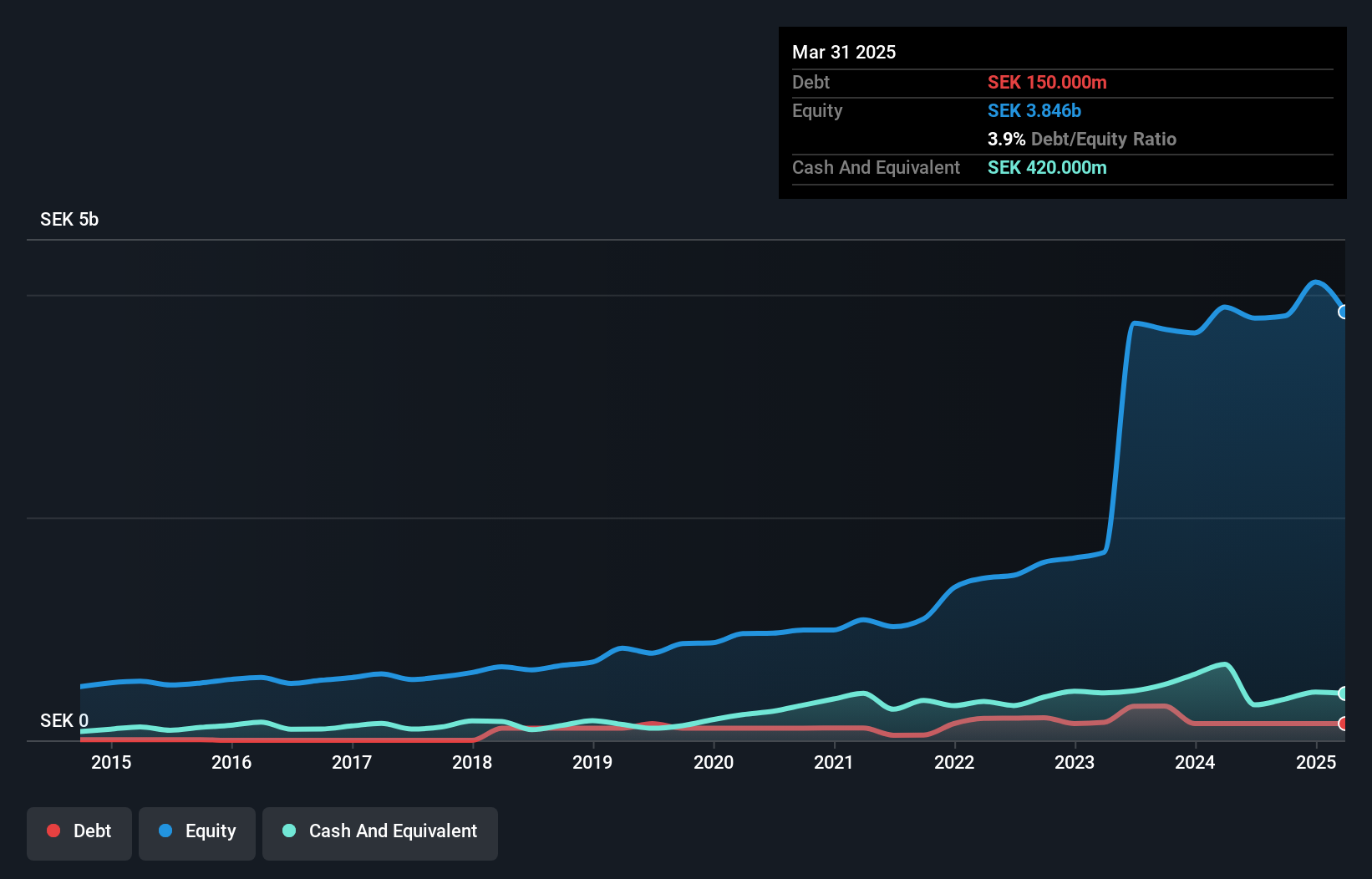

Overview: Biotage AB (publ) offers solutions and products focused on drug discovery and development, analytical testing, and water and environmental testing, with a market capitalization of approximately SEK11.29 billion.

Operations: Biotage generates revenue primarily through its offerings in drug discovery and development, analytical testing, and water and environmental testing. The company's gross profit margin is 58.5%.

Biotage, a promising player in the life sciences sector, has seen its earnings grow by 8.6% annually over the past five years, although recent earnings of SEK 4 million for Q1 2025 were notably lower than last year's SEK 33 million. The company's debt to equity ratio improved significantly from 11.4% to 3.9% over five years, reflecting better financial health with more cash than total debt. A major development is Kohlberg Kravis Roberts & Co.'s proposal to acquire an 83% stake at SEK 145 per share, signaling potential value recognition and growth opportunities despite recent volatility in share price and macroeconomic challenges.

Kernel Holding (WSE:KER)

Simply Wall St Value Rating: ★★★★★★

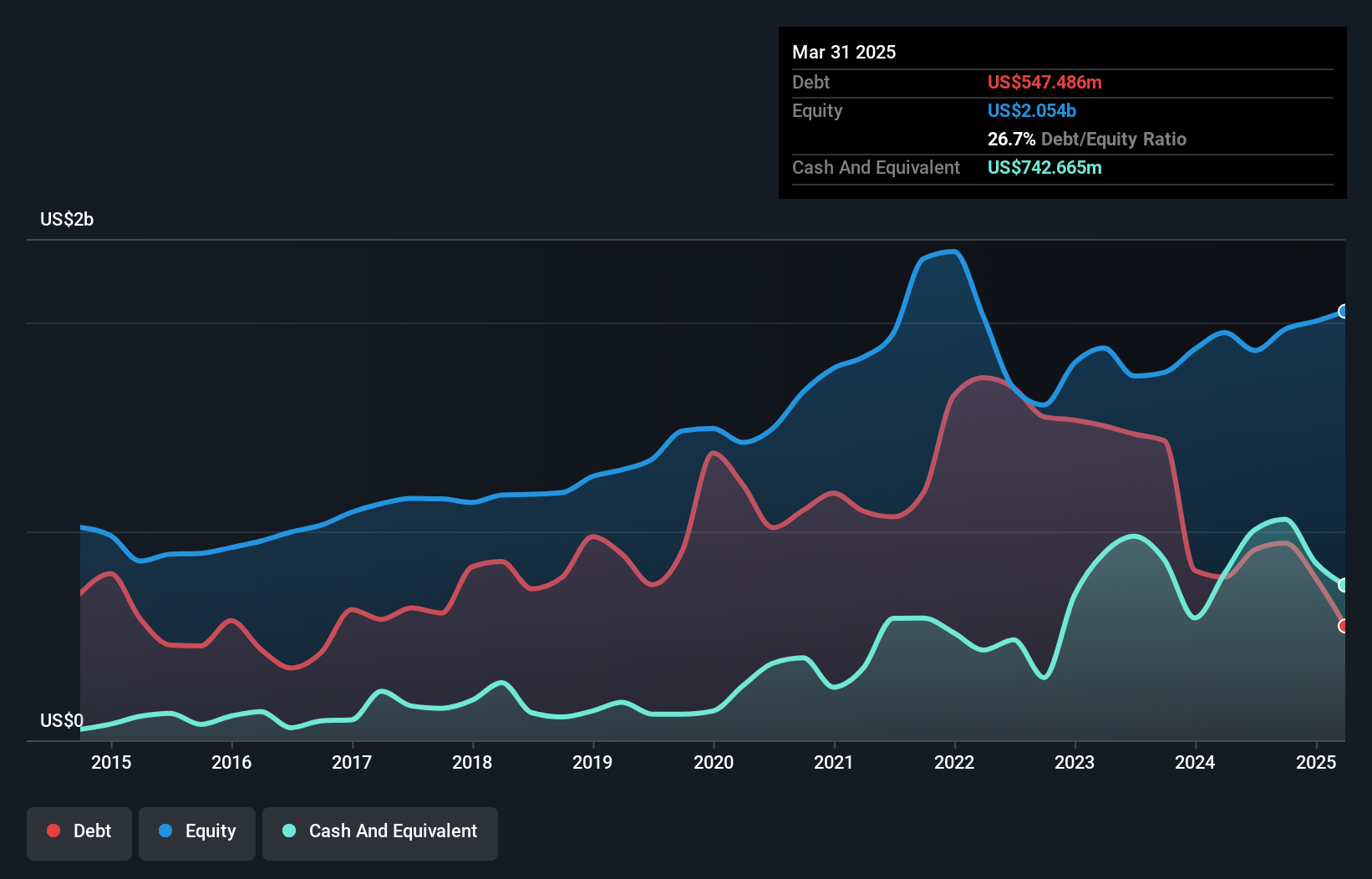

Overview: Kernel Holding S.A. operates a diversified agricultural business with a presence in India, Hong Kong, China, Singapore, Switzerland, the Netherlands, Ukraine, Spain, and other international markets; it has a market capitalization of PLN5.57 billion.

Operations: Kernel Holding S.A. generates revenue primarily from its Infrastructure and Trading segment at $2.22 billion, followed by Oilseed Processing at $1.91 billion, and Farming at $560.08 million. The company experiences a cost adjustment in the form of a reconciliation amounting to -$753.37 million, impacting its overall financial results.

Kernel Holding, a nimble player in the European market, has shown resilience despite recent challenges. The company's earnings surged by 626% over the past year, outpacing the broader food industry growth of 25%. Kernel's debt-to-equity ratio improved significantly from 92% to 39% over five years, indicating prudent financial management. Although it faced a one-off loss of US$141M last year, its interest payments are well-covered at 11.4 times by EBIT. Recent legal victories against minority shareholders underscore Kernel's commitment to robust corporate governance and long-term shareholder confidence amidst plans for delisting from Warsaw Stock Exchange.

- Navigate through the intricacies of Kernel Holding with our comprehensive health report here.

Evaluate Kernel Holding's historical performance by accessing our past performance report.

Key Takeaways

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 354 more companies for you to explore.Click here to unveil our expertly curated list of 357 European Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kernel Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:KER

Kernel Holding

Engages in the diversified agricultural business in Ukraine, Switzerland, rest of Europe, India, rest of Asia, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives