- Poland

- /

- Capital Markets

- /

- WSE:CPA

European Market Insights: Capital Partners Among 3 Prominent Penny Stocks

Reviewed by Simply Wall St

The European stock market recently saw a downturn, with the pan-European STOXX Europe 600 Index ending 1.10% lower as investors took profits after record highs and political turmoil in France added to the uncertainty. Despite these challenges, opportunities still exist for those willing to explore smaller or newer companies known as penny stocks. Although the term may seem outdated, penny stocks can offer substantial value when they are built on strong financial foundations and have potential for growth.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.12 | €16.64M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.32 | €44.1M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.92 | €26.53M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €228.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.28 | DKK108.21M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.50 | €36.49M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.50 | SEK212.94M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €284.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.075 | €7.93M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 279 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Capital Partners (WSE:CPA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Capital Partners S.A. offers strategic and transaction consulting services in Poland, with a market cap of PLN6.93 million.

Operations: Capital Partners S.A. has not reported any revenue segments.

Market Cap: PLN6.93M

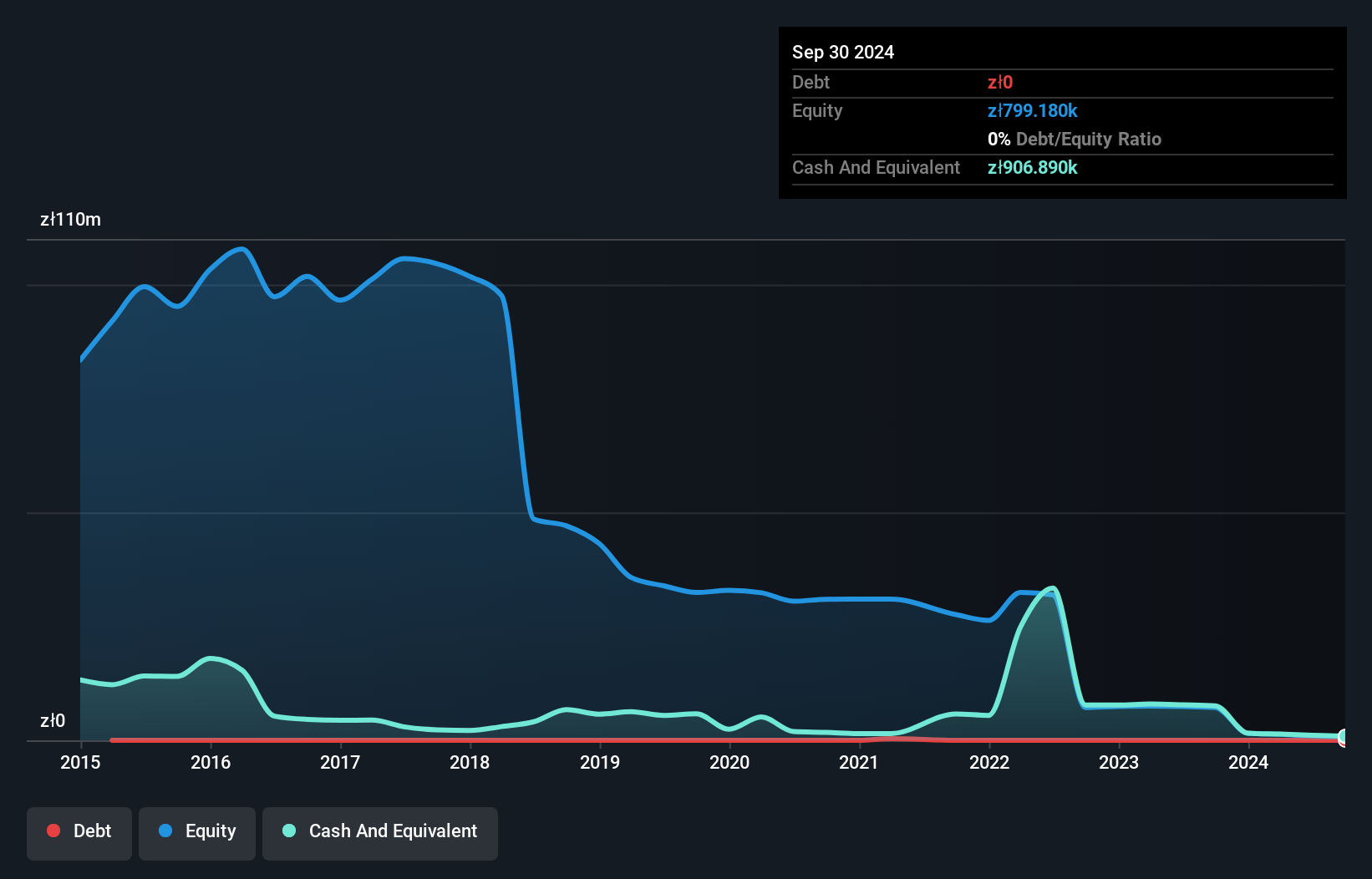

Capital Partners S.A., with a market cap of PLN6.93 million, remains pre-revenue, reporting a net loss of PLN0.31 million for the half year ended June 30, 2025. Despite its lack of revenue and profitability, the company benefits from being debt-free and having short-term assets (PLN938.5K) that cover its short-term liabilities (PLN139.3K). The board is seasoned with an average tenure of 16.5 years, providing stability amidst high share price volatility over the past three months. Shareholders have not faced significant dilution recently, although return on equity remains negative due to ongoing unprofitability.

- Take a closer look at Capital Partners' potential here in our financial health report.

- Understand Capital Partners' track record by examining our performance history report.

Forever Entertainment (WSE:FOR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Forever Entertainment S.A. is a company that produces and publishes video games both in Poland and internationally, with a market cap of PLN81.33 million.

Operations: The company's revenue segment is primarily derived from Software & Programming, generating PLN25.01 million.

Market Cap: PLN81.33M

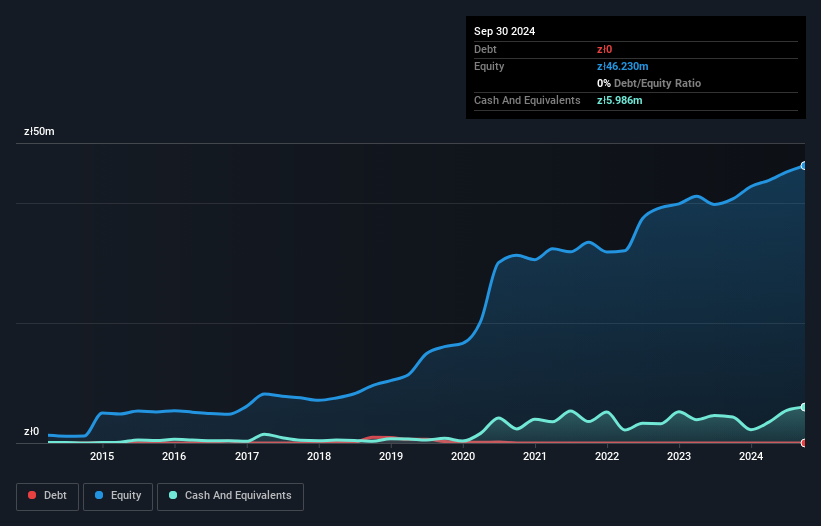

Forever Entertainment S.A., with a market cap of PLN81.33 million, shows mixed signals for penny stock investors. The company is debt-free and maintains high-quality earnings, with short-term assets (PLN16.6M) comfortably covering both short-term (PLN7.8M) and long-term liabilities (PLN3.4M). Despite a stable weekly volatility of 4% and an improved net profit margin of 28.5%, recent earnings have declined compared to the previous year, with Q2 revenue at PLN6.16 million down from PLN10.16 million a year ago, highlighting potential challenges in sustaining growth amidst industry pressures.

- Navigate through the intricacies of Forever Entertainment with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Forever Entertainment's track record.

Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien (XTRA:BVB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien, along with its subsidiaries, operates in the football business in Germany and has a market cap of approximately €394.05 million.

Operations: The company generates revenue through its main segments: Borussia Dortmund Kgaa (€528.66 million), BVB Merchandising GmbH (€42.90 million), and BVB Event & Catering Gmbh (€38.27 million).

Market Cap: €394.05M

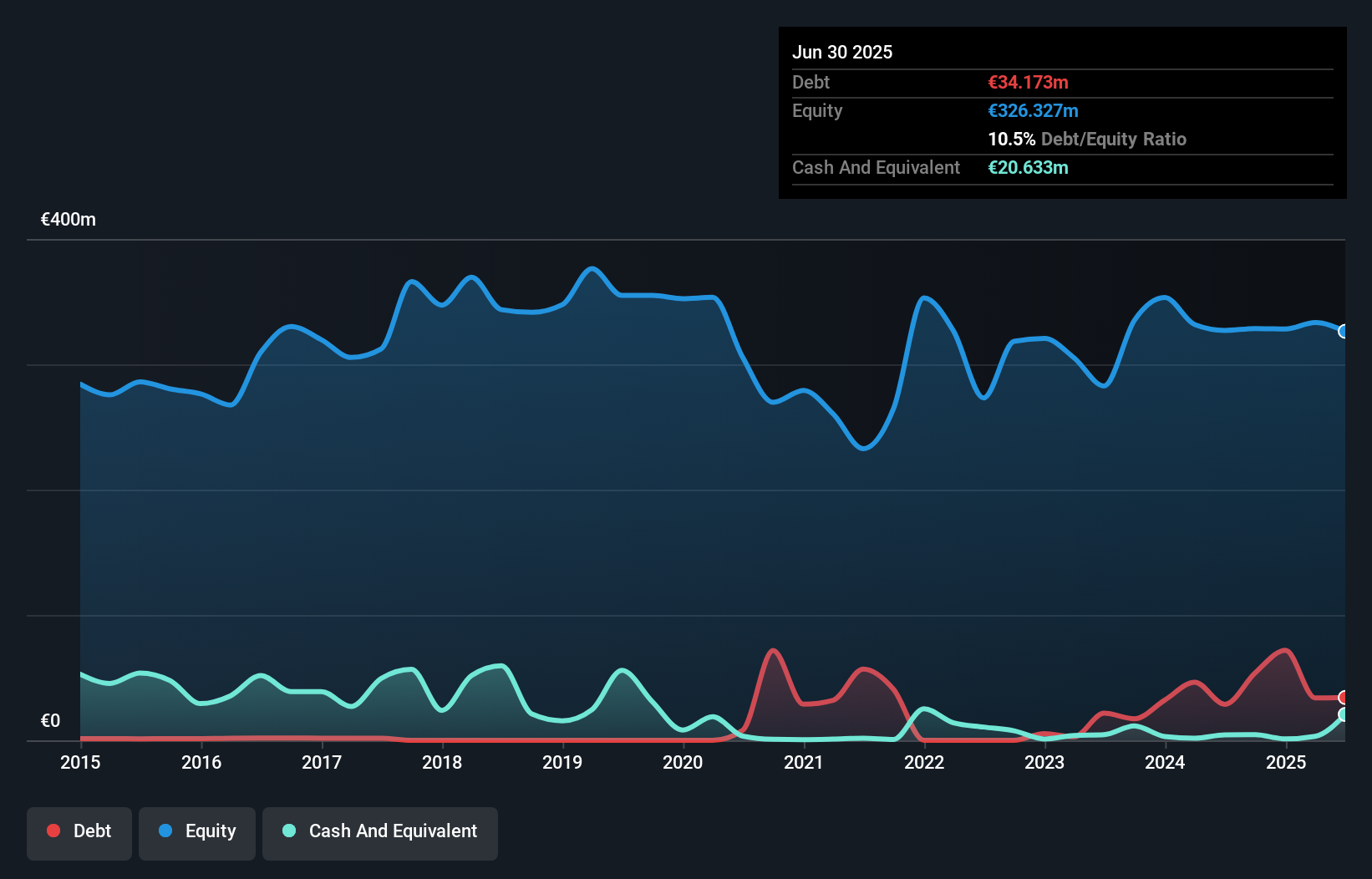

Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien, with a market cap of €394.05 million, presents a complex picture for penny stock investors. Despite achieving profitability over the past five years with earnings growth of 57.9% per year, recent performance has been challenging, as net income dropped significantly to €6.5 million from €44.31 million last year due to declining sales and profit margins (1.2%). The company's debt is well-covered by operating cash flow (168.9%), but short-term liabilities exceed short-term assets (€126.7M vs €188.7M), indicating potential liquidity concerns despite stable weekly volatility and experienced management and board teams.

- Click to explore a detailed breakdown of our findings in Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien's financial health report.

- Assess Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Click through to start exploring the rest of the 276 European Penny Stocks now.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CPA

Capital Partners

Provides strategic and transaction consulting services in Poland.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives