Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Wojas S.A. (WSE:WOJ) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Wojas

How Much Debt Does Wojas Carry?

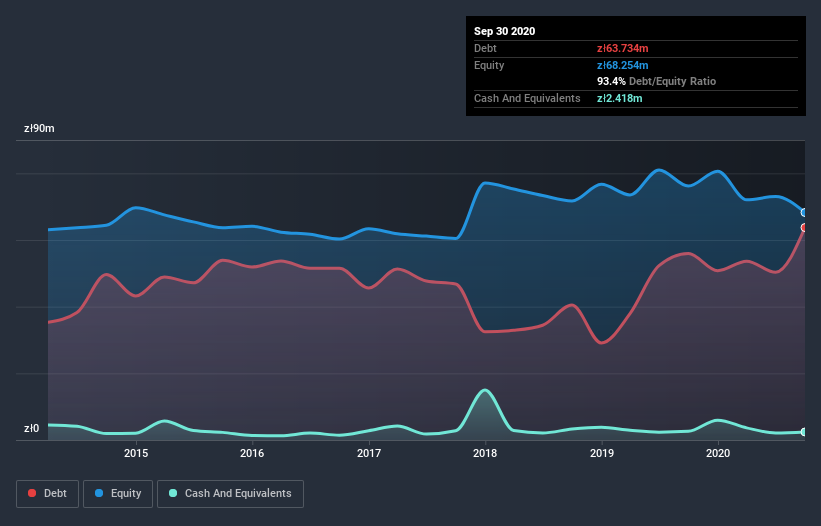

As you can see below, at the end of September 2020, Wojas had zł63.7m of debt, up from zł55.9m a year ago. Click the image for more detail. However, because it has a cash reserve of zł2.42m, its net debt is less, at about zł61.3m.

A Look At Wojas' Liabilities

According to the last reported balance sheet, Wojas had liabilities of zł119.6m due within 12 months, and liabilities of zł80.7m due beyond 12 months. Offsetting this, it had zł2.42m in cash and zł33.8m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł164.0m.

The deficiency here weighs heavily on the zł60.6m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Wojas would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Wojas's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Wojas had a loss before interest and tax, and actually shrunk its revenue by 9.0%, to zł258m. We would much prefer see growth.

Caveat Emptor

Importantly, Wojas had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping zł11m. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely since it is low on liquid assets, and made a loss of zł8.9m in the last year. So while it's not wise to assume the company will fail, we do think it's risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Wojas has 4 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Wojas, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wojas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:WOJ

Wojas

Primarily engages in the manufacture and sale of leather footwear for men and women in Poland.

Flawless balance sheet and good value.

Market Insights

Community Narratives