- Poland

- /

- Consumer Durables

- /

- WSE:TOA

Most Shareholders Will Probably Find That The Compensation For TOYA S.A.'s (WSE:TOA) CEO Is Reasonable

Key Insights

- TOYA's Annual General Meeting to take place on 26th of June

- Total pay for CEO Grzegorz Pinkosz includes zł1.12m salary

- The overall pay is 36% below the industry average

- Over the past three years, TOYA's EPS grew by 0.02% and over the past three years, the total loss to shareholders 6.9%

Performance at TOYA S.A. (WSE:TOA) has been rather uninspiring recently and shareholders may be wondering how CEO Grzegorz Pinkosz plans to fix this. At the next AGM coming up on 26th of June, they can influence managerial decision making through voting on resolutions, including executive remuneration. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for TOYA

Comparing TOYA S.A.'s CEO Compensation With The Industry

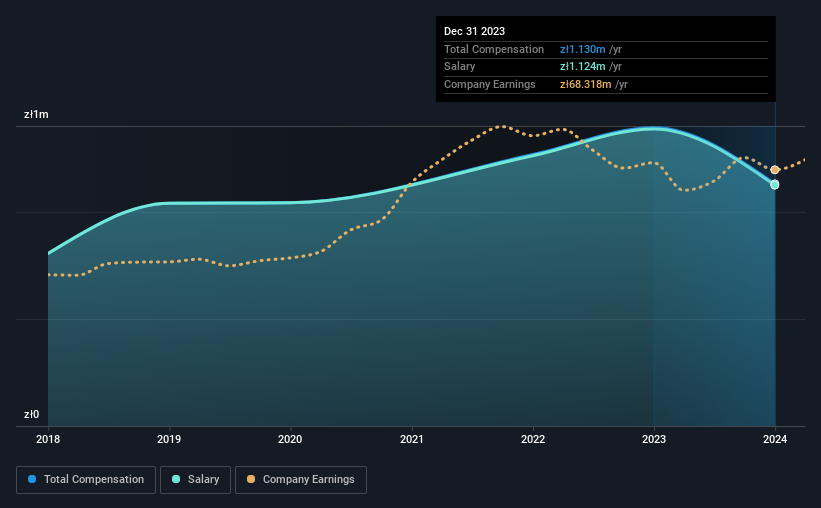

At the time of writing, our data shows that TOYA S.A. has a market capitalization of zł597m, and reported total annual CEO compensation of zł1.1m for the year to December 2023. We note that's a decrease of 19% compared to last year. Notably, the salary which is zł1.12m, represents most of the total compensation being paid.

In comparison with other companies in the Polish Consumer Durables industry with market capitalizations under zł808m, the reported median total CEO compensation was zł1.8m. In other words, TOYA pays its CEO lower than the industry median. Moreover, Grzegorz Pinkosz also holds zł1.2m worth of TOYA stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | zł1.1m | zł1.4m | 99% |

| Other | zł6.0k | zł6.0k | 1% |

| Total Compensation | zł1.1m | zł1.4m | 100% |

Talking in terms of the industry, salary represented approximately 60% of total compensation out of all the companies we analyzed, while other remuneration made up 40% of the pie. Investors will find it interesting that TOYA pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

TOYA S.A.'s Growth

Earnings per share at TOYA S.A. are much the same as they were three years ago, albeit with slightly higher. In the last year, its revenue changed by just 0.5%.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has TOYA S.A. Been A Good Investment?

Given the total shareholder loss of 6.9% over three years, many shareholders in TOYA S.A. are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

TOYA pays its CEO a majority of compensation through a salary. It may not be surprising to some that the recent weak performance in the share price may be driven in part by rather flat EPS growth. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling TOYA (free visualization of insider trades).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if TOYA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:TOA

TOYA

Produces hand and power tools, professional gastronomy, and home equipment in Poland and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success