As European markets rebound with the STOXX Europe 600 Index climbing 3.93% amid positive sentiment from delayed tariffs and potential ECB rate cuts, investors are increasingly looking toward dividend stocks to enhance their portfolios. In this environment of economic uncertainty and evolving monetary policies, selecting stocks that offer reliable dividend yields can provide a measure of stability and income potential for investors seeking to navigate these dynamic market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.27% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.54% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.50% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.09% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.17% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.24% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.36% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.64% | ★★★★★☆ |

Click here to see the full list of 241 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Firefly (OM:FIRE)

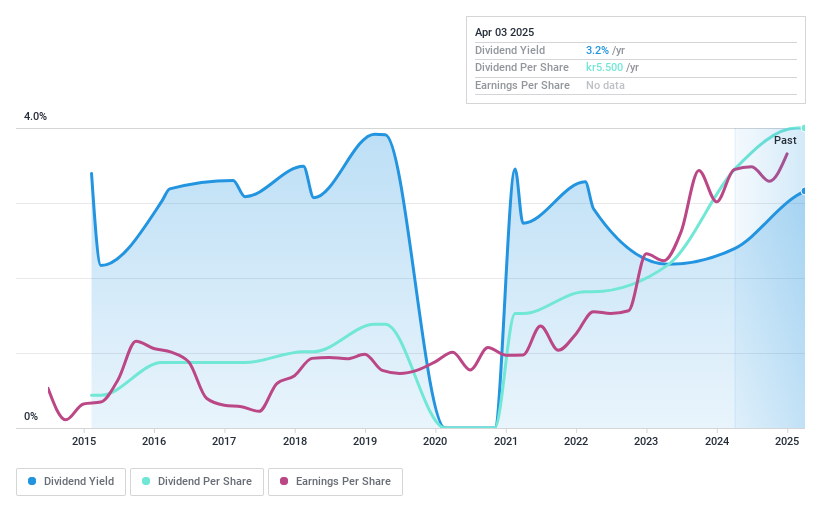

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Firefly AB (publ) specializes in developing and selling industrial fire prevention and protection systems for the process industry globally, with a market cap of SEK1.07 billion.

Operations: Firefly AB (publ) generates revenue by providing industrial fire prevention and protection systems to the process industry on a global scale.

Dividend Yield: 3.1%

Firefly AB's dividend sustainability is supported by a payout ratio of 60.2% and a cash payout ratio of 85.1%, indicating coverage by earnings and cash flows. However, its dividend history has been volatile with unreliable payments over the past decade, despite recent growth in dividends. The company's price-to-earnings ratio (19.6x) is below the Swedish market average, suggesting potential value. Recently, Firefly announced an annual dividend of SEK 5.50 per share payable in May 2025.

- Click here to discover the nuances of Firefly with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Firefly is priced higher than what may be justified by its financials.

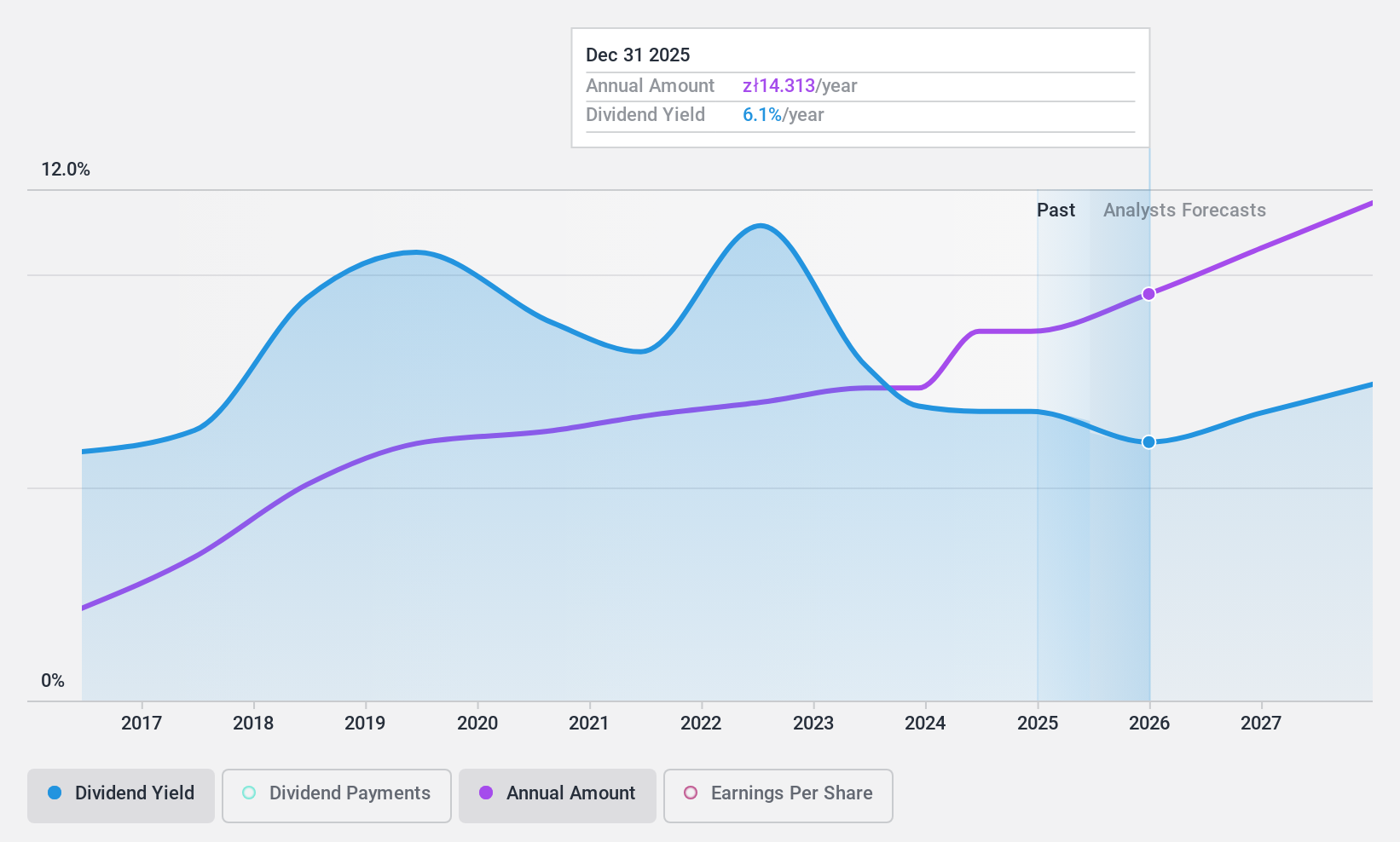

Dom Development (WSE:DOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dom Development S.A. operates in Poland, focusing on the development and sale of residential and commercial real estate properties along with related support activities, with a market cap of PLN5.61 billion.

Operations: Dom Development S.A. generates revenue primarily from its Home Builders segment, which includes residential and commercial real estate, amounting to PLN3.17 billion.

Dividend Yield: 6%

Dom Development's earnings grew by 23.6% last year, with a reasonable payout ratio of 65%, ensuring dividends are covered by earnings. However, the high cash payout ratio of 94% suggests dividends aren't well covered by cash flows. Despite this, Dom's dividend has been stable and growing over the past decade. The dividend yield is lower than top-tier Polish payers but remains reliable. Shares trade at a discount to estimated fair value, enhancing potential appeal for investors.

- Get an in-depth perspective on Dom Development's performance by reading our dividend report here.

- Our valuation report unveils the possibility Dom Development's shares may be trading at a discount.

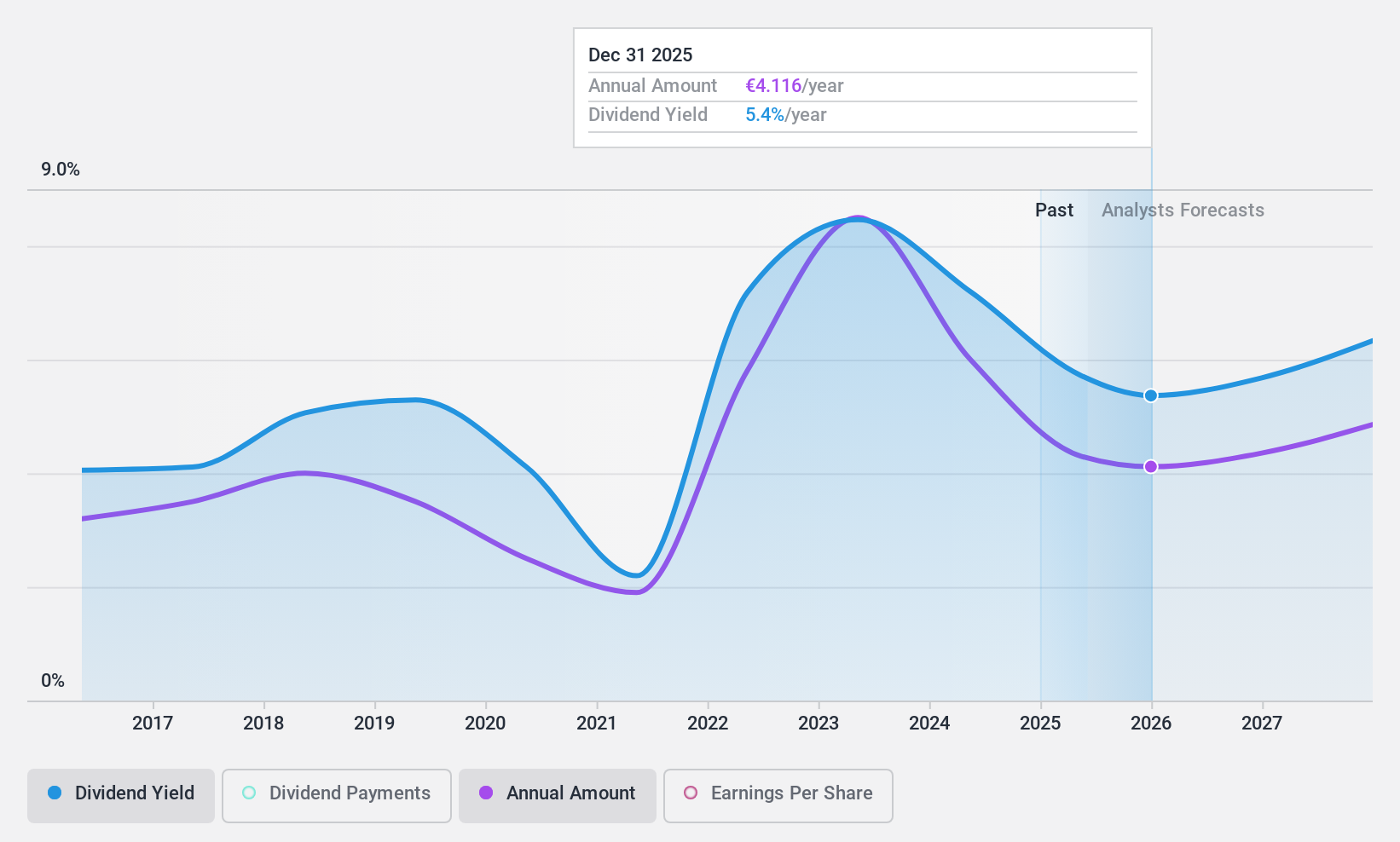

Bayerische Motoren Werke (XTRA:BMW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft develops, manufactures, and sells automobiles and motorcycles, along with spare parts and accessories globally, with a market cap of approximately €43.49 billion.

Operations: Bayerische Motoren Werke's revenue is primarily derived from its Automotive segment at €124.92 billion, followed by Financial Services at €38.56 billion, and Motorcycles contributing €3.22 billion.

Dividend Yield: 6.1%

BMW's dividend yield of 6.12% ranks among the top in Germany, yet its dividends are not covered by free cash flows, raising sustainability concerns. Despite a low payout ratio of 37%, past dividend volatility and recent decreases to €4.30 per share highlight reliability issues. Trading at a significant discount to fair value, BMW offers good relative value compared to peers but faces challenges with debt coverage by operating cash flow amidst declining earnings and sales figures.

- Click here and access our complete dividend analysis report to understand the dynamics of Bayerische Motoren Werke.

- The analysis detailed in our Bayerische Motoren Werke valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Explore the 241 names from our Top European Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayerische Motoren Werke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BMW

Bayerische Motoren Werke

Develops, manufactures, and sells automobiles and motorcycles, spare parts, and accessories worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives