- Poland

- /

- Specialty Stores

- /

- WSE:CCC

CCC S.A. (WSE:CCC) Stock Rockets 25% But Many Are Still Ignoring The Company

CCC S.A. (WSE:CCC) shares have continued their recent momentum with a 25% gain in the last month alone. The last month tops off a massive increase of 109% in the last year.

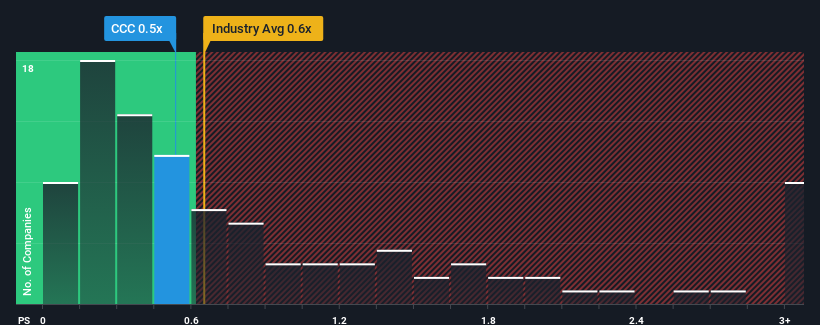

Even after such a large jump in price, you could still be forgiven for feeling indifferent about CCC's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Luxury industry in Poland is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for CCC

What Does CCC's Recent Performance Look Like?

CCC could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CCC.What Are Revenue Growth Metrics Telling Us About The P/S?

CCC's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 7.4% gain to the company's revenues. The latest three year period has also seen an excellent 79% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 14% per annum over the next three years. With the industry only predicted to deliver 7.7% per year, the company is positioned for a stronger revenue result.

In light of this, it's curious that CCC's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From CCC's P/S?

Its shares have lifted substantially and now CCC's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at CCC's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You always need to take note of risks, for example - CCC has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CCC

CCC

Engages in the retail sale of footwear and other products in Poland, Central and Eastern Europe, and Western Europe.

High growth potential with solid track record.

Market Insights

Community Narratives