- Poland

- /

- Consumer Durables

- /

- WSE:ARH

European Stocks With Estimated Discounts Up To 42.7% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets remain relatively stable with the pan-European STOXX Europe 600 Index ending roughly flat, investors are keenly observing trade discussions between the U.S. and Europe. Amidst this cautious environment, identifying undervalued stocks can be an effective strategy for those looking to capitalize on potential discounts below intrinsic value, particularly when economic indicators suggest room for growth in select sectors.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talenom Oyj (HLSE:TNOM) | €3.53 | €6.95 | 49.2% |

| Surgical Science Sweden (OM:SUS) | SEK148.40 | SEK294.49 | 49.6% |

| RVRC Holding (OM:RVRC) | SEK45.68 | SEK90.96 | 49.8% |

| InPost (ENXTAM:INPST) | €12.82 | €25.24 | 49.2% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.90 | 49.3% |

| Honkarakenne Oyj (HLSE:HONBS) | €2.74 | €5.40 | 49.2% |

| Green Oleo (BIT:GRN) | €0.79 | €1.57 | 49.8% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.42 | €6.75 | 49.3% |

| ATON Green Storage (BIT:ATON) | €2.13 | €4.22 | 49.5% |

| Atea (OB:ATEA) | NOK143.00 | NOK284.22 | 49.7% |

Let's uncover some gems from our specialized screener.

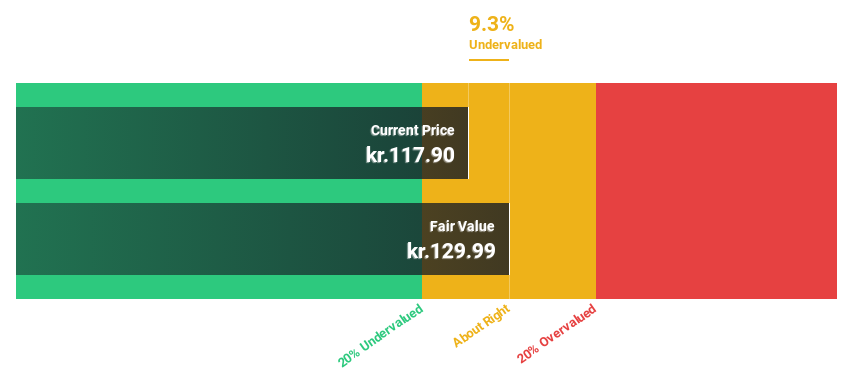

Ambu (CPSE:AMBU B)

Overview: Ambu A/S is a medical technology company that develops, produces, and sells medical devices to hospitals, clinics, and rescue services globally, with a market cap of DKK26.16 billion.

Operations: The company's revenue is primarily generated from its Disposable Medical Products segment, which amounts to DKK5.83 billion.

Estimated Discount To Fair Value: 28.7%

Ambu is trading at DKK98.2, significantly below its estimated fair value of DKK137.73, representing a 28.7% discount. Analysts anticipate a 33.1% price rise, driven by expected annual earnings growth of 25.2%, outpacing the Danish market's 7.6%. Despite slower revenue growth at 10.1%, it surpasses the local market's forecast of 7.8%. Recent earnings show improved performance with sales rising to DKK3 billion and net income reaching DKK371 million for six months ending March 2025.

- In light of our recent growth report, it seems possible that Ambu's financial performance will exceed current levels.

- Dive into the specifics of Ambu here with our thorough financial health report.

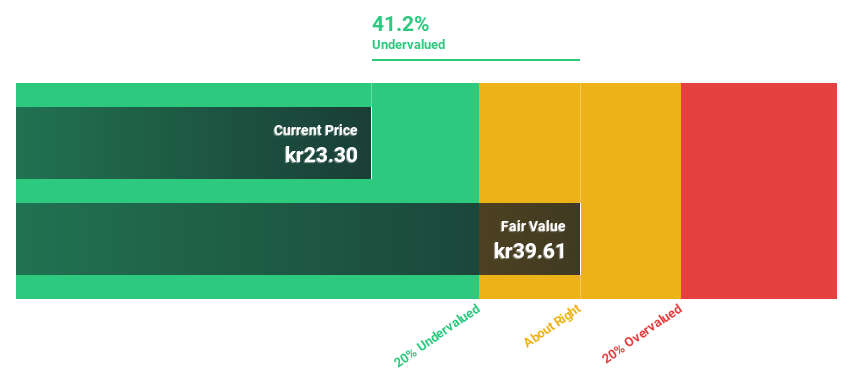

LINK Mobility Group Holding (OB:LINK)

Overview: LINK Mobility Group Holding ASA, along with its subsidiaries, offers mobile and communication-platform-as-a-service solutions and has a market capitalization of NOK8.69 billion.

Operations: The company's revenue is derived from several segments, including Central Europe (NOK1.73 billion), Western Europe (NOK2.14 billion), Northern Europe (NOK1.55 billion), and Global Messaging (NOK1.55 billion).

Estimated Discount To Fair Value: 42.7%

LINK Mobility Group Holding, at NOK30.6, is trading well below its fair value estimate of NOK53.43, indicating a 42.7% discount. Despite recent earnings challenges with net income dropping to NOK39.26 million in Q1 2025 from NOK253.05 million a year ago, LINK's earnings are forecast to grow significantly at 41.3% annually over the next three years, outpacing the Norwegian market's growth rate of 10.3%. The company recently refinanced debt with a EUR100 million bond issue to strengthen its financial position.

- The analysis detailed in our LINK Mobility Group Holding growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of LINK Mobility Group Holding stock in this financial health report.

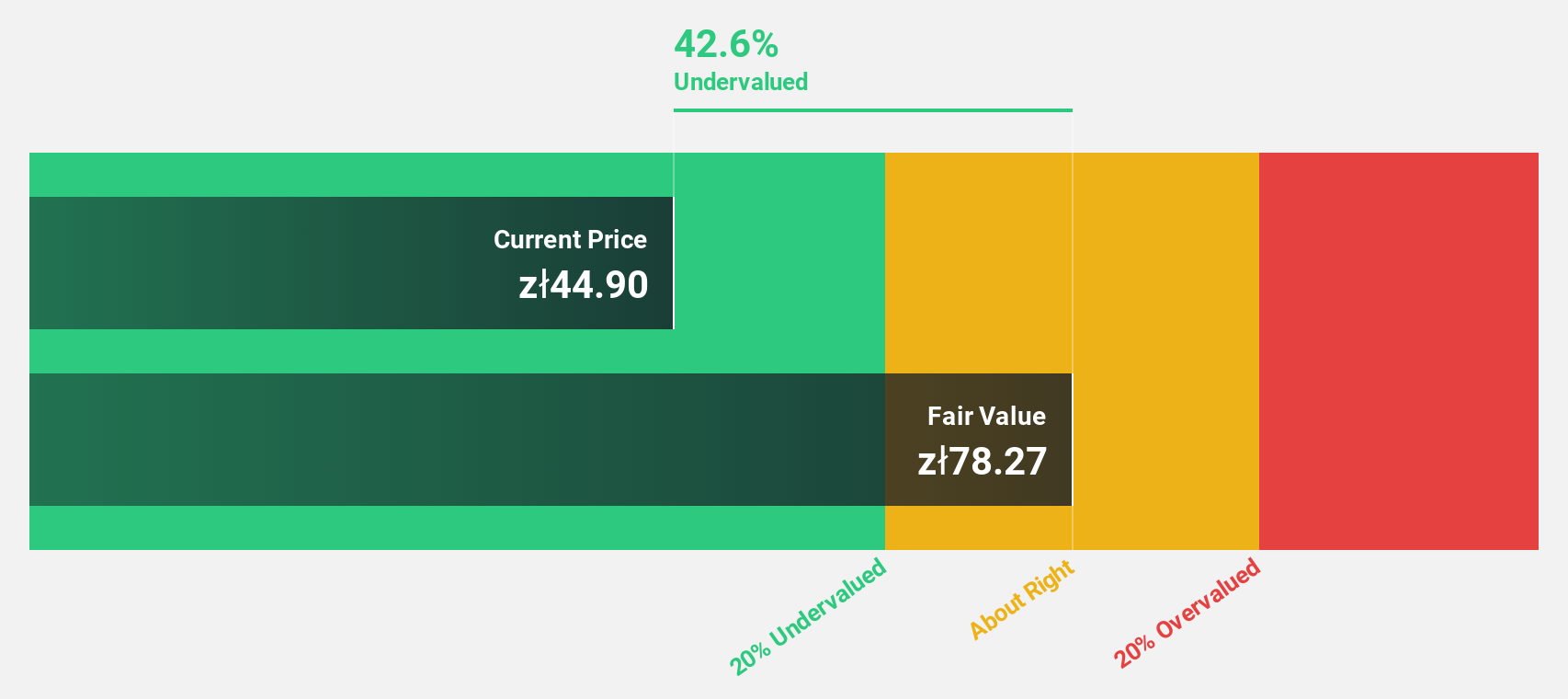

Archicom (WSE:ARH)

Overview: Archicom S.A. operates in the real estate sector in Poland, with a market capitalization of PLN2.88 billion.

Operations: The company's revenue segments include PLN254.23 million from Supporting Companies and contributions from Unclassified Activities in various cities: PLN3.73 million in Lodz, PLN82.89 million in Cracow, PLN12.23 million in Poznan, PLN42.43 million in Warsaw, and PLN307.53 million in Wroclaw.

Estimated Discount To Fair Value: 18.4%

Archicom, trading at PLN49.3, is priced below its fair value estimate of PLN60.4, reflecting an 18.4% discount. Despite a challenging Q1 2025 with revenue dropping to PLN21.47 million and a net loss of PLN32.22 million, earnings are expected to grow significantly at 45.9% annually over the next three years, outpacing the Polish market's growth rate of 13.4%. However, interest payments are not well covered by earnings and one-off items impact financial results.

- Our earnings growth report unveils the potential for significant increases in Archicom's future results.

- Take a closer look at Archicom's balance sheet health here in our report.

Taking Advantage

- Embark on your investment journey to our 177 Undervalued European Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ARH

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives