Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Mo-BRUK (WSE:MBR). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Mo-BRUK

How Fast Is Mo-BRUK Growing Its Earnings Per Share?

Over the last three years, Mo-BRUK has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Mo-BRUK's EPS shot from zł9.22 to zł19.37, over the last year. Year on year growth of 110% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

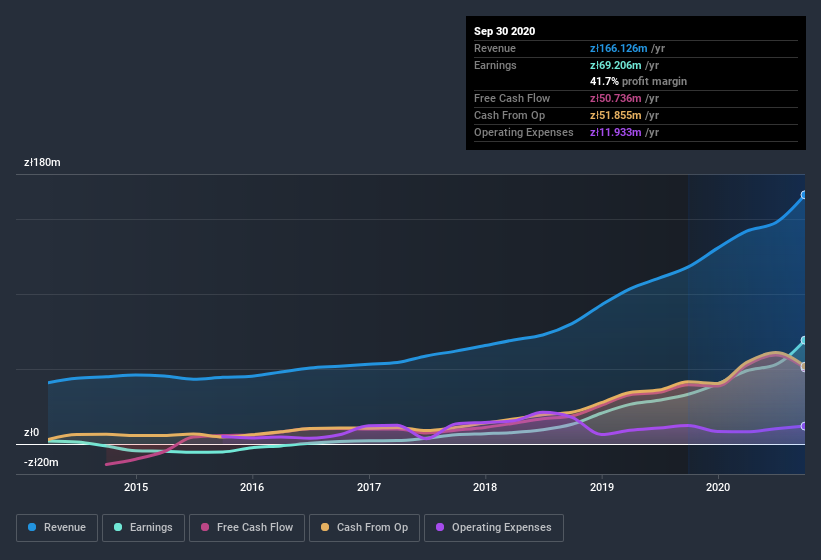

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Mo-BRUK is growing revenues, and EBIT margins improved by 16.6 percentage points to 52%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Since Mo-BRUK is no giant, with a market capitalization of zł1.0b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Mo-BRUK Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between zł374m and zł1.5b, like Mo-BRUK, the median CEO pay is around zł912k.

Mo-BRUK offered total compensation worth zł774k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Mo-BRUK To Your Watchlist?

Mo-BRUK's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Such fast EPS growth makes me wonder if the business has hit an inflection point (and I mean the good kind.) Meanwhile, the very reasonable CEO pay reassures me a little, since it points to an absence profligacy. While I couldn't be sure without a deeper dive, it does seem that Mo-BRUK has the hallmarks of a quality business; and that would make it well worth watching. Even so, be aware that Mo-BRUK is showing 1 warning sign in our investment analysis , you should know about...

Although Mo-BRUK certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Mo-BRUK, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:MBR

Mo-BRUK

Processes industrial, hazardous, and municipal waste in Poland, Germany, Italy, Slovenia, Denmark, Romania, and Lithuania.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives