- Poland

- /

- Professional Services

- /

- WSE:ETX

Not Many Are Piling Into Euro-Tax.pl S.A. (WSE:ETX) Stock Yet As It Plummets 27%

To the annoyance of some shareholders, Euro-Tax.pl S.A. (WSE:ETX) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

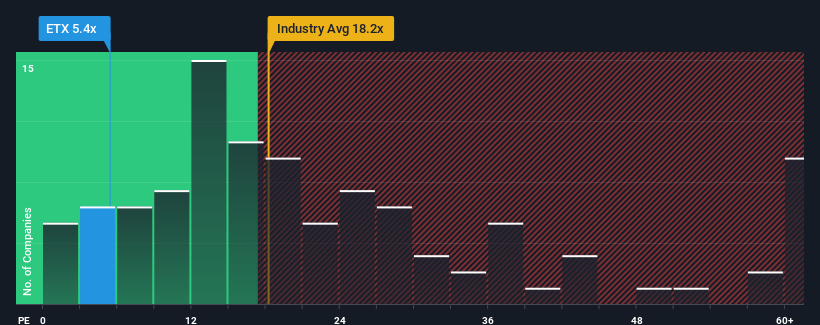

Following the heavy fall in price, Euro-Tax.pl may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.4x, since almost half of all companies in Poland have P/E ratios greater than 12x and even P/E's higher than 20x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Euro-Tax.pl recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Euro-Tax.pl

How Is Euro-Tax.pl's Growth Trending?

In order to justify its P/E ratio, Euro-Tax.pl would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 20% last year. The strong recent performance means it was also able to grow EPS by 131% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 19% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Euro-Tax.pl is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Having almost fallen off a cliff, Euro-Tax.pl's share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Euro-Tax.pl currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Euro-Tax.pl you should be aware of, and 1 of them is concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Euro-Tax.pl might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ETX

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success