- Germany

- /

- Commercial Services

- /

- XTRA:TGT

European Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of interest rate policies and trade tensions, major stock indexes have shown resilience, with Italy's FTSE MIB and Germany's DAX posting gains. In this context, penny stocks—often seen as a relic of past trading days—still hold potential for investors seeking growth opportunities in smaller or newer companies. By focusing on those with robust financials and clear growth trajectories, investors can uncover hidden value in these often-overlooked segments of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.112 | €1.42B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.01 | €15M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.35 | €44.5M | ✅ 5 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €225.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.83 | €39.16M | ✅ 3 ⚠️ 3 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.494 | RON16.71M | ✅ 2 ⚠️ 4 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.18 | €10.09M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.505 | €398.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 330 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Glycorex Transplantation (NGM:GTAB B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Glycorex Transplantation AB (publ) is a medical technology company specializing in transplantation, blood transfusion, and autoimmune diseases, with a market cap of SEK166.38 million.

Operations: The company generates revenue primarily from its Organ Transplantation segment, which amounts to SEK37.78 million.

Market Cap: SEK166.38M

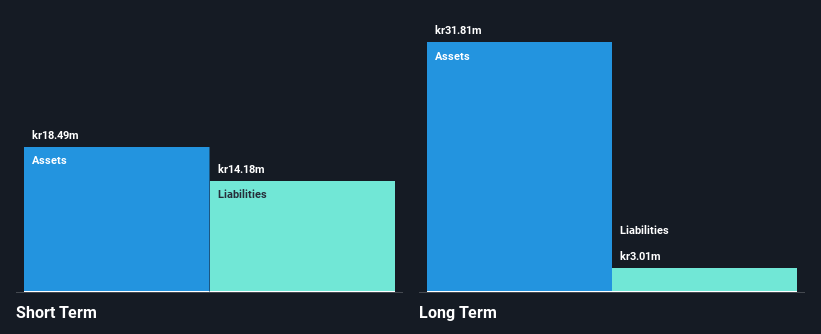

Glycorex Transplantation AB, a medical technology company, exhibits some financial resilience despite being unprofitable. The firm reported SEK 22.02 million in revenue for the first half of 2025, showing growth compared to the previous year. Its short-term assets of SEK 25.4 million comfortably cover both short and long-term liabilities, and it maintains a positive cash runway exceeding three years even if free cash flow declines. While shareholders haven't faced dilution recently and debt levels remain low relative to cash reserves, the company's negative return on equity highlights ongoing profitability challenges amidst declining earnings over five years.

- Take a closer look at Glycorex Transplantation's potential here in our financial health report.

- Review our historical performance report to gain insights into Glycorex Transplantation's track record.

Zaklady Urzadzen Kotlowych Staporków (WSE:ZUK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zaklady Urzadzen Kotlowych Staporków (WSE:ZUK) operates in the industrial sector, focusing on the production of boiler equipment, with a market cap of PLN27.32 million.

Operations: The company's revenue is primarily derived from three segments: Steel Structures (PLN31.11 million), Mass Production (PLN11.33 million), and Power Engineering (PLN4.09 million).

Market Cap: PLN27.32M

Zaklady Urzadzen Kotlowych Staporków has recently achieved profitability, marking a significant shift in its financial performance. The company maintains a satisfactory net debt to equity ratio of 23.1%, with short-term assets covering both short and long-term liabilities, ensuring financial stability. Despite the increased debt to equity ratio over five years, operating cash flow adequately covers its debt obligations at 42%. However, the stock remains highly volatile compared to most Polish stocks. With a Price-To-Earnings ratio of 10.2x below the market average and high-quality earnings reported, ZUK presents an intriguing yet cautious opportunity for investors interested in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Zaklady Urzadzen Kotlowych Staporków.

- Examine Zaklady Urzadzen Kotlowych Staporków's past performance report to understand how it has performed in prior years.

11880 Solutions (XTRA:TGT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 11880 Solutions AG, with a market cap of €17.84 million, provides telephone directory assistance services to both private and business customers in Germany through its subsidiaries.

Operations: The company generates revenue through its Digital segment, which accounts for €44.09 million, and its Directory Assistance segment, contributing €10.95 million.

Market Cap: €17.84M

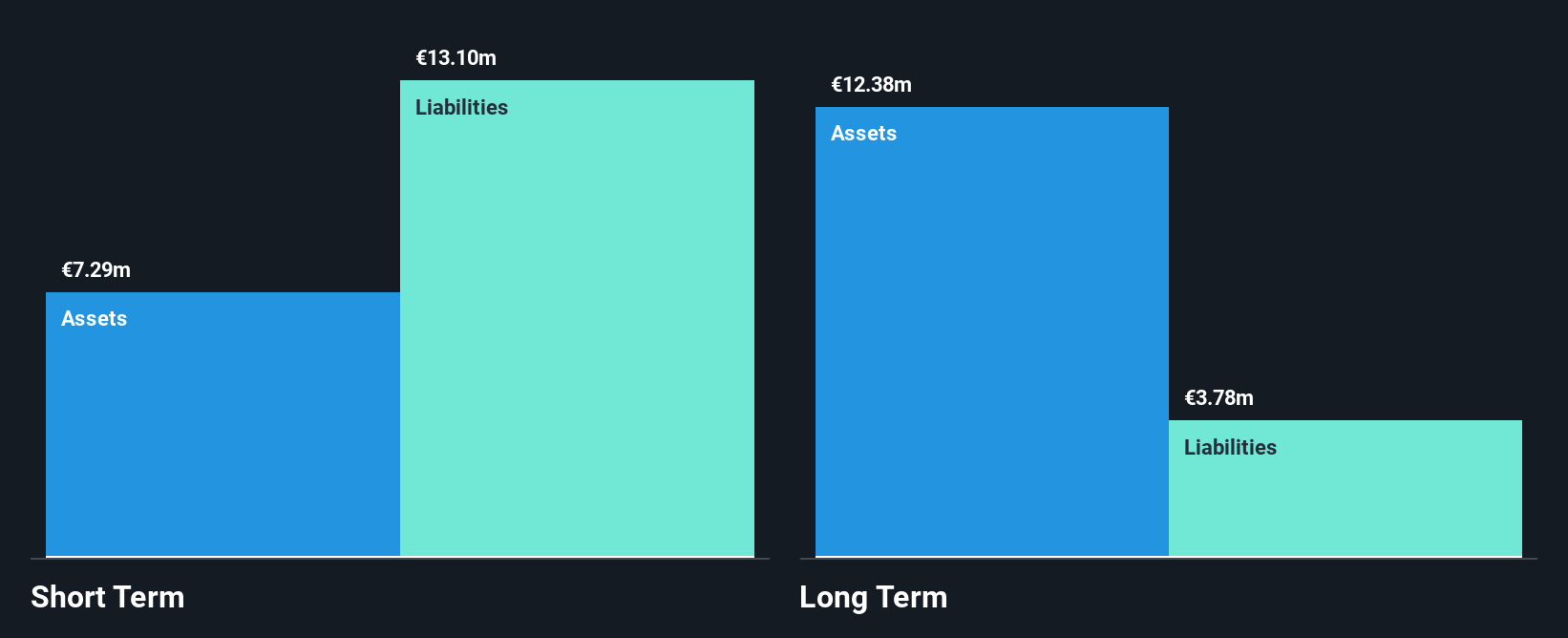

11880 Solutions AG faces challenges with its unprofitable status, reporting a net loss of €1.11 million for the first half of 2025. Despite this, it has a stable cash runway exceeding three years due to positive free cash flow growth. The company's short-term assets (€7.3M) are insufficient to cover short-term liabilities (€13.1M), but they do exceed long-term liabilities (€3.8M). While shareholders haven't been diluted recently, the stock's high volatility and increased debt-to-equity ratio over five years could concern investors seeking stability in penny stocks within Europe’s market landscape.

- Dive into the specifics of 11880 Solutions here with our thorough balance sheet health report.

- Explore historical data to track 11880 Solutions' performance over time in our past results report.

Make It Happen

- Dive into all 330 of the European Penny Stocks we have identified here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TGT

11880 Solutions

Offers telephone directory assistance services to private and business customers in Germany.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives