- France

- /

- Semiconductors

- /

- ENXTPA:MEMS

European Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As European markets grapple with concerns over inflated AI stock valuations and shifting interest rate expectations, the pan-European STOXX Europe 600 Index recently ended 2.21% lower. In this context, penny stocks — a term that may seem outdated but still captures the essence of smaller or less-established companies — can present unique opportunities for investors. By focusing on those with strong financials and clear growth potential, these stocks might offer both stability and upside in a market characterized by volatility.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.076 | €1.41B | ✅ 5 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €83.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.03 | €15.3M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €232.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.12 | €66.18M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.33 | €382.71M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.85 | €75.08M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.20 | €304.09M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.858 | €28.73M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 276 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

MEMSCAP (ENXTPA:MEMS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MEMSCAP, S.A. offers micro-electro-mechanical systems (MEMS) based solutions across aerospace and defense, optical communications, medical, and biomedical sectors globally with a market cap of €29.97 million.

Operations: MEMSCAP does not report specific revenue segments.

Market Cap: €29.97M

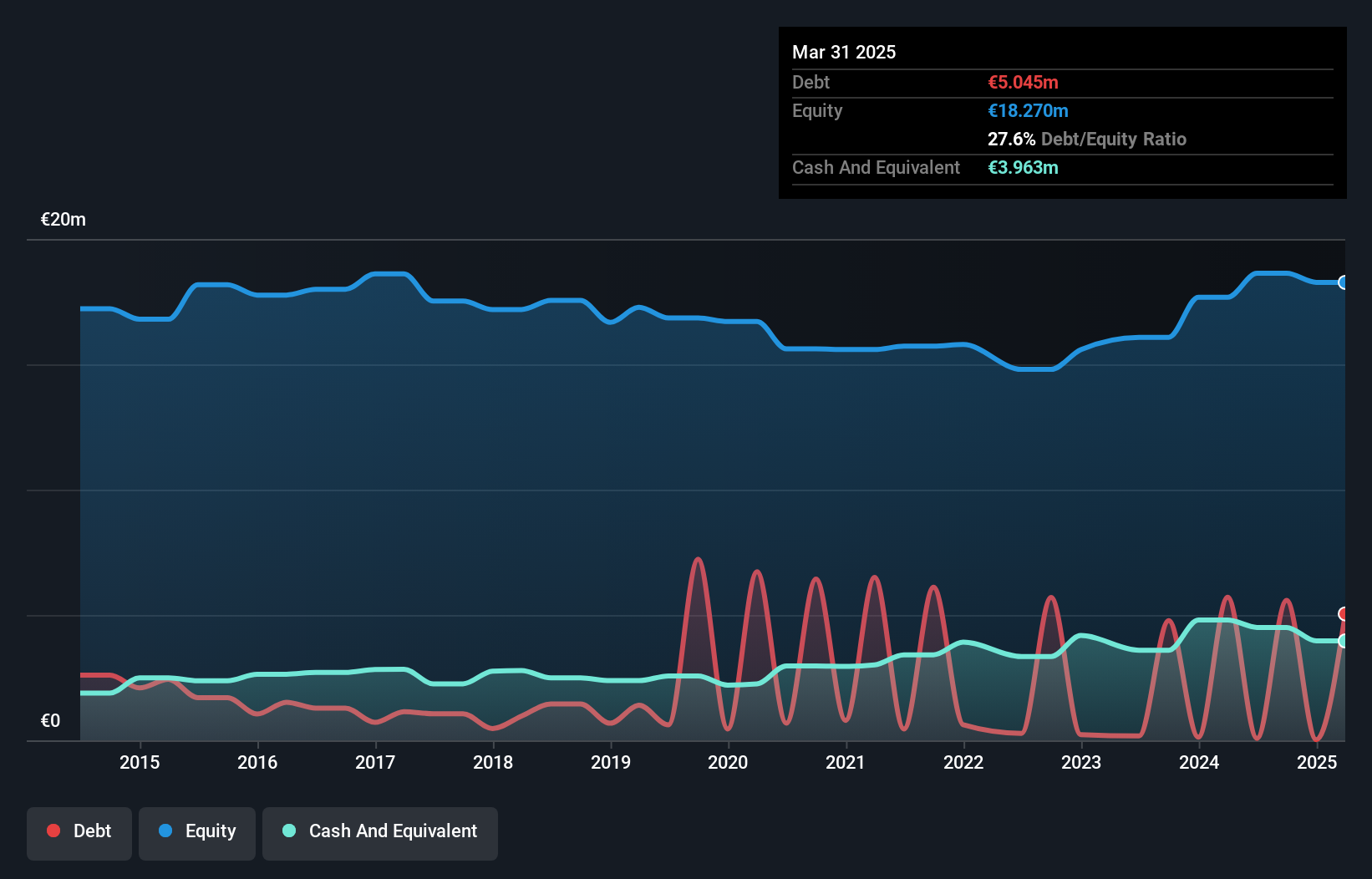

MEMSCAP, S.A., with a market cap of €29.97 million, offers promising potential in the penny stock realm through its micro-electro-mechanical systems (MEMS) solutions across various sectors. Despite a recent decline in net profit margins to 6.4% from 13.5% last year and negative earnings growth over the past year, MEMSCAP's financials show stability with satisfactory debt levels and well-covered interest payments by EBIT. Recent developments include a strategic contract with Parker Hannifin Corporation for aerospace applications, highlighting growth opportunities in high-performance pressure sensing solutions within an expansive market valued at several hundreds of millions annually.

- Unlock comprehensive insights into our analysis of MEMSCAP stock in this financial health report.

- Explore MEMSCAP's analyst forecasts in our growth report.

Eniro Group (OM:ENRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eniro Group AB (publ) is a software-as-a-service company operating in Sweden, Norway, Denmark, and Finland with a market cap of approximately SEK300.67 million.

Operations: The company's revenue is derived from two main segments: Dynava, contributing SEK334 million, and Marketing Partner, contributing SEK617 million.

Market Cap: SEK300.67M

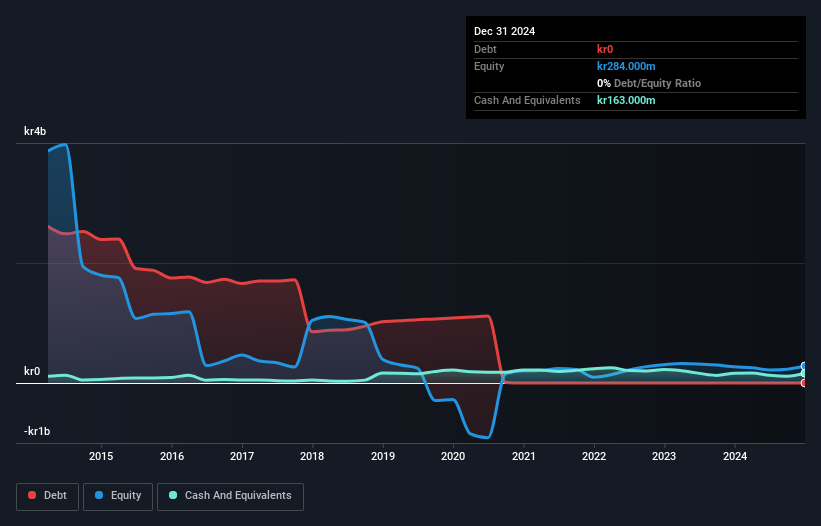

Eniro Group AB, with a market cap of SEK300.67 million, shows potential within the penny stock domain through its software-as-a-service operations across Scandinavia. The company has demonstrated robust earnings growth of 38.8% over the past year, outpacing the media industry's decline. Despite having no debt and high-quality earnings, Eniro's short-term liabilities slightly exceed its assets by SEK21 million. Recent earnings announcements revealed stable sales but a decrease in quarterly net income to SEK22 million from SEK30 million previously, reflecting challenges amidst otherwise strong operational metrics like a high return on equity at 20.6%.

- Click here and access our complete financial health analysis report to understand the dynamics of Eniro Group.

- Examine Eniro Group's past performance report to understand how it has performed in prior years.

Zaklady Urzadzen Kotlowych Staporków (WSE:ZUK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zaklady Urzadzen Kotlowych Staporków (WSE:ZUK) is a company involved in the manufacturing of boiler equipment, with a market cap of PLN 28.36 million.

Operations: The company's revenue is primarily derived from three segments: Steel Structures with PLN 33.22 million, Serial Production contributing PLN 11.50 million, and Power Engineering generating PLN 2.84 million.

Market Cap: PLN28.36M

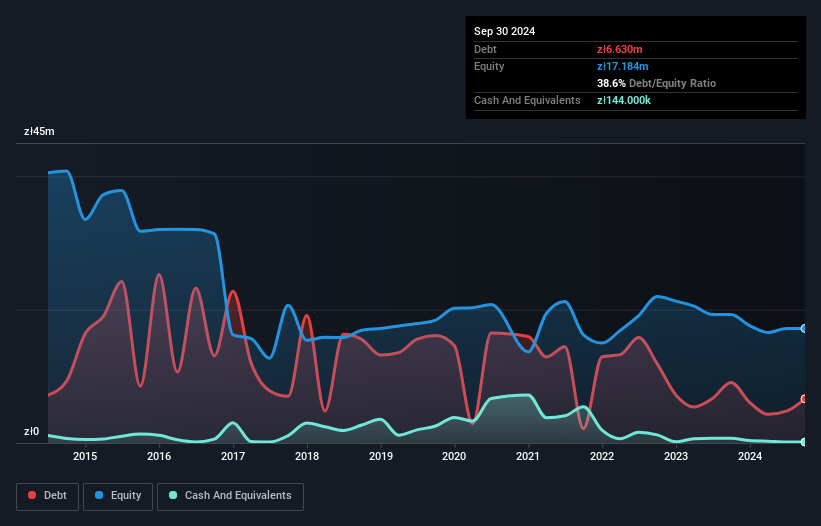

Zaklady Urzadzen Kotlowych Staporków, with a market cap of PLN 28.36 million, has recently reported significant financial improvements. The company achieved profitability this year, with third-quarter revenue rising to PLN 13.54 million from PLN 11.85 million and net income increasing to PLN 1.21 million from PLN 0.82 million year-over-year. ZUK's debt management is commendable, reducing its debt-to-equity ratio significantly over five years and maintaining satisfactory net debt levels covered by operating cash flow and EBIT interest coverage at 7.9 times. However, the stock remains volatile compared to most Polish stocks despite stable weekly volatility over the past year.

- Jump into the full analysis health report here for a deeper understanding of Zaklady Urzadzen Kotlowych Staporków.

- Gain insights into Zaklady Urzadzen Kotlowych Staporków's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Explore the 276 names from our European Penny Stocks screener here.

- Curious About Other Options? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEMS

MEMSCAP

Provides micro-electro-mechanical systems (MEMS) based solutions for aerospace and defense, optical communications, medical, and biomedical markets worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success