Subdued Growth No Barrier To PGF Polska Grupa Fotowoltaiczna SA (WSE:PGV) With Shares Advancing 58%

PGF Polska Grupa Fotowoltaiczna SA (WSE:PGV) shareholders would be excited to see that the share price has had a great month, posting a 58% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 83% in the last year.

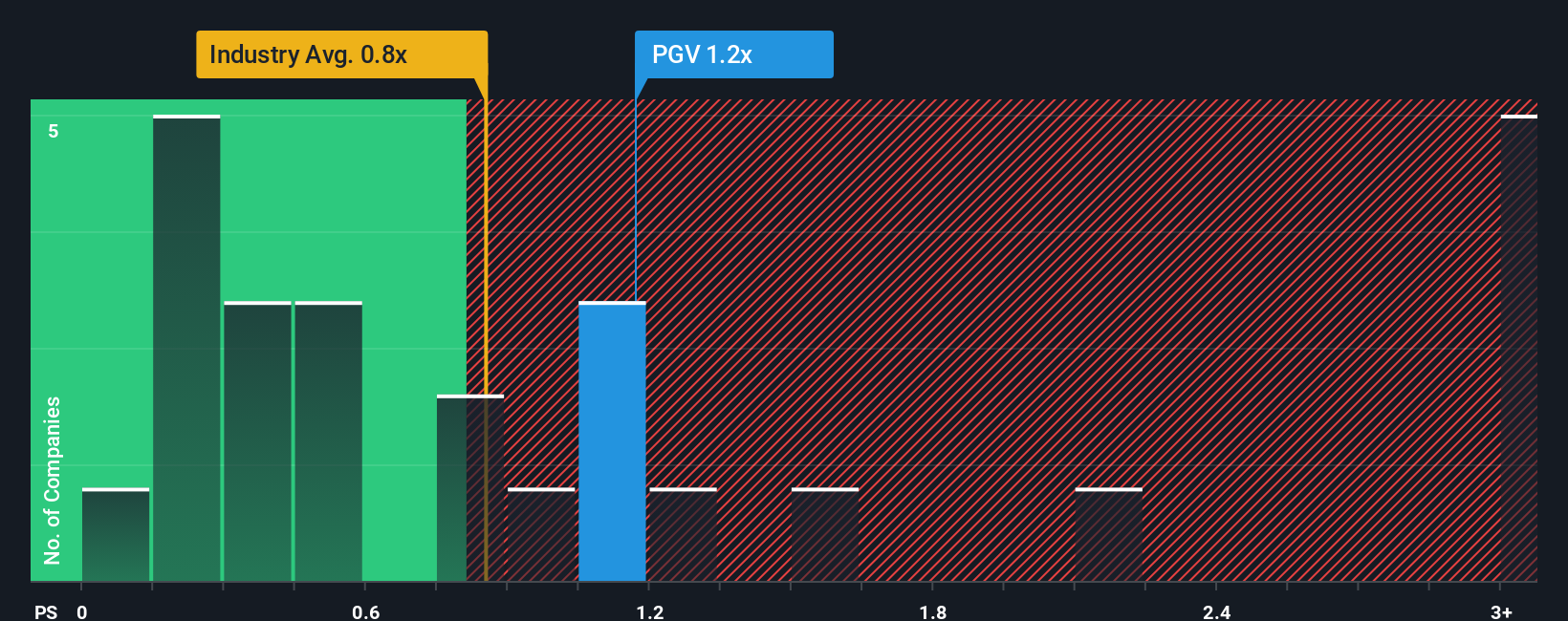

Although its price has surged higher, you could still be forgiven for feeling indifferent about PGF Polska Grupa Fotowoltaiczna's P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Poland is also close to 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for PGF Polska Grupa Fotowoltaiczna

How PGF Polska Grupa Fotowoltaiczna Has Been Performing

As an illustration, revenue has deteriorated at PGF Polska Grupa Fotowoltaiczna over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for PGF Polska Grupa Fotowoltaiczna, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

PGF Polska Grupa Fotowoltaiczna's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 93%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 32% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that PGF Polska Grupa Fotowoltaiczna's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Its shares have lifted substantially and now PGF Polska Grupa Fotowoltaiczna's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that PGF Polska Grupa Fotowoltaiczna's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

We don't want to rain on the parade too much, but we did also find 3 warning signs for PGF Polska Grupa Fotowoltaiczna (1 is potentially serious!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PGV

PGF Polska Grupa Fotowoltaiczna

An investment company, operates in the renewable energy sector primarily focusing on the photovoltaic market in Poland.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives