As European markets experience a wave of optimism following the reopening of the U.S. federal government, the pan-European STOXX Europe 600 Index has seen a rise, although tempered by cooling sentiment around artificial intelligence. In this environment, dividend stocks stand out as appealing options for investors seeking stability and income; they are often characterized by strong fundamentals and consistent payout histories, making them attractive in times of economic uncertainty.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.55% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.24% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.33% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.10% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.85% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.93% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.31% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.71% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.70% | ★★★★★★ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

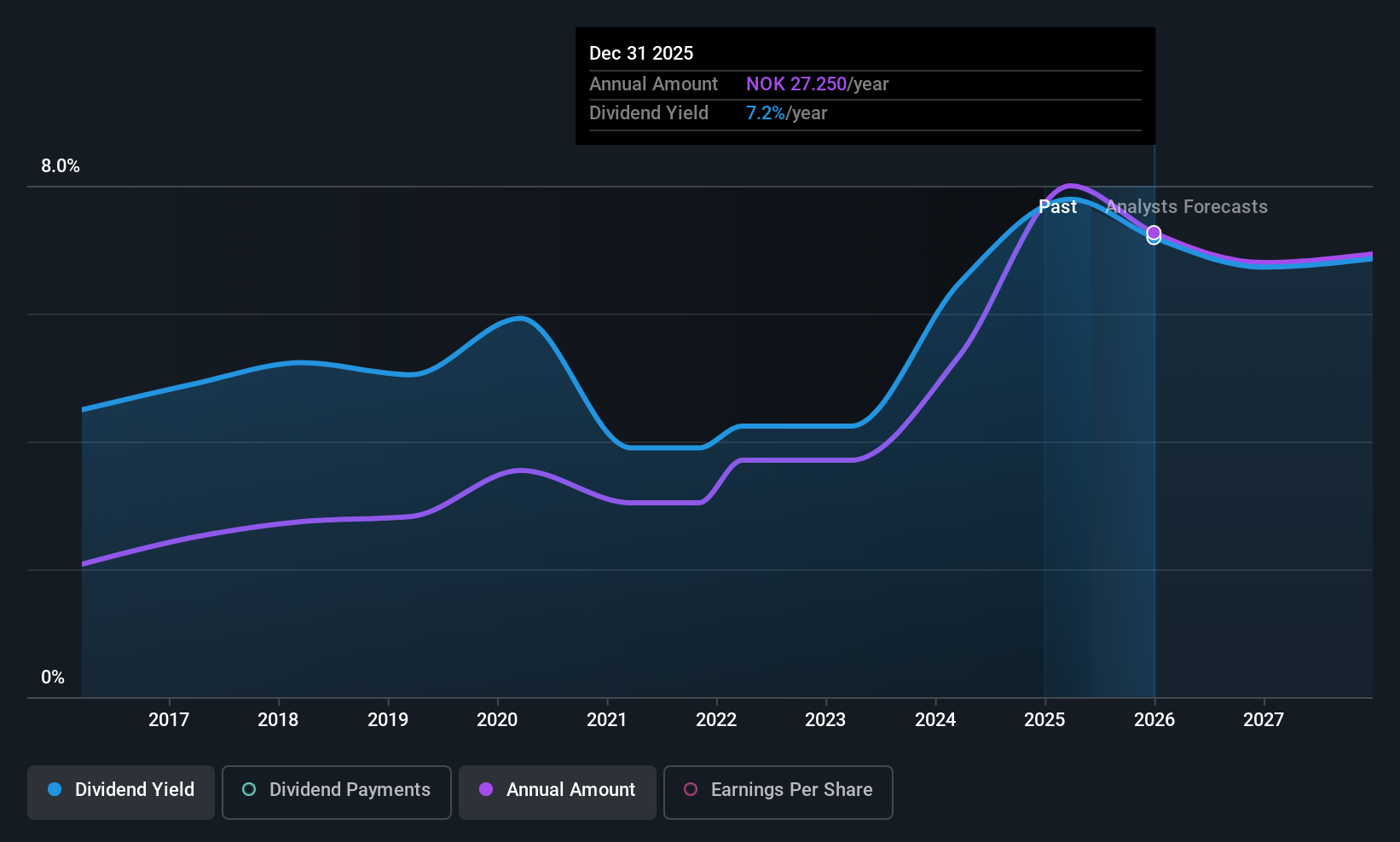

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Ringerike Hadeland is a financial institution offering a range of banking products and services to private and corporate customers in Norway, with a market cap of NOK6.02 billion.

Operations: SpareBank 1 Ringerike Hadeland generates its revenue from several segments, including NOK469 million from the private market, NOK378 million from the corporate market, NOK68 million from real estate brokerage, and NOK93 million from IT and accounting services.

Dividend Yield: 7.8%

SpareBank 1 Ringerike Hadeland offers a reliable dividend yield of 7.79%, though it falls short of the top tier in Norway. Its dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 66.9%. However, recent earnings showed a decline in net income for Q3 2025 compared to last year, which might impact future dividend sustainability as earnings are forecasted to decline by an average of 6.5% annually over the next three years.

- Click to explore a detailed breakdown of our findings in SpareBank 1 Ringerike Hadeland's dividend report.

- The analysis detailed in our SpareBank 1 Ringerike Hadeland valuation report hints at an deflated share price compared to its estimated value.

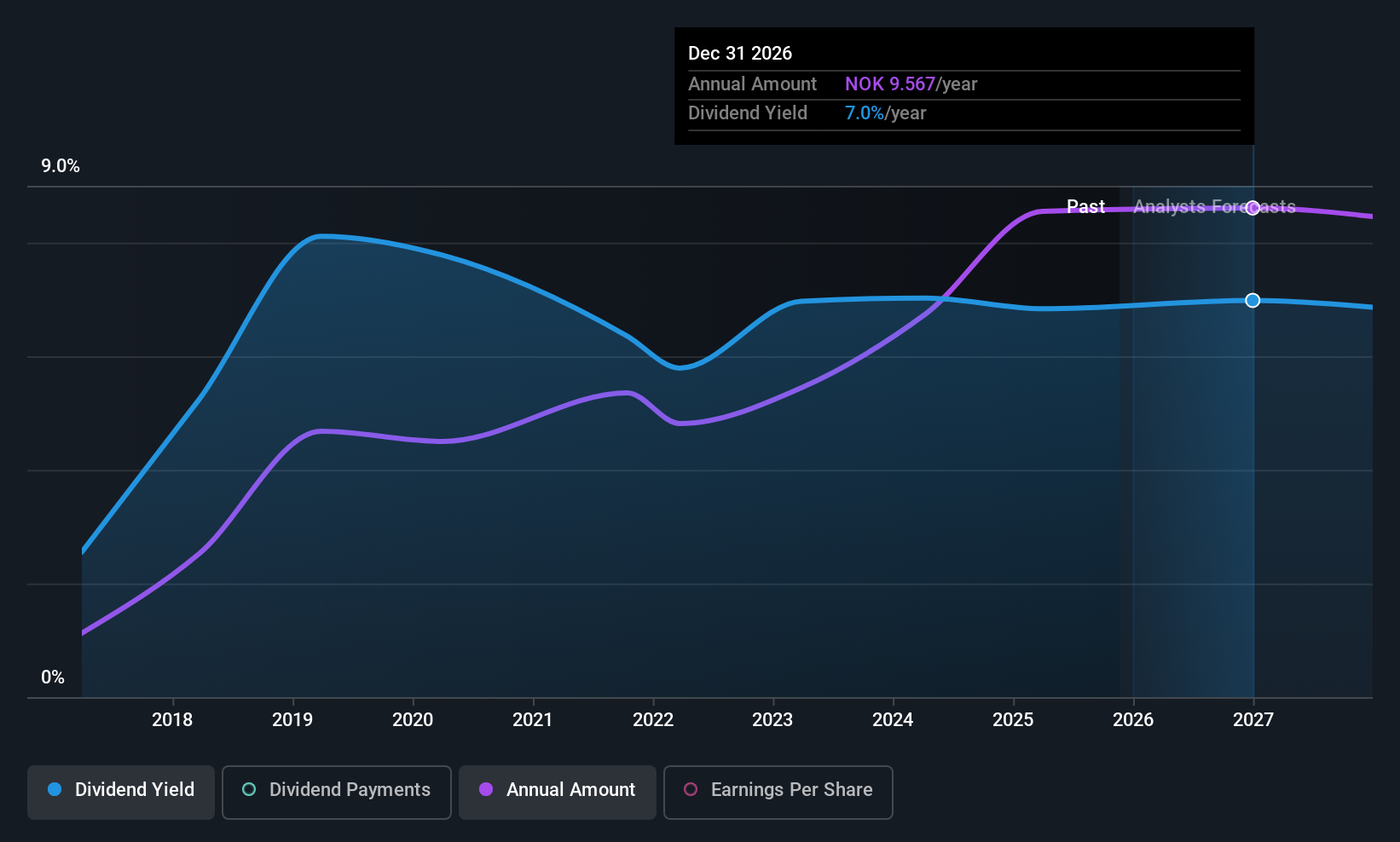

Rogaland Sparebank (OB:ROGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rogaland Sparebank is an independent savings bank offering a range of banking and investment products to retail and corporate customers in Norway, with a market cap of NOK3.15 billion.

Operations: Rogaland Sparebank generates its revenue by providing a variety of financial services and products tailored to both individual and business clients in Norway.

Dividend Yield: 6.9%

Rogaland Sparebank's dividend payments have been inconsistent over the past decade, despite an increase in payouts. The current payout ratio of 74.4% suggests dividends are covered by earnings and are expected to remain so, with a forecasted coverage of 80.3% in three years. Recent earnings reports indicate a decrease in net income for Q3 2025 compared to last year, which could affect future dividend stability given the anticipated decline in earnings growth.

- Delve into the full analysis dividend report here for a deeper understanding of Rogaland Sparebank.

- Our comprehensive valuation report raises the possibility that Rogaland Sparebank is priced lower than what may be justified by its financials.

ING Bank Slaski (WSE:ING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ING Bank Slaski S.A. operates in Poland, offering a range of banking products and services to retail clients and businesses, with a market capitalization of PLN43.97 billion.

Operations: ING Bank Slaski S.A. generates revenue from two main segments: Retail Banking, contributing PLN4.91 billion, and Corporate Banking, accounting for PLN5.63 billion.

Dividend Yield: 7.4%

ING Bank Slaski's dividend payments have been volatile over the past decade, despite recent increases. The current payout ratio of 71.7% indicates dividends are covered by earnings, with future coverage expected to improve to 46.6%. While trading below fair value, ING faces challenges with a high level of bad loans (3.9%) and a low allowance for bad loans (64%). Recent earnings show slight growth in net income and basic EPS compared to last year.

- Take a closer look at ING Bank Slaski's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that ING Bank Slaski is trading behind its estimated value.

Key Takeaways

- Get an in-depth perspective on all 223 Top European Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ROGS

Rogaland Sparebank

An independent savings bank, provides various banking and investment products to retail and corporate customers in Norway.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives