- Pakistan

- /

- Oil and Gas

- /

- KASE:MARI

3 Dividend Stocks To Consider With Up To 9.8% Yield

Reviewed by Simply Wall St

As global markets rebound from recent sell-offs and central banks adjust interest rates, investors are keenly observing opportunities for stable returns amidst economic shifts. With core inflation slightly higher than expected and treasury yields at year-to-date lows, dividend stocks offer a compelling option for those seeking steady income. In the current market environment, a good dividend stock is characterized by reliable payouts and the potential for growth. Here are three dividend stocks to consider, each offering yields of up to 9.8%.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.37% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.84% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.11% | ★★★★★★ |

| Innotech (TSE:9880) | 4.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.24% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 2060 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

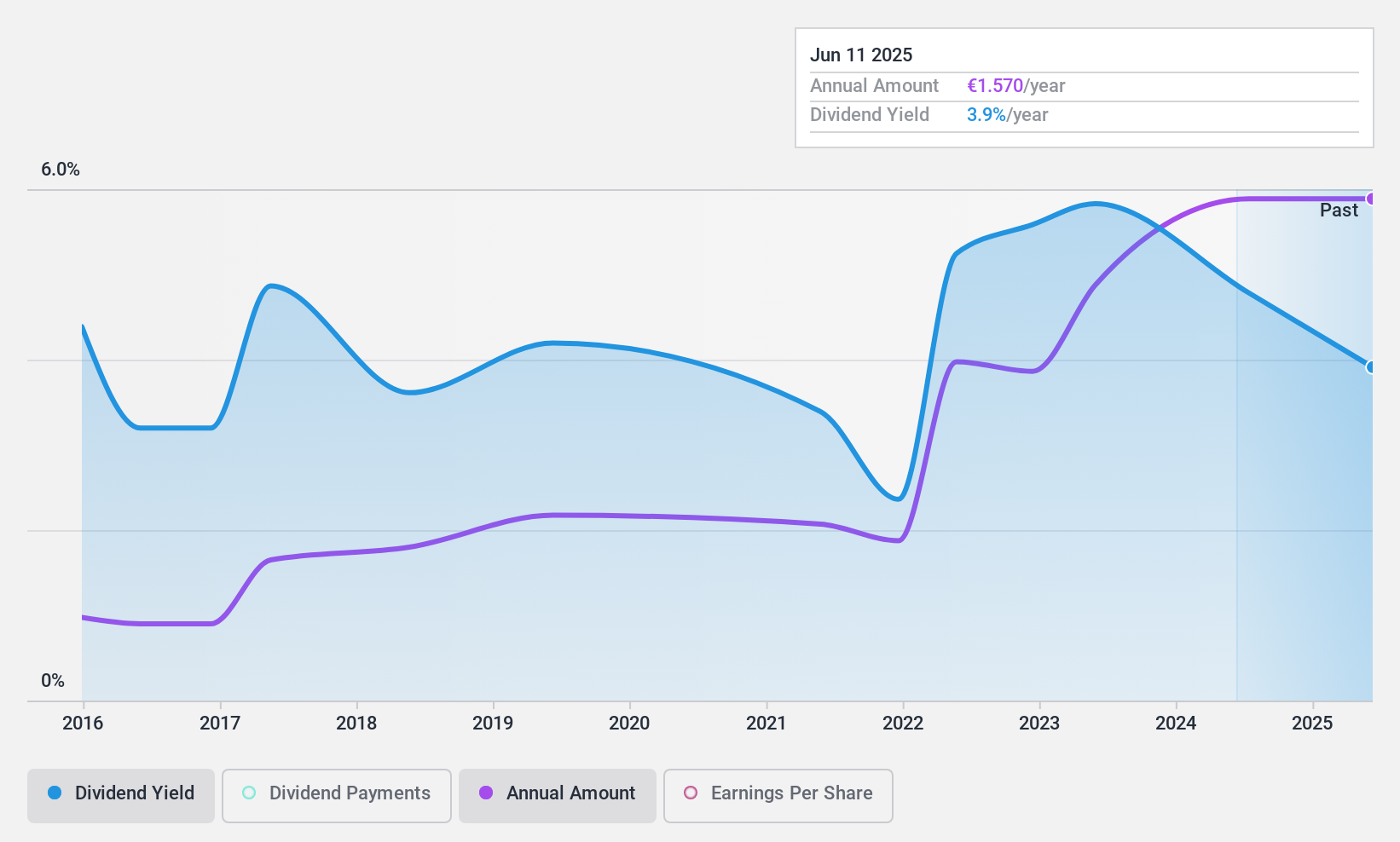

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics and has a market cap of €601.56 million.

Operations: Clínica Baviera generates €243.31 million in revenue from its ophthalmology clinics.

Dividend Yield: 4.3%

Clínica Baviera reported half-year sales of €132.97 million and net income of €23.43 million, reflecting strong earnings growth. However, its dividend yield of 4.25% is low compared to the Spanish market's top payers and has been unreliable and volatile over the past decade. Despite this, dividends are covered by both earnings (66.6% payout ratio) and cash flows (65.5% cash payout ratio), indicating sustainability amidst a highly volatile share price recently.

- Dive into the specifics of Clínica Baviera here with our thorough dividend report.

- The valuation report we've compiled suggests that Clínica Baviera's current price could be quite moderate.

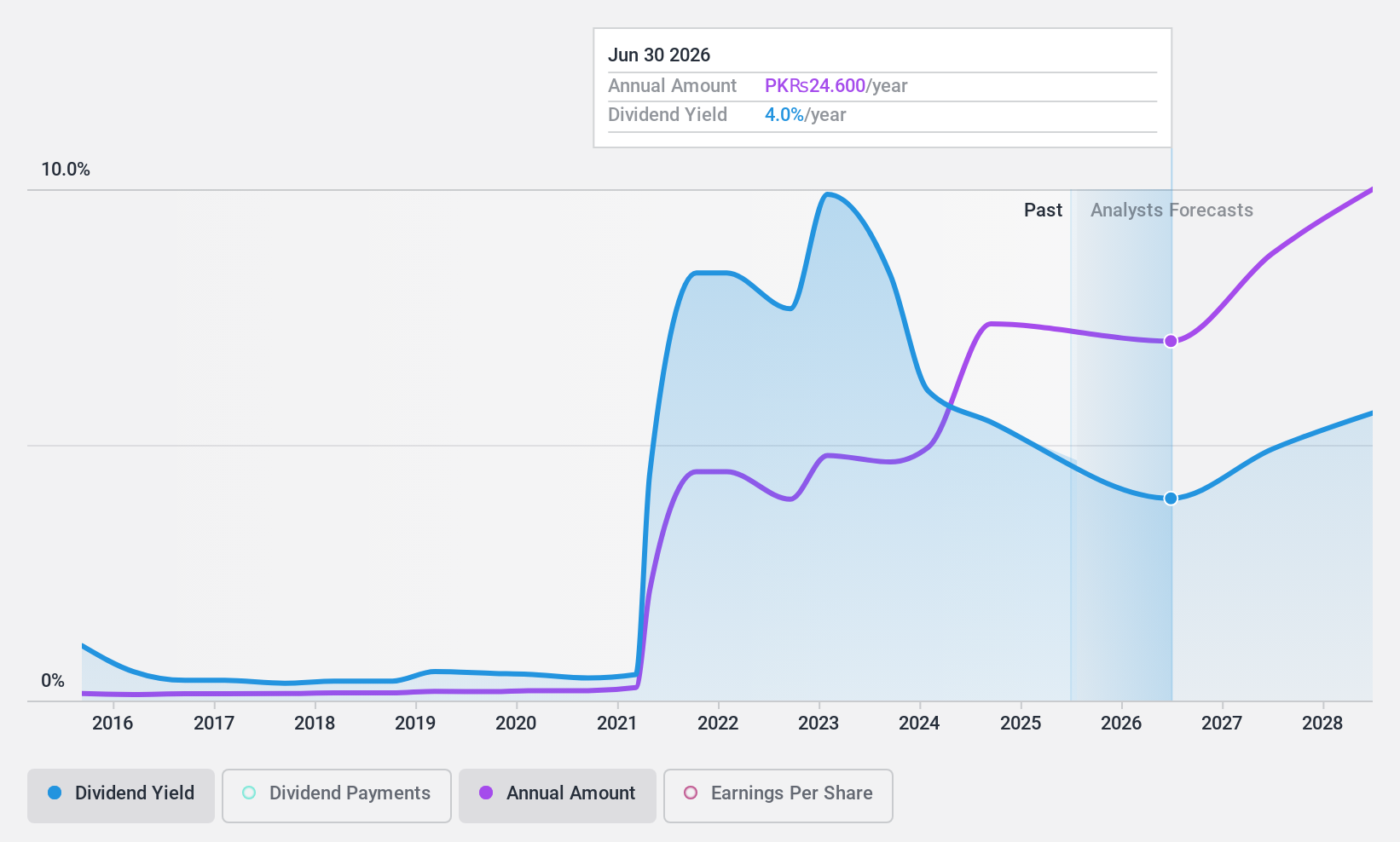

Mari Petroleum (KASE:MARI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mari Petroleum Company Limited explores for, produces, and sells hydrocarbons in Pakistan, with a market cap of PKR549.27 billion.

Operations: Mari Petroleum's revenue primarily comes from its Oil & Gas - Exploration & Production segment, which generated PKR159.73 billion.

Dividend Yield: 5.6%

Mari Petroleum's dividend payments have been volatile over the past decade, despite being covered by earnings (40% payout ratio) and cash flows (59.8% cash payout ratio). Earnings grew 37.7% last year, but are forecasted to decline by 6.5% annually over the next three years. The company recently reported net income of PKR 77.29 billion for FY2024, up from PKR 56.13 billion last year, and announced a stock split effective September 16, 2024.

- Get an in-depth perspective on Mari Petroleum's performance by reading our dividend report here.

- According our valuation report, there's an indication that Mari Petroleum's share price might be on the expensive side.

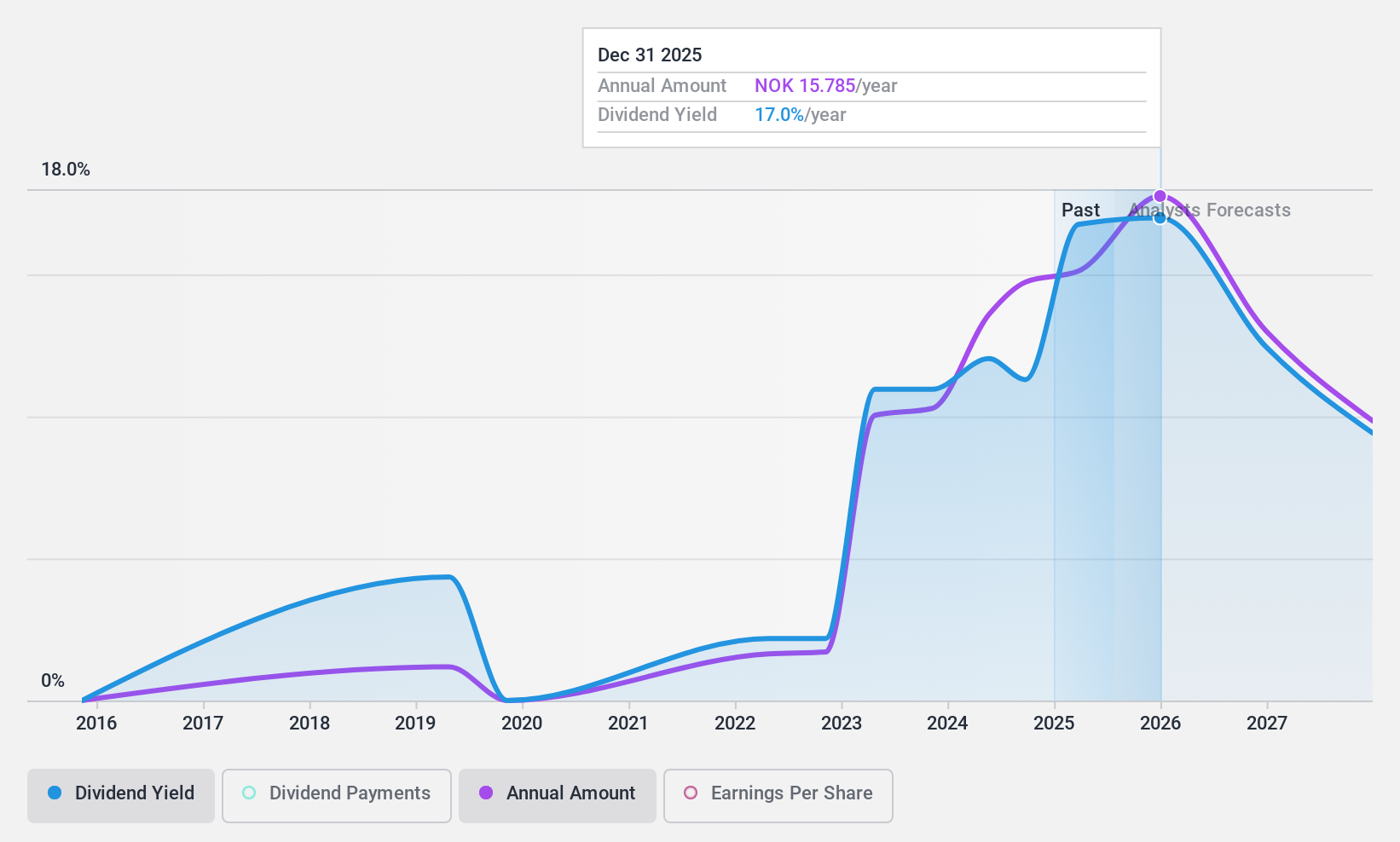

Wallenius Wilhelmsen (OB:WAWI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wallenius Wilhelmsen ASA, with a market cap of NOK55.46 billion, operates globally in the logistics and transportation sector through its subsidiaries.

Operations: Wallenius Wilhelmsen ASA generates its revenue from three main segments: Shipping Services ($3.87 billion), Logistics Services ($1.20 billion), and Government Services ($371 million).

Dividend Yield: 9.9%

Wallenius Wilhelmsen's dividend payments, covered by earnings (84.4% payout ratio) and cash flows (33.1% cash payout ratio), have been volatile over the past decade but have increased overall. The company declared a US$0.61 per share dividend for H1 2024 under its new policy, with a payment date of October 10, 2024. Recent earnings show growth, with Q2 net income rising to US$292 million from US$262 million last year and signing a significant multi-year contract valued at approximately US$195 million.

- Click here to discover the nuances of Wallenius Wilhelmsen with our detailed analytical dividend report.

- The analysis detailed in our Wallenius Wilhelmsen valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Explore the 2060 names from our Top Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KASE:MARI

Mari Energies

Explores for, produces, and sells hydrocarbons in Pakistan.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives