- Philippines

- /

- Metals and Mining

- /

- PSE:NIKL

Asian Undervalued Small Caps With Insider Buying To Watch In November 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances in key indices and cautious monetary policies, the Asian market remains an area of interest for investors, particularly in the small-cap segment. With small-cap stocks often sensitive to economic shifts and interest rate movements, identifying those with potential value can be crucial; factors such as insider buying may offer additional insights into promising opportunities amidst these dynamic conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.2x | 0.9x | 25.14% | ★★★★★★ |

| East West Banking | 3.1x | 0.7x | 18.75% | ★★★★☆☆ |

| Civmec | 16.4x | 0.9x | 47.69% | ★★★★☆☆ |

| Eureka Group Holdings | 10.5x | 4.6x | 26.80% | ★★★★☆☆ |

| PSC | 9.8x | 0.4x | 20.28% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.03% | ★★★★☆☆ |

| PolyNovo | 60.9x | 6.3x | 28.29% | ★★★☆☆☆ |

| Nickel Asia | 12.0x | 1.8x | 17.78% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 7.0x | 0.4x | -459.68% | ★★★☆☆☆ |

| Chinasoft International | 23.0x | 0.7x | -1253.99% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

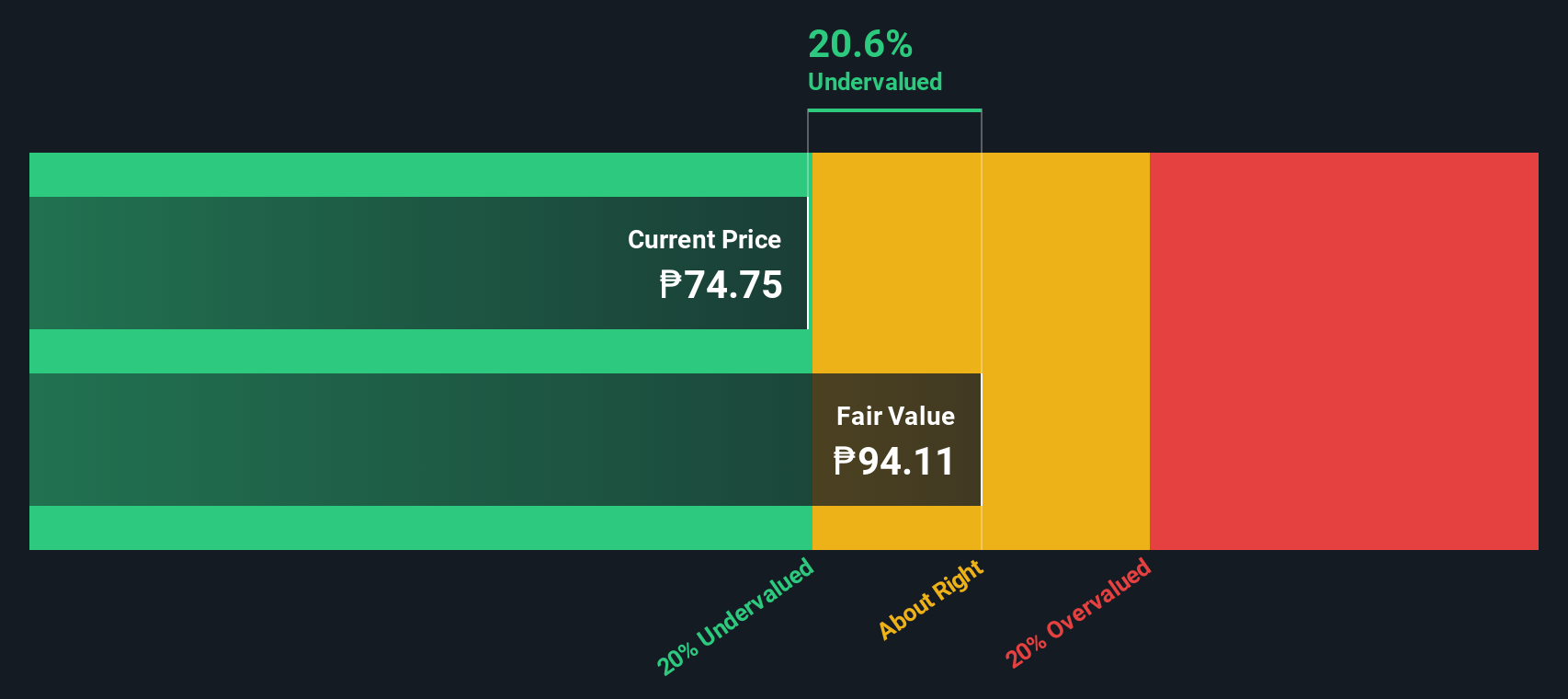

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asia United Bank provides a range of financial services including branch, consumer, and commercial banking, as well as treasury operations, with a market capitalization of ₱35.76 billion.

Operations: Asia United Bank's primary revenue streams are derived from branch banking, treasury operations, and commercial banking. As of the latest data, the net income margin stands at 55.78%, indicating a strong profitability position. The company has experienced fluctuations in its operating expenses over time, which include significant contributions from general and administrative expenses.

PE: 4.6x

Asia United Bank, a smaller player in the Asian financial sector, shows potential for value appreciation. Insider confidence is evident with Ernesto Tan Uy purchasing 30,000 shares worth approximately ₱1.05 million in recent months, indicating belief in future performance. The bank's strategic leadership changes include appointing Dennis Edmund E. Balagtas as Head of Trust and Investments Group from November 2025, bringing decades of experience to enhance trust banking operations. These developments suggest a focus on strengthening its market position amidst evolving industry dynamics.

- Dive into the specifics of Asia United Bank here with our thorough valuation report.

Examine Asia United Bank's past performance report to understand how it has performed in the past.

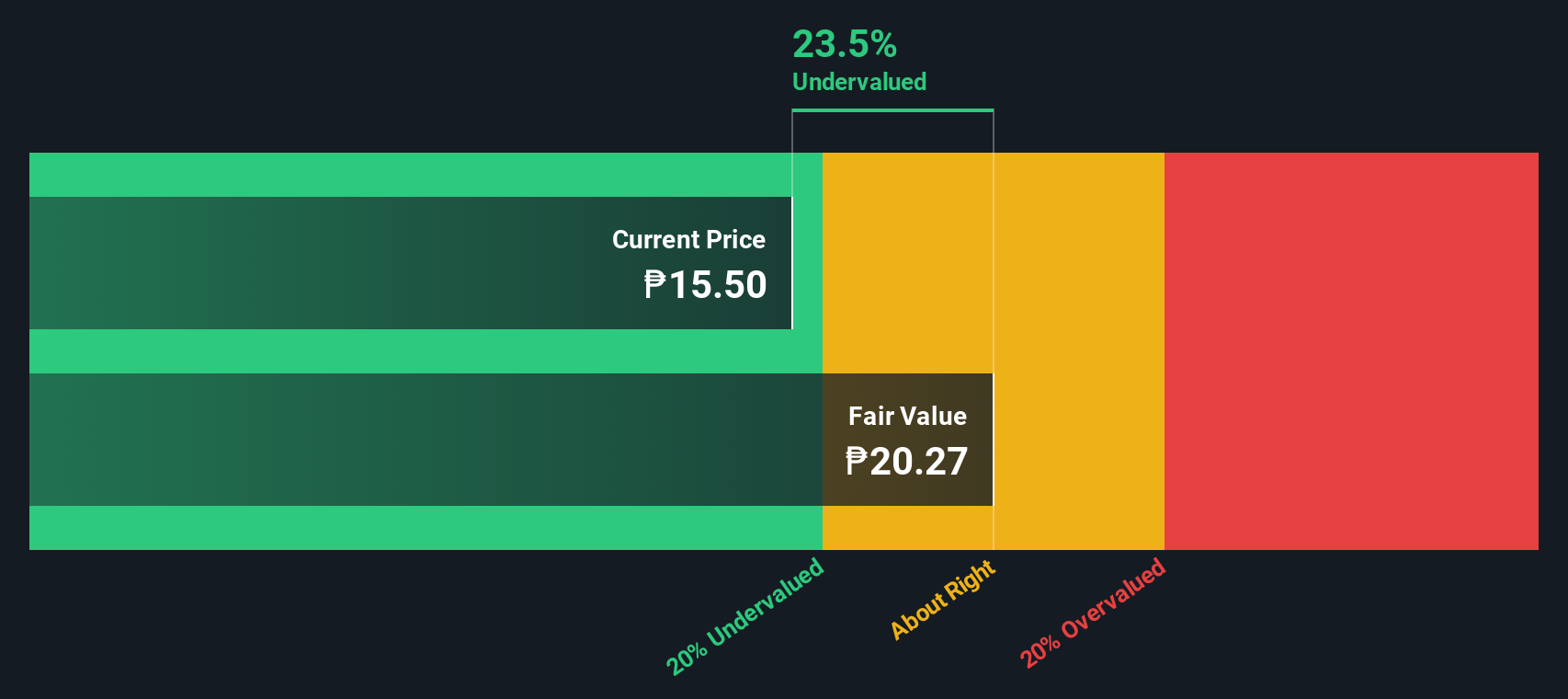

Maynilad Water Services (PSE:MYNLD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Maynilad Water Services is a Philippine-based company that provides water and wastewater services in the western zone of Metro Manila, with a market capitalization of ₱54.23 billion.

Operations: Maynilad Water Services generates revenue primarily through its water distribution and wastewater services, with a notable gross profit margin of 86.22% as of September 2025. The company experiences significant operating expenses, including general and administrative costs, which impact its overall profitability. Non-operating expenses also play a role in financial outcomes, contributing to variations in net income margins over time.

PE: 8.0x

Maynilad Water Services, a prominent player in Asia's water utility sector, recently reported a rise in third-quarter sales to PHP 9.24 billion from PHP 8.48 billion last year, reflecting solid operational performance despite its reliance on external borrowing for funding. The company's IPO raised PHP 30.6 billion, indicating market confidence and potential for growth as it joins the PSE All Share Index. With new leadership under COO Christopher Lichauco and strategic shifts like discontinuing certain international projects, Maynilad is poised for focused domestic expansion while maintaining insider confidence through significant share purchases over the past year.

- Get an in-depth perspective on Maynilad Water Services' performance by reading our valuation report here.

Learn about Maynilad Water Services' historical performance.

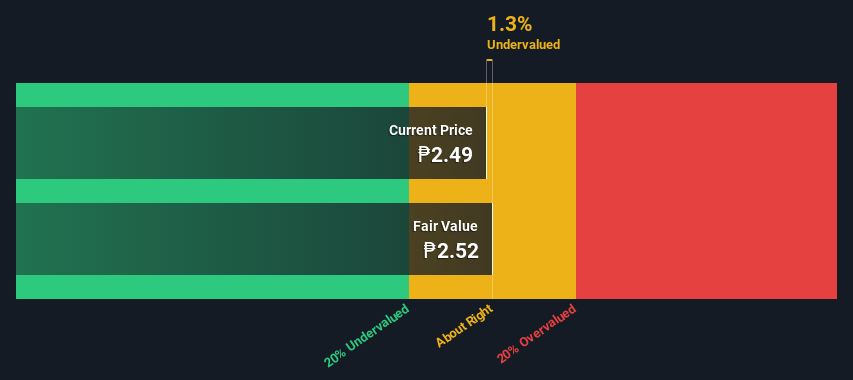

Nickel Asia (PSE:NIKL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nickel Asia is a leading nickel mining company in the Philippines, engaged in extracting, processing, and exporting nickel ore with a market capitalization of approximately ₱88.13 billion.

Operations: Nickel Asia generates revenue primarily through its operations, with significant costs attributed to the cost of goods sold (COGS). The company's net income margin has shown variability, reaching as high as 32.88% in June 2022 and declining to 7.06% by December 2024. Operating expenses and non-operating expenses also play a role in financial performance, impacting the overall profitability.

PE: 12.0x

Nickel Asia's recent financial performance highlights its potential in the Asian small-cap sector, with third-quarter revenue reaching PHP 11.05 billion and net income at PHP 3.09 billion, both showing significant year-over-year growth. Despite a volatile share price recently, insider confidence is evident through share purchases from March to October 2025. The company declared a special dividend of PHP 0.07 per share, payable on December 15, reflecting strong cash flow management despite relying solely on external borrowing for funding. Organizational changes effective January 2026 could further strengthen strategic planning and corporate governance structures as they navigate projected earnings declines over the next three years.

- Click here and access our complete valuation analysis report to understand the dynamics of Nickel Asia.

Understand Nickel Asia's track record by examining our Past report.

Make It Happen

- Unlock our comprehensive list of 43 Undervalued Asian Small Caps With Insider Buying by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nickel Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:NIKL

Nickel Asia

Engages in the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials in the Philippines.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives