- China

- /

- Metals and Mining

- /

- SZSE:002532

Global Dividend Stocks To Consider In Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of interest rate expectations and inflationary pressures, investors are keenly observing the performance of major indices, which have recently reached new highs amid AI optimism and anticipated rate cuts. In this dynamic environment, dividend stocks can provide a measure of stability and income potential, making them a compelling consideration for those looking to balance growth with regular returns in their investment portfolios.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.00% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.67% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.72% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.41% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.81% | ★★★★★★ |

| NCD (TSE:4783) | 4.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| Daicel (TSE:4202) | 4.32% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.51% | ★★★★★★ |

Click here to see the full list of 1312 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

i-Scream Media (KOSDAQ:A461300)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: i-Scream Media CO., LTD. is a digital education content company serving both South Korea and international markets, with a market cap of ₩256.99 billion.

Operations: i-Scream Media CO., LTD. generates revenue through its operations as a digital education content provider in both domestic and international markets.

Dividend Yield: 3.3%

i-Scream Media's recent initiation of dividend payments is supported by a low payout ratio of 14.2%, indicating strong coverage by earnings and cash flows, with a cash payout ratio at 33.5%. Despite its dividend yield of 3.31% being slightly below the top quartile in the KR market, the company trades at a significant discount to its estimated fair value. Recent share buybacks totaling KRW 4.95 billion suggest management's confidence in long-term growth prospects despite share price volatility.

- Dive into the specifics of i-Scream Media here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of i-Scream Media shares in the market.

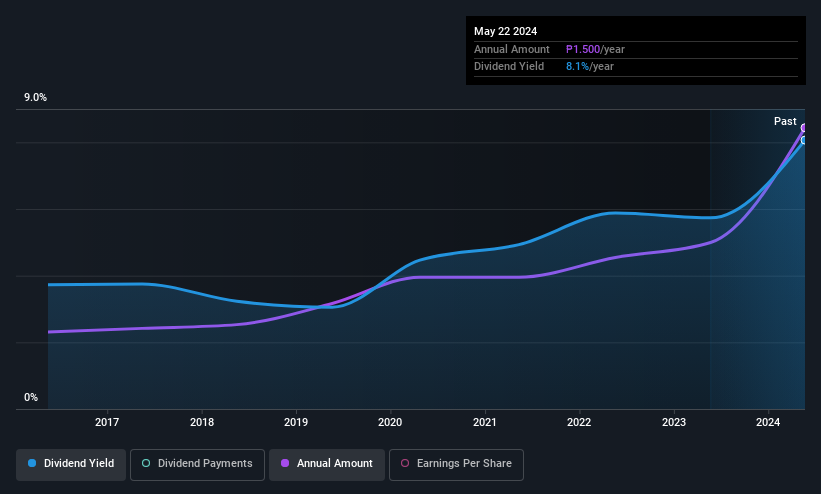

Asian Terminals (PSE:ATI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asian Terminals, Inc. operates and manages the South Harbor Port of Manila and the Port of Batangas in the Philippines, with a market cap of ₱56.49 billion.

Operations: Asian Terminals, Inc. generates its revenue primarily from its Ports Business segment, which amounted to ₱17.92 billion.

Dividend Yield: 5.1%

Asian Terminals offers a reliable dividend yield of 5.29%, supported by stable and growing dividends over the past decade. The payout ratio of 37.8% indicates strong earnings coverage, while a cash payout ratio of 75.4% shows dividends are adequately covered by cash flows. Recent earnings growth, with net income rising to PHP 1.5 billion in Q2, underscores financial strength and potential for continued dividend stability, despite its yield being below the top tier in the PH market.

- Click to explore a detailed breakdown of our findings in Asian Terminals' dividend report.

- Our valuation report unveils the possibility Asian Terminals' shares may be trading at a premium.

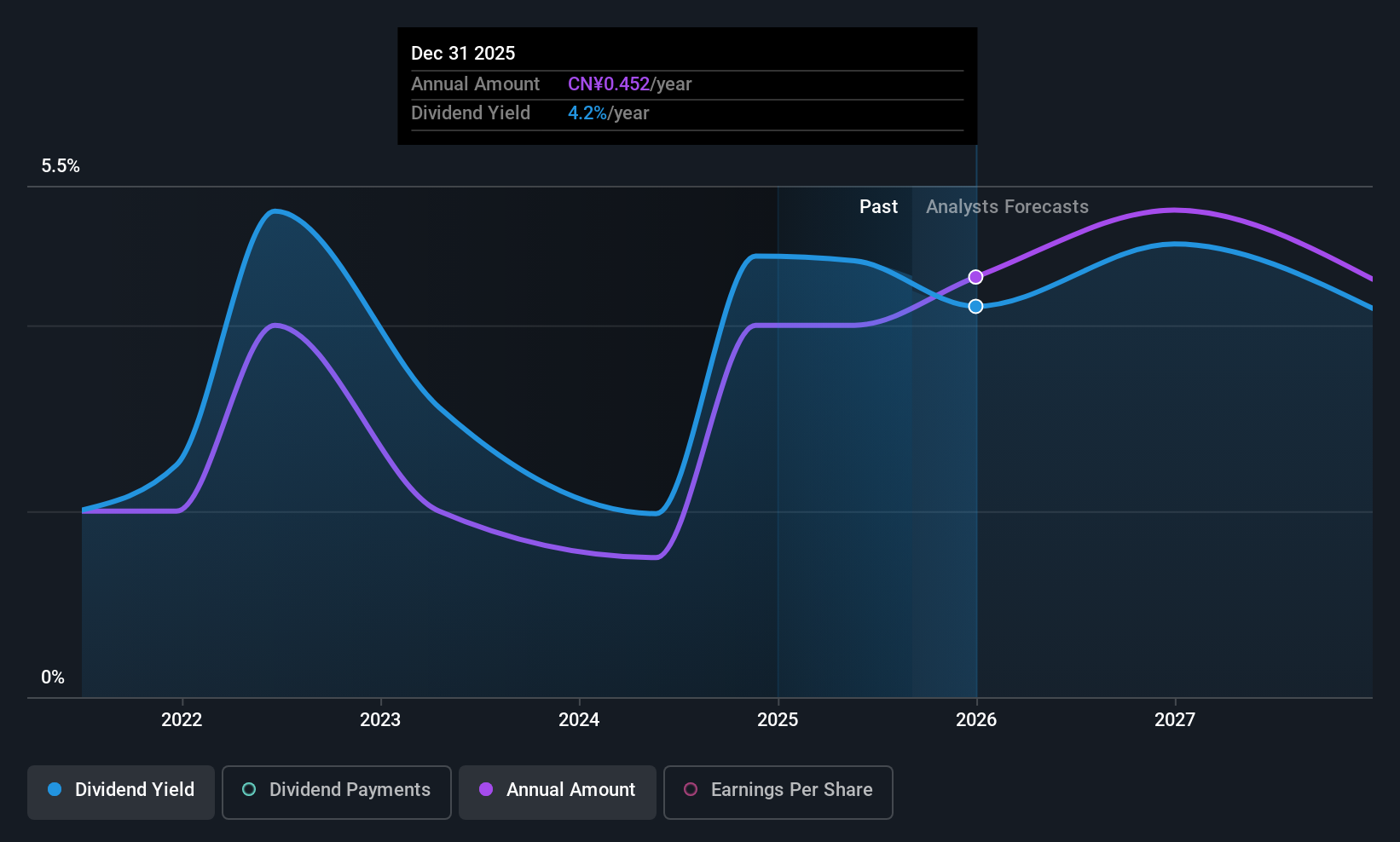

Tianshan Aluminum GroupLtd (SZSE:002532)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianshan Aluminum Group Co., Ltd, with a market cap of CN¥53.20 billion, produces and sells primary aluminum, alumina, prebaked anodes, high-purity aluminum, and aluminum deep-processed products and materials both in China and internationally.

Operations: Tianshan Aluminum Group Co., Ltd's revenue is primarily derived from the sale of original aluminum plate excluding high-purity aluminum (CN¥19.23 billion), followed by aluminum oxide plate (CN¥7.76 billion), sales of aluminum foil and aluminum foil blanks (CN¥1.46 billion), and high-purity aluminum (CN¥693.30 million).

Dividend Yield: 3.4%

Tianshan Aluminum Group's dividend yield ranks in the top 25% of the CN market, yet its dividend history is marked by volatility and only spans four years. Despite this, dividends are well covered by earnings and cash flows with payout ratios of 41.7% and 36.3%, respectively. Recent earnings results show modest growth, with net income reaching CNY 2.08 billion for H1 2025, supporting its interim cash dividend plan announced for September's extraordinary meeting.

- Delve into the full analysis dividend report here for a deeper understanding of Tianshan Aluminum GroupLtd.

- Our valuation report unveils the possibility Tianshan Aluminum GroupLtd's shares may be trading at a discount.

Summing It All Up

- Click here to access our complete index of 1312 Top Global Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tianshan Aluminum GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002532

Tianshan Aluminum GroupLtd

Produces and sells primary aluminum, alumina, prebaked anodes, high-purity aluminum, and aluminum deep-processed products and materials in China and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion