- Philippines

- /

- Wireless Telecom

- /

- PSE:GLO

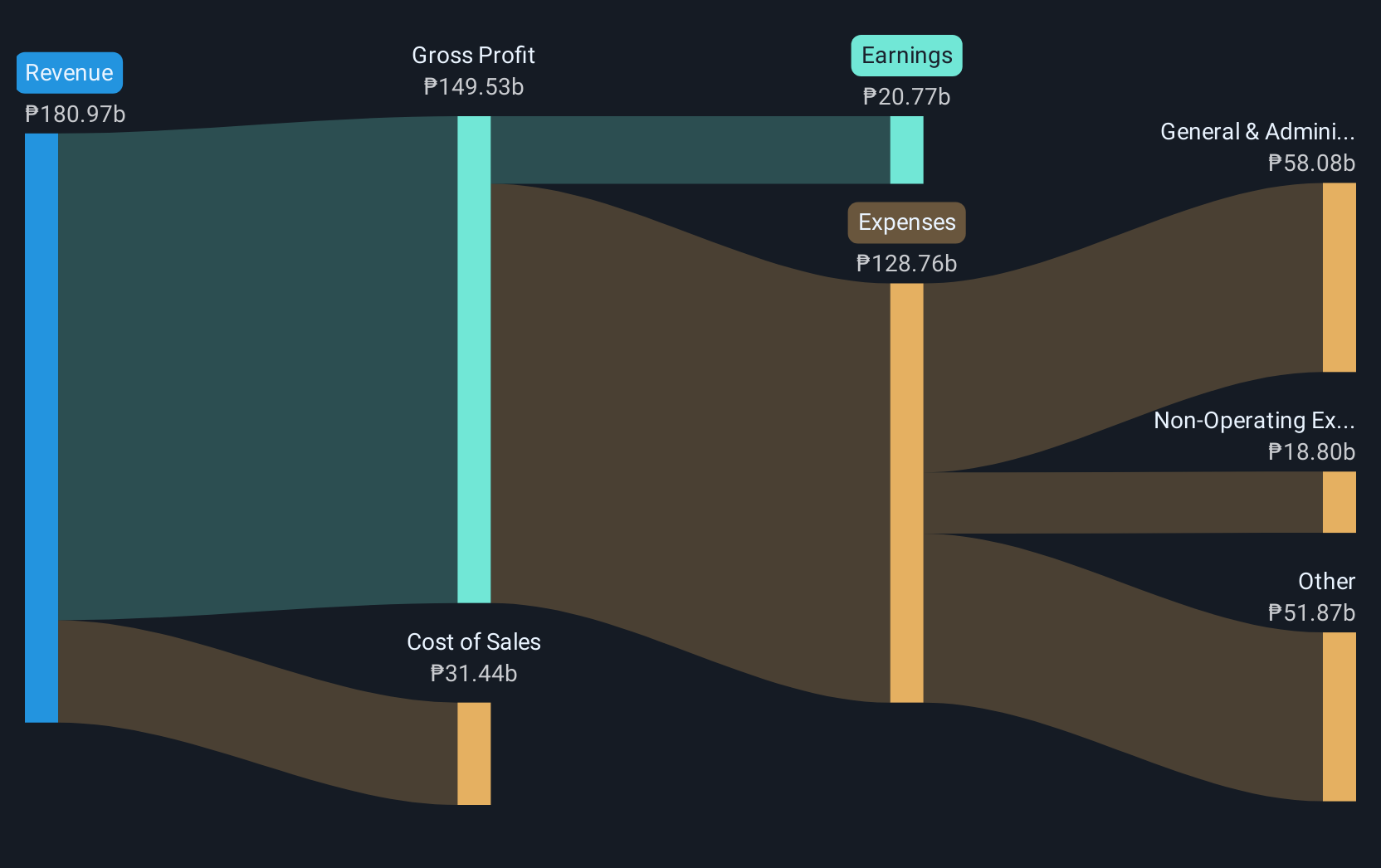

Globe Telecom (PSE:GLO) Reports Decline In Q2 Revenue And Profitability

Reviewed by Simply Wall St

Globe Telecom (PSE:GLO) saw its share price increase by 4% over the last month, during which it announced a decline in second-quarter sales, revenue, and net income, indicating some financial challenges. The earnings call on July 24, 2025, and the following announcement on August 6, 2025, highlighted these results. Despite these negative financial outcomes, the broader market, reflected by gains in major indexes amid strong corporate earnings and ongoing trade news, likely influenced Globe's share performance. This market environment, rather than company-specific news, would have provided upward momentum for the stock.

Despite Globe Telecom's recent share price increase, the company's decline in second-quarter sales, revenue, and net income suggests potential hurdles in maintaining momentum. Globe's long-term total return, encompassing both share price and dividends, was 2.53% over five years, highlighting a modest growth profile. This is a stark contrast to its performance against the broader PH market, which returned 6% over the past year, indicating Globe's shortfall in keeping pace with market trends.

The current financial challenges, highlighted in the company's recent earnings announcements, may influence future revenue and earnings forecasts. With ongoing pressures from inflation and a shifting telecom landscape, Globe faces the task of stabilizing its revenue streams. Meanwhile, analysts maintain a consensus price target of ₱2364.0, which is 37.6% above the current share price of ₱1718.00, suggesting potential upside if the company can align its strategic goals with market expectations. Furthermore, Globe's earnings are forecast to grow 10.6% per year, albeit slightly slower than the PH market's 10.9%.

Learn about Globe Telecom's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:GLO

Globe Telecom

Engages in the provision of telecommunications services to individual consumers, corporate, and small and medium enterprise clients in the Philippines.

Undervalued average dividend payer.

Market Insights

Community Narratives