Exploring 3 Undervalued Small Caps In Global With Insider Activity

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mixed performance, with the S&P 500 and Russell 2000 indices showing gains amid Federal Reserve Chair Jerome Powell's hints at potential rate cuts, while concerns about inflation and labor market weaknesses continue to loom. As small-cap stocks within these indices demonstrate resilience, particularly in sectors like energy and financials, investors are increasingly attentive to opportunities that arise from insider activity as a potential indicator of value. In this context, identifying stocks that exhibit strong fundamentals and insider confidence can be crucial for navigating current market dynamics effectively.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GDI Integrated Facility Services | 18.4x | 0.3x | 3.27% | ★★★★★☆ |

| Bytes Technology Group | 17.8x | 4.5x | 10.10% | ★★★★☆☆ |

| Hemisphere Energy | 5.9x | 2.3x | 9.30% | ★★★★☆☆ |

| East West Banking | 3.3x | 0.8x | 17.04% | ★★★★☆☆ |

| Sagicor Financial | 7.2x | 0.4x | -72.87% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 12.8x | 6.7x | 15.66% | ★★★★☆☆ |

| A.G. BARR | 19.2x | 1.8x | 46.86% | ★★★☆☆☆ |

| Dicker Data | 20.4x | 0.7x | -20.70% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 7.0x | 1.9x | 18.72% | ★★★☆☆☆ |

| CVS Group | 47.8x | 1.4x | 34.41% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is a wholesale distributor specializing in computer peripherals, with a market capitalization of A$1.8 billion.

Operations: Dicker Data's revenue primarily comes from its wholesale segment, specifically in computer peripherals, amounting to A$2.28 billion. The company's gross profit margin has shown an upward trend, reaching 14.56% as of the latest period. Operating expenses have increased alongside revenue growth but remain a significant part of the cost structure.

PE: 20.4x

Dicker Data, a smaller company in its sector, is attracting attention with insider confidence shown by Vladimir Mitnovetski's recent purchase of 20,000 shares for A$161,000. Despite its reliance on external borrowing for funding and high debt levels, the company's earnings are projected to grow at 9.13% annually. Recently affirming a quarterly dividend of A$0.11 per share payable September 1, Dicker Data continues to offer potential growth opportunities amidst financial challenges.

Hays (LSE:HAS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hays is a global recruitment company specializing in qualified, professional, and skilled recruitment services with a market capitalization of approximately £1.83 billion.

Operations: Hays generates revenue primarily from its Qualified, Professional and Skilled Recruitment segment, amounting to £6.61 billion. The company's cost of goods sold (COGS) significantly impacts its gross profit margin, which was 3.78% as of June 2025. Operating expenses are a notable part of the cost structure, with general and administrative expenses being a significant component.

PE: -130.8x

Hays, a smaller company in the staffing industry, recently reported a decline in sales to £6.6 billion for the year ending June 30, 2025, with a net loss of £7.8 million. Despite these figures, earnings are projected to grow by over 73% annually. Recent board changes could signal strategic shifts ahead. The company's reliance on external borrowing adds risk but also potential upside if managed well. Insider confidence through share purchases suggests belief in future prospects despite current challenges.

- Delve into the full analysis valuation report here for a deeper understanding of Hays.

Explore historical data to track Hays' performance over time in our Past section.

MREIT (PSE:MREIT)

Simply Wall St Value Rating: ★★★★☆☆

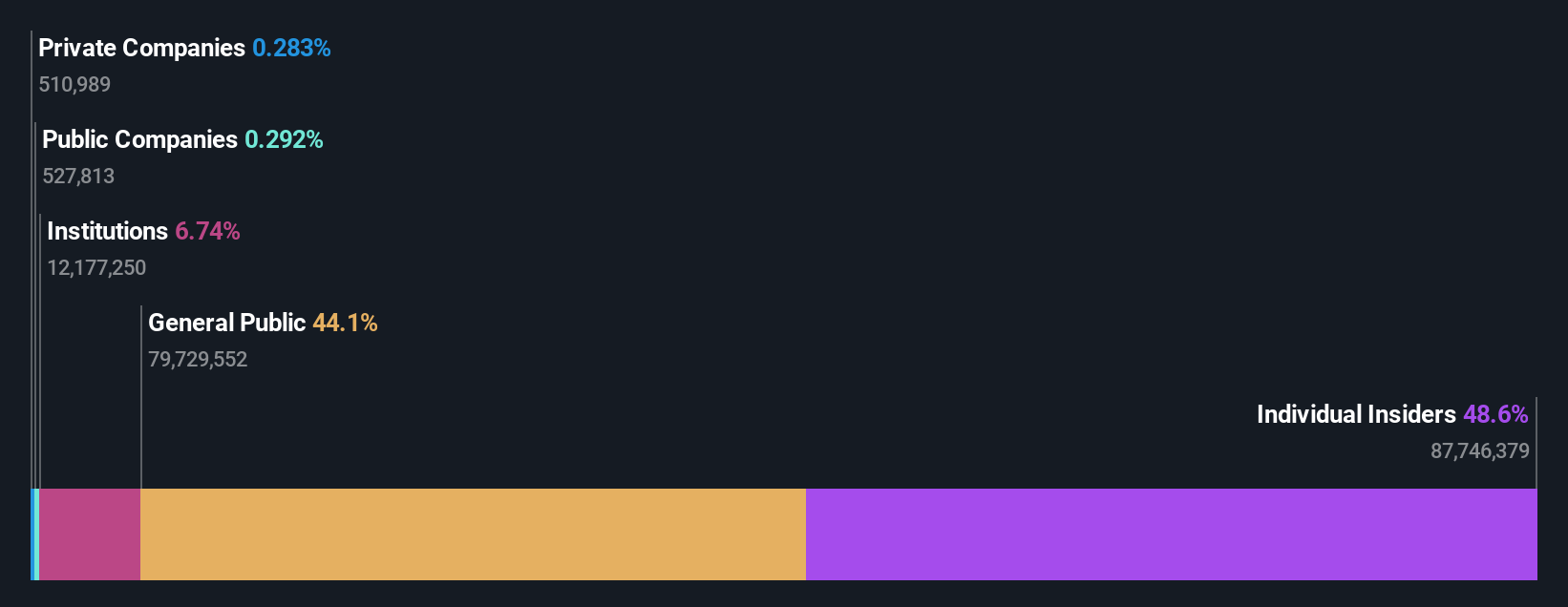

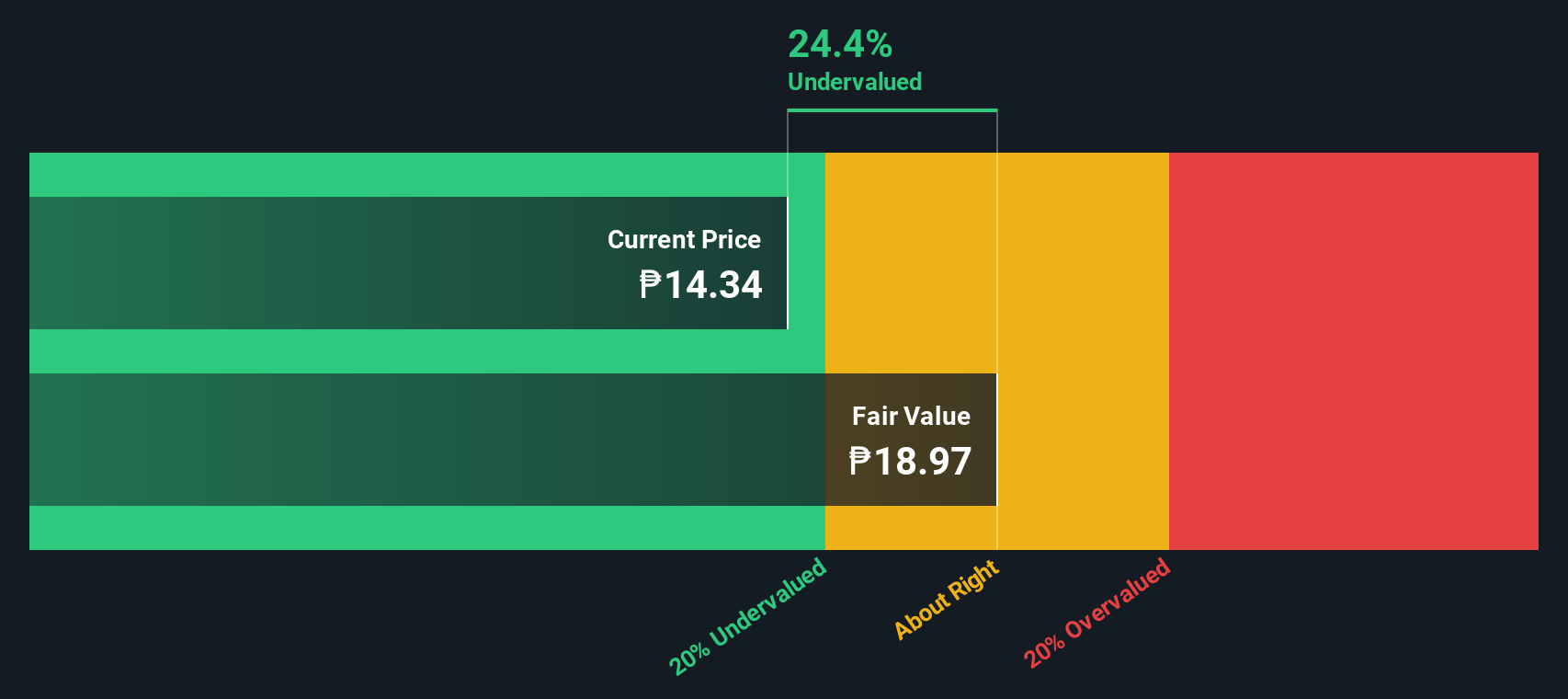

Overview: MREIT is a real estate investment trust primarily engaged in leasing its portfolio of buildings, with a market capitalization of approximately ₱54.67 billion.

Operations: The primary revenue stream is from leasing its buildings, generating ₱3.88 billion in recent periods. The gross profit margin has shown variability, reaching 74.24% recently, reflecting changes in cost management and pricing strategies over time. Operating expenses have been a significant factor influencing net income outcomes across different periods.

PE: 12.4x

MREIT's recent financial performance highlights its potential as an undervalued investment, with revenue for the second quarter reaching PHP 1.36 billion, up from PHP 1.03 billion last year. The company's net income also saw an increase to PHP 965.8 million from PHP 736.46 million previously. Insider confidence is evident as President Jose Arnulfo Batac acquired 100,000 shares in August, reflecting belief in future growth prospects despite funding primarily through higher-risk external borrowing sources and no customer deposits.

- Get an in-depth perspective on MREIT's performance by reading our valuation report here.

Review our historical performance report to gain insights into MREIT's's past performance.

Turning Ideas Into Actions

- Delve into our full catalog of 92 Undervalued Global Small Caps With Insider Buying here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DDR

Dicker Data

Engages in the wholesale distribution of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives